CA FTB 592-F 2018 free printable template

Show details

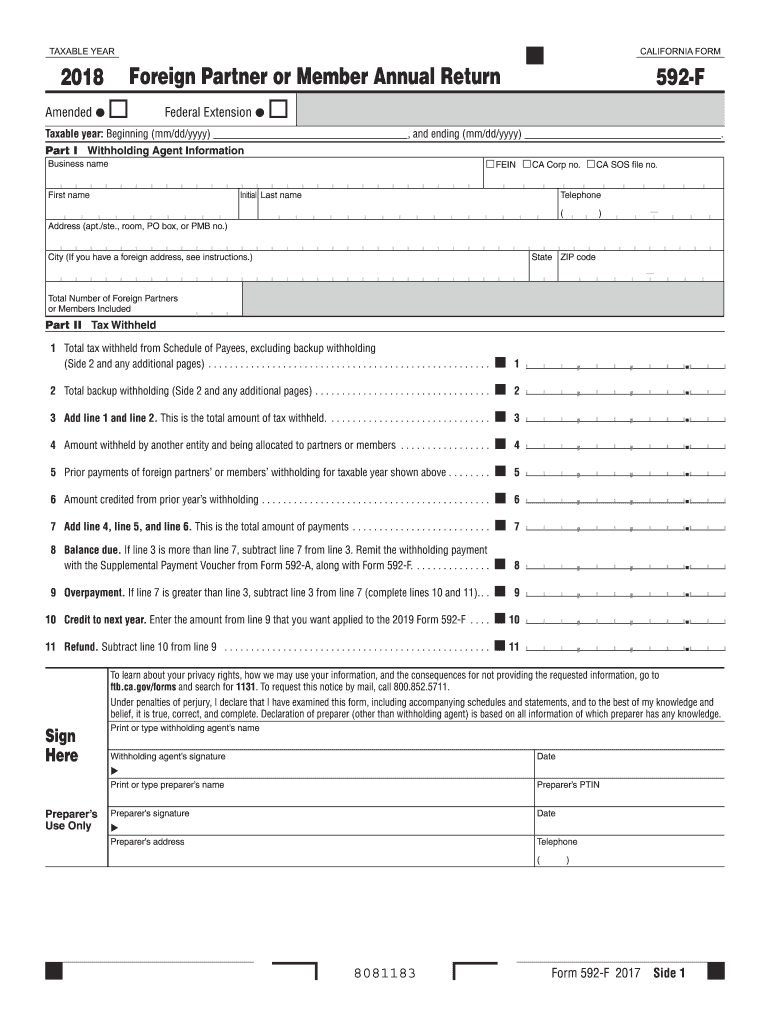

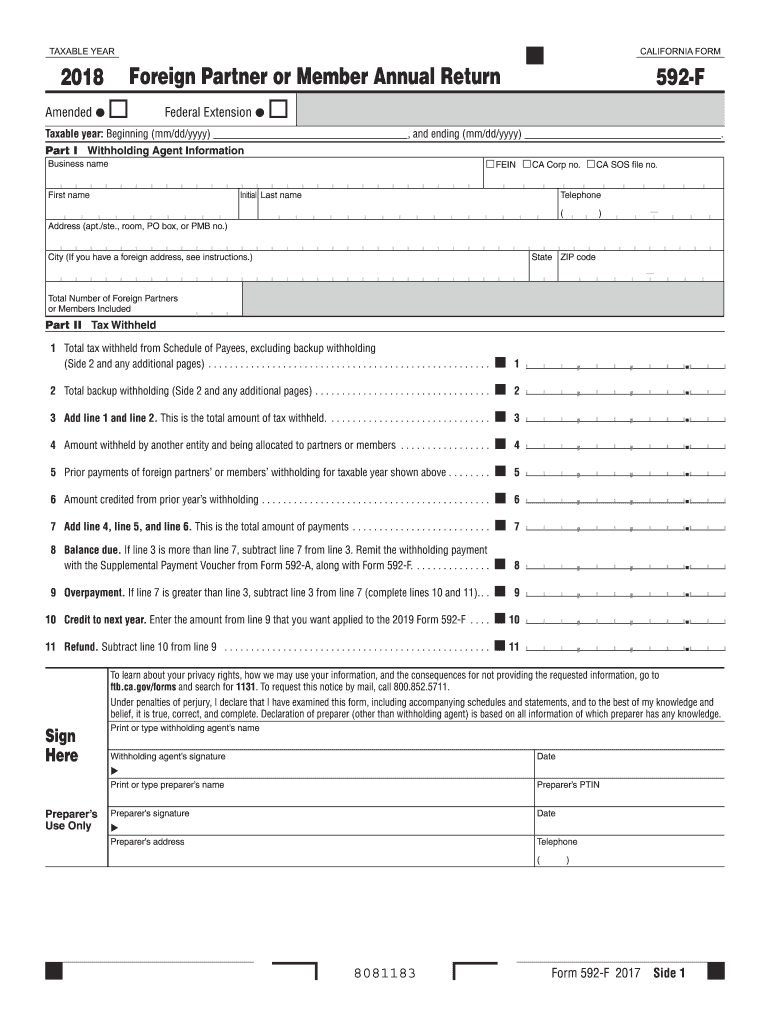

TAXABLE YEARCALIFORNIA FORMForeign Partner or Member Annual Return2018

Amended I592FFederal Extension Taxable year: Beginning (mm/dd/YYY), and ending (mm/dd/YYY). Part I Withholding Agent Information

FEI

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 592-F

Edit your CA FTB 592-F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 592-F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA FTB 592-F online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA FTB 592-F. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 592-F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 592-F

How to fill out CA FTB 592-F

01

Begin by downloading the CA FTB 592-F form from the California Franchise Tax Board website.

02

Fill in your name, address, and Taxpayer Identification Number (TIN) at the top of the form.

03

Provide the information of the entity that paid you, including their name, address, and TIN.

04

List the type of payments you received that require reporting on this form.

05

Calculate the total amount you received during the tax year in the appropriate section.

06

Complete the 'Withholding Amount' section if applicable, providing the necessary details.

07

Review the form for accuracy and ensure all required fields are completed.

08

Sign and date the form at the bottom to certify that the information provided is accurate.

09

Submit the completed form to the Franchise Tax Board by the specified deadline.

Who needs CA FTB 592-F?

01

Any individual or business entity that has received California source income and had California taxes withheld on that income must fill out CA FTB 592-F.

02

This includes non-residents and residents who have received payments subject to California withholding.

Fill

form

: Try Risk Free

People Also Ask about

Can form 592 be filed electronically?

Electronic Filing Requirements. When the number of payees entered on Form 592, Schedule of Payees, exceeds 250, Form 592 must be filed with the FTB electronically using FTB's Secure Web Internet File Transfer (SWIFT) instead of paper.

What is form 592-B 2018?

Form 592‑B, Resident and Nonresident Withholding Tax Statement – The withholding agent must provide Form 592-B to each payee which shows the total amount withheld and reported for the tax year. The withholding agent does not submit Form 592-B to the FTB. For more information, get Form 592-B.

What are forms 592b and 593?

The real estate withholding amount for California generate when withholding information are entered in the California Form 592-B/Form 593.

Is CA Form 592 required?

Form 592‑B, Resident and Nonresident Withholding Tax Statement – The withholding agent must provide Form 592-B to each payee which shows the total amount withheld and reported for the tax year. The withholding agent does not submit Form 592-B to the FTB. For more information, get Form 592-B.

Who is not subject to California withholding?

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods.

Who is required to file CA form 592?

A pass-through entity should use Form 592 if: It is reporting withholding from payments made to domestic nonresident independent contractors or domestic nonresident recipients of rents, endorsement income, or royalties.

What is form 592-F foreign partner or member annual withholding return?

Use Form 592-F to report the total withholding for the year on foreign partners or members under California Revenue and Taxation Code Section 18666. Form 592-F is also used by pass‑through entities to pass through withholding credit to their foreign partners or members.

How to file CA Form 592?

D. Amending Form 592 Complete a new Form 592 with the correct taxable year. Enter all the withholding and payee information. Complete a second Form 592 with the same taxable year as originally filed. Mail both forms to the address shown under General Information B, When and Where to File.

What is Form 592 2018 CA?

Form 592 includes a Schedule of Payees section, on Side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. This schedule will allow the FTB to allocate the withholding payments to the payee upon receipt of the completed Form 592.

What is the form for California non resident withholding tax?

Use Form 592-F to pass the withholding to your foreign (non-U.S.) partners or members. If you are an estate or trust, you must pass through the withholding to your beneficiaries if the related income was distributed. Use Form 592-PTE to pass through the withholding to your beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA FTB 592-F to be eSigned by others?

Once you are ready to share your CA FTB 592-F, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get CA FTB 592-F?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific CA FTB 592-F and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out the CA FTB 592-F form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign CA FTB 592-F and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is CA FTB 592-F?

CA FTB 592-F is a form used by the California Franchise Tax Board to report withholding on California source income paid to nonresidents.

Who is required to file CA FTB 592-F?

The form CA FTB 592-F must be filed by any person or entity that pays California source income to nonresidents and is required to withhold California income tax.

How to fill out CA FTB 592-F?

To fill out CA FTB 592-F, you need to provide information about the withholding agent, the recipient of the payments, the type of income, the amount paid, and the amount withheld, along with any relevant calculations.

What is the purpose of CA FTB 592-F?

The purpose of CA FTB 592-F is to report and remit withholding tax to the California Franchise Tax Board for nonresident recipients of California source income.

What information must be reported on CA FTB 592-F?

The information that must be reported on CA FTB 592-F includes the payer's identification details, the recipient's name and identification information, the types of income paid, amounts paid, and the withholding amount.

Fill out your CA FTB 592-F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 592-F is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.