CA FTB 592-F 2022 free printable template

Show details

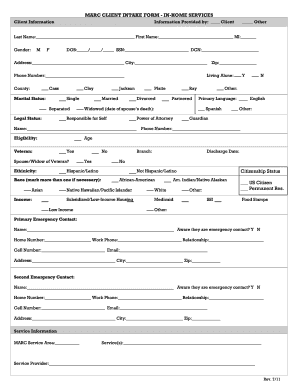

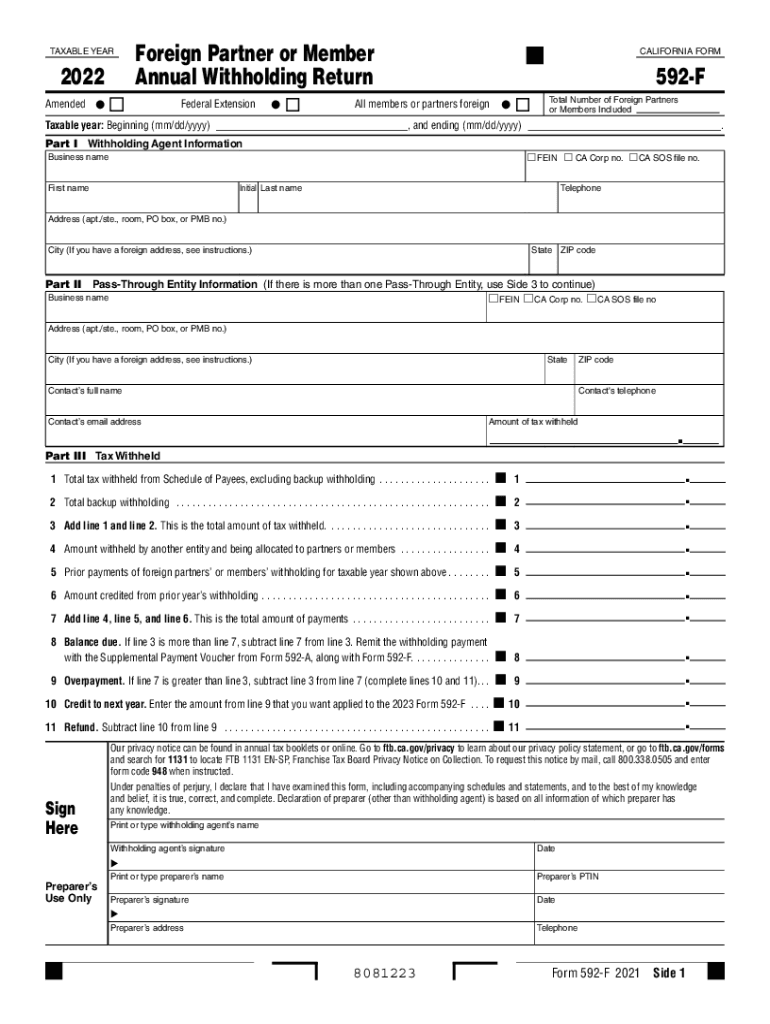

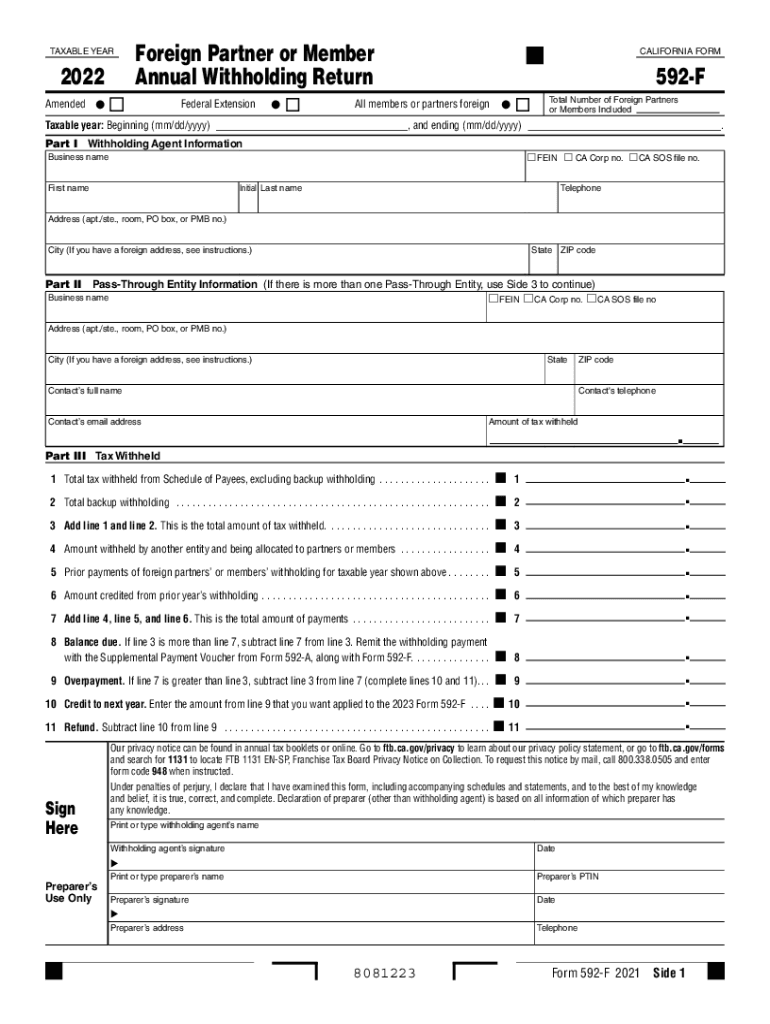

TAXABLE YEAR2022 AmendedForeign Partner or Member Annual Withholding Return Federal ExtensionTaxable year: Beginning (mm/dd/YYY)CALIFORNIA Formal members or partners foreign592FTotal Number of Foreign

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 592-F

Edit your CA FTB 592-F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 592-F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA FTB 592-F online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA FTB 592-F. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 592-F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 592-F

How to fill out CA FTB 592-F

01

Obtain a copy of CA FTB 592-F form from the California Franchise Tax Board website.

02

Provide your entity name, address, and taxpayer identification number at the top of the form.

03

Fill in the total amount of California source income received or collected in the year.

04

Complete the sections for any withholding amounts and specific exemptions, if applicable.

05

Detail the amount of income distributed to each recipient and their respective identification numbers.

06

Sign and date the form to certify that all information provided is accurate.

07

Submit the form by the due date, along with any required payment or additional documentation.

Who needs CA FTB 592-F?

01

Any entity that has paid or will pay California source income to non-resident recipients.

02

Taxpayers who have withheld California income tax from payments made to individuals or entities.

03

Businesses required to report withholding on payments such as rents, royalties, or other income to non-residents.

Fill

form

: Try Risk Free

People Also Ask about

What is form 592 A?

2021 Form 592-A Payment Voucher for Foreign Partner or Member Withholding.

What is a Form 592?

Tax withheld on California source income is reported to the Franchise Tax Board (FTB) using Form 592. Form 592 includes a Schedule of Payees section, on Side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts.

Where do I report Form 592-B?

Form 592-B is provided to the payee to file with their state tax return. This form can be provided to the payee electronically. For Privacy Notice, get FTB 1131 EN-SP.

Who must file CA 592 PTE?

For the purpose of this form, a PTE is an entity that has paid withholding on behalf of a nonresident owner or has had its income withheld upon. Each of these PTEs is a withholding agent and is required to file Form 592-PTE on an annual basis to allocate withholding.

Can CA 592 be filed electronically?

C. However, withholding agents must provide payees with copies of Form 592‑B. For electronic filing, submit your file using the SWIFT process as outlined in FTB Pub. 923, SWIFT Guide for Resident, Nonresident, and Real Estate Withholding.

What is form 592 and 593?

Use Form 592-F, Foreign Partner or Member Annual Withholding Return. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale of real estate. Use Form 593, Real Estate Withholding Statement.

What is California tax form 592-B?

California Revenue and Taxation Code (R&TC) Sections 18662 and 18664 require the withholding agent to provide a completed Form 592-B, Resident and Nonresident Withholding Tax Statement, to the payee to report the amount of payment or distribution subject to withholding and tax.

Who files form 592-PTE?

Note: Lower tier PTEs are required to file Form 592-PTE to allocate withholding paid on behalf of nonresident owners, while upper tier PTEs are required to file Form 592-PTE to allocate withholding paid on their behalf to all owners, regardless of the state of residency of each owner.

What form is the CA 592 PTE?

Use Form 592-PTE to report the total withholding under California Revenue and Taxation Code (R&TC) Sections 18662. A PTE is generally an entity that passes its income or losses through to its owners instead of paying the related tax at the entity level.

Do I need to file a form 592?

Form 592 must be filed for each payment period for which withholding was required to be remitted to FTB. Payment Voucher for Resident and Nonresident Withholding (Form 592-V) must be submitted with Form 592 and the nonwage withholding payment.

Can form 592 be filed electronically?

Electronic Filing Requirements. When the number of payees entered on Form 592, Schedule of Payees, exceeds 250, Form 592 must be filed with the FTB electronically using FTB's Secure Web Internet File Transfer (SWIFT) instead of paper.

Does form 593 need to be attached to tax return?

To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return, Withholding (Form 592-B and/or 593). Attach one copy of Form(s) 593, to the lower front of your California tax return.

What is form 592-B used for?

Use Form 592-B to report to the payee the amount of payment or distribution subject to withholding and tax withheld as reported on Form 592, Resident and Nonresident Withholding Statement, Form 592-PTE, or Form 592-F, Foreign Partner or Member Annual Withholding Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA FTB 592-F in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your CA FTB 592-F and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for signing my CA FTB 592-F in Gmail?

Create your eSignature using pdfFiller and then eSign your CA FTB 592-F immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out the CA FTB 592-F form on my smartphone?

Use the pdfFiller mobile app to complete and sign CA FTB 592-F on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is CA FTB 592-F?

CA FTB 592-F is a form used by California to report and pay California state income tax withholding on income paid to non-resident partners, members, or shareholders.

Who is required to file CA FTB 592-F?

Entities that make payments to non-resident partners, members, or shareholders of partnerships, limited liability companies, or corporations are required to file CA FTB 592-F.

How to fill out CA FTB 592-F?

To fill out CA FTB 592-F, you must enter identifying information about the withholding agent and the non-resident recipient, report the total amount paid and the California income tax withheld, and ensure all sections are completed as per instructions.

What is the purpose of CA FTB 592-F?

The purpose of CA FTB 592-F is to report California state income tax withheld from non-resident income and to ensure the proper tax remittances are made to the California Franchise Tax Board.

What information must be reported on CA FTB 592-F?

The information that must be reported on CA FTB 592-F includes the withholding agent's information, the non-resident recipient's information, amounts paid, withholding amounts, and applicable tax identification numbers.

Fill out your CA FTB 592-F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 592-F is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.