WI DoR 1-ES (D-101) 2019 free printable template

Show details

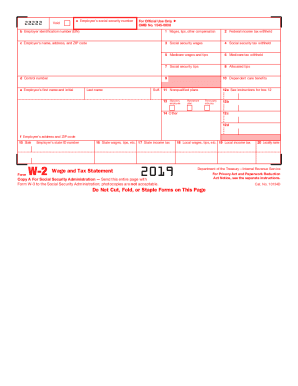

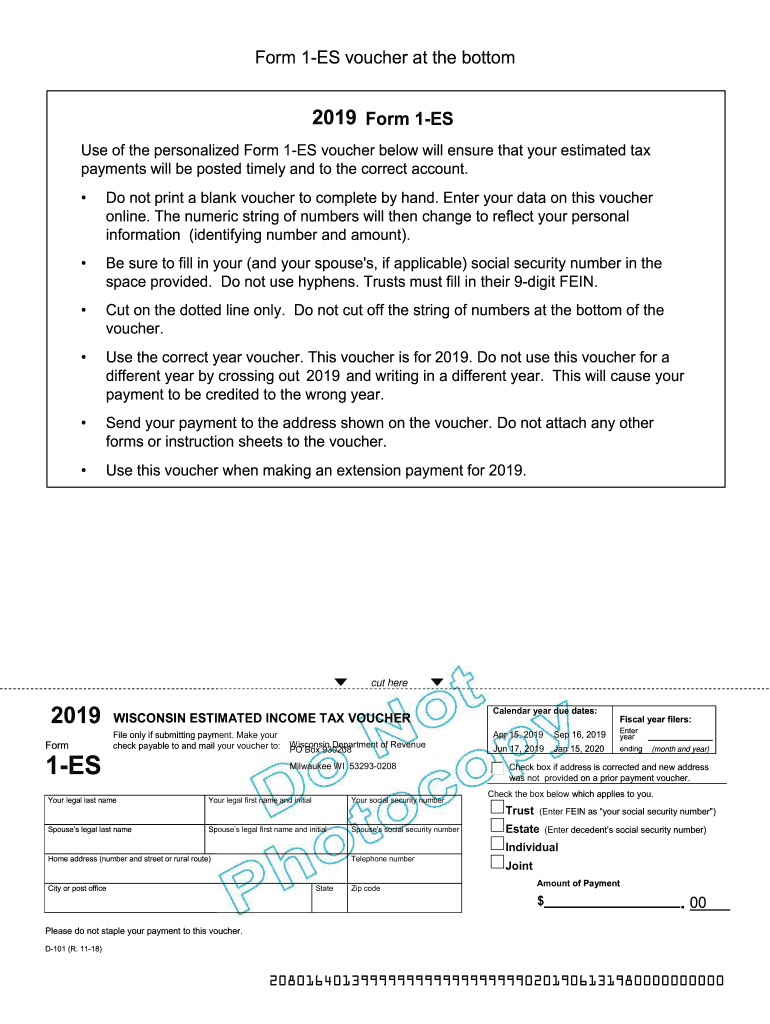

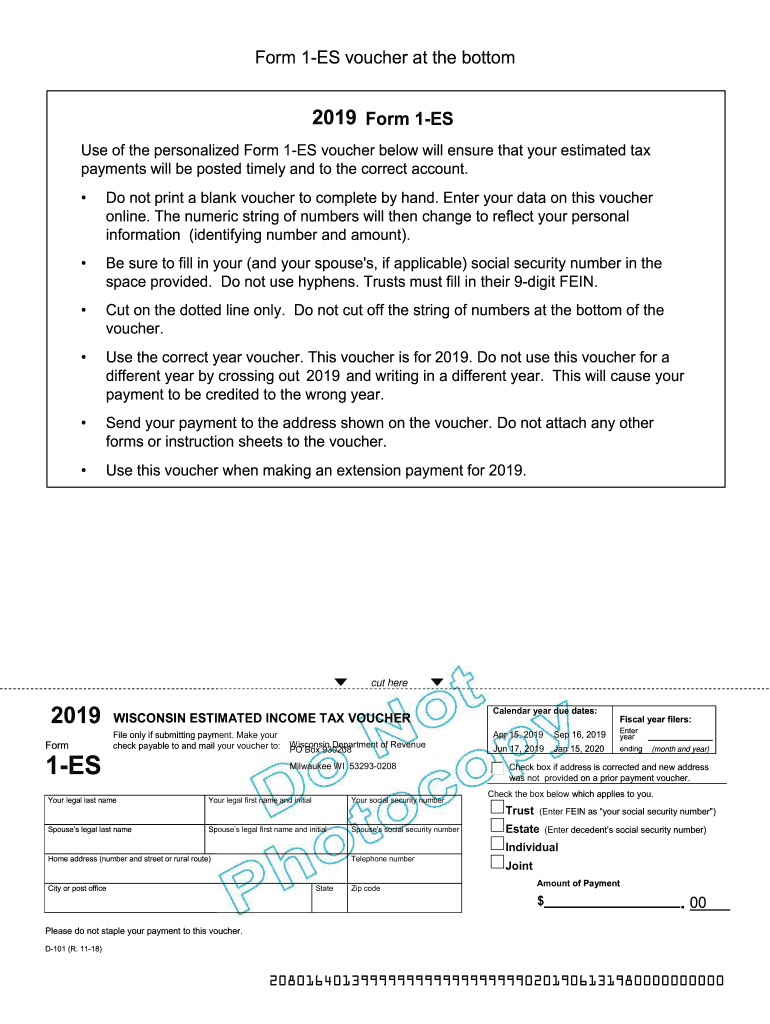

The ink must not spatter or smear. i. The OCR print line should read Form 1-ES for Individuals Form 1-ES for Trusts Form 1-ES for Estates Form 1-ES for Joint Filers j. Of Revenue staff cc 1. Form 1-ES Document Specifications a. Size Form 1-ES must be 8 1/2 x 3 2/3. b. Form 1-ES voucher at the bottom 2019 Form 1-ES Use of the personalized Form 1-ES voucher below will ensure that your estimated tax payments will be posted timely and to the correct account. OCR Scan Line Specifications Form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR 1-ES D-101

Edit your WI DoR 1-ES D-101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR 1-ES D-101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DoR 1-ES D-101 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WI DoR 1-ES D-101. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR 1-ES (D-101) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR 1-ES D-101

How to fill out WI DoR 1-ES (D-101)

01

Obtain the WI DoR 1-ES (D-101) form from the Wisconsin Department of Revenue website or through local offices.

02

Enter your personal information in the designated sections, including your name, address, and Social Security number.

03

Indicate your filing status by checking the appropriate box (e.g., single, married, etc.).

04

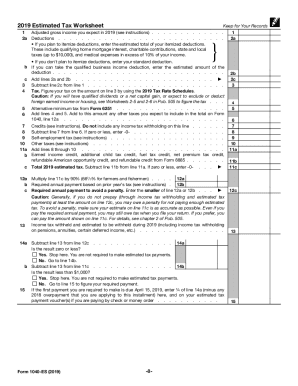

Provide details of your estimated tax liability for the year, including taxable income and deductions.

05

Calculate your estimated tax payments for the year and enter that amount in the appropriate section.

06

Review the form for accuracy and completeness to ensure all required fields are filled in.

07

Sign and date the form before submission.

08

Submit the completed form via mail or as instructed by the Wisconsin Department of Revenue.

Who needs WI DoR 1-ES (D-101)?

01

Individuals who expect to owe more than $500 in Wisconsin state taxes for the year.

02

Self-employed individuals or freelancers who need to estimate their taxes.

03

Taxpayers who want to avoid penalties for underpayment of taxes throughout the year.

04

Individuals who have sources of income that are not subject to withholding tax like interest, dividends, or rental income.

Fill

form

: Try Risk Free

People Also Ask about

What is Massachusetts form 1 ES?

Form 1-ES. Massachusetts Estimated Income Tax. General Information. What is the purpose of estimated tax payment vouch ers? The purpose of the payment vouchers is to provide a means for paying any taxes due on income which is not subject to withhold- ing.

What is Wisconsin entity level tax payment?

The new provision allows for pass-through entities to elect to be taxed at the entity-level which is a flat rate of 7.9% (the WI corporate income tax rate) rather than passing the income to shareholders to be taxed on their individual return (7.65% for individuals at the highest income tax rates).

What is Form 1040-ES payment Voucher 1?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

What does es mean on a tax form?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

What is Wisconsin form 1 ES?

Form 1 is the general income tax return (long form) for Wisconsin residents. It can be efiled or sent by mail. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Estimated tax payments must be sent to the Wisconsin Department of Revenue on a quarterly basis.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit WI DoR 1-ES D-101 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your WI DoR 1-ES D-101 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find WI DoR 1-ES D-101?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific WI DoR 1-ES D-101 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit WI DoR 1-ES D-101 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign WI DoR 1-ES D-101. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is WI DoR 1-ES (D-101)?

WI DoR 1-ES (D-101) is a form used in Wisconsin for individuals to report estimated income tax payments.

Who is required to file WI DoR 1-ES (D-101)?

Individuals who expect to owe tax of $1,000 or more when they file their state income tax return are required to file WI DoR 1-ES (D-101).

How to fill out WI DoR 1-ES (D-101)?

To fill out WI DoR 1-ES (D-101), you need to provide your name, address, Social Security number, estimated income, and the amount of estimated tax paid.

What is the purpose of WI DoR 1-ES (D-101)?

The purpose of WI DoR 1-ES (D-101) is to help individuals keep track of their estimated tax payments to ensure they meet their tax obligations for the year.

What information must be reported on WI DoR 1-ES (D-101)?

The information that must be reported on WI DoR 1-ES (D-101) includes personal identification details, estimated income for the year, and amounts of estimated tax payments made.

Fill out your WI DoR 1-ES D-101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR 1-ES D-101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.