IRS 5500-EZ Instructions 2017 free printable template

Get, Create, Make and Sign IRS 5500-EZ Instructions

How to edit IRS 5500-EZ Instructions online

Uncompromising security for your PDF editing and eSignature needs

IRS 5500-EZ Instructions Form Versions

How to fill out IRS 5500-EZ Instructions

How to fill out IRS 5500-EZ Instructions

Who needs IRS 5500-EZ Instructions?

Instructions and Help about IRS 5500-EZ Instructions

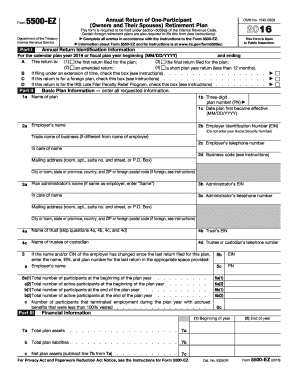

Hello YouTubers your cursor here on Thursday jun 23 2016 at 12 45 in the afternoon now some days just aren't complete without a little absurdity involving the Internal Revenue Service because I have a pension / profit sharing plan well I have an IRA too, but this is with an IRA you don't have to file any forms but with the pension profit sharing plans you do and the form that you file is called form 5500 e-z it actually is somewhat easy the regular font regular form 5500 this is real best and that's called annual return of one participant retirement plan well that's me so every year since I've set this thing up in 1982 I've duly been filing this thing now Ally years there are no changes in the form it's just it's the same you know a few years back there was a fairly big change and this year there was a new section at the bottom, and it's called questions 13 and there are several subsections on your question 13 question 14 15 and 16 now this is classic government question 13 an as the plan been timely amended for all required tax law changes parenthesis skip this question well then you go to the instructions, and it says 113a the IRS has decided not to require plan sponsors to complete this question for the two 15 2015 plan year and plan sponsors should skip this question when completing the form question 13 beef date the last plan amendment / Restatement for the required law changes was adopted skip this question and is the applicable code see instructions for tax law changes and codes skip this question and again in the instructions it's the same thing the IRS has decided not to require plan sponsors to complete this question 4 2015 plan your plan sponsor should skip this question when completed before well I'm 13 see if the employer is an adopter of a pre-approved master in prototype or volume submitter plan that is subject to a favorable IRS opinion or advisory letter and is the date of that favorable letter and the letter serial number skip this question go the instructions for line 13 C, and it's the same boilerplate you know for the two previous questions question 13 d blind 13 d if the plan is an individually designed plan and received a favorable determination letter from the IRS and in the date of the plans last favorable determination letter skip this question and instructions same language as before question 14 were required minimum distributions made to 5% owners who have attained age 70 and a half regardless of whether retired as required under Section 401 a nine skip this question and 114 again the same boilerplate in fact you know but in the suspense it's the same for line 15 in line 16 as well 115 did the plan trust and curve business related business taxable income skip this question if yes enter her mouth for in-service distributions made during the plan year this is a question 16 skips this question if yes better the amount you've got to love that you just got to love that kind of stuff don't you okay bye-bye YouTubers

People Also Ask about

Can I file form 5500-EZ electronically?

What is a 5500-EZ form?

Who is required to file form 5500-EZ?

What is Form 5500 and 5500-EZ?

Who is required to file 5500-EZ?

Can I file form 5500-EZ electronically?

Can form 5500-EZ be signed electronically?

Do I need to file form 5500 for Solo 401k?

Can I file my own 5500?

What is the form 5500-EZ for solo 401k?

How to fill out a 5500 form?

What is the 5500-EZ for Solo 401k?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 5500-EZ Instructions in Gmail?

Can I create an electronic signature for signing my IRS 5500-EZ Instructions in Gmail?

How do I edit IRS 5500-EZ Instructions on an Android device?

What is IRS 5500-EZ Instructions?

Who is required to file IRS 5500-EZ Instructions?

How to fill out IRS 5500-EZ Instructions?

What is the purpose of IRS 5500-EZ Instructions?

What information must be reported on IRS 5500-EZ Instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.