VT HS-122 & HI-144 2018 free printable template

Show details

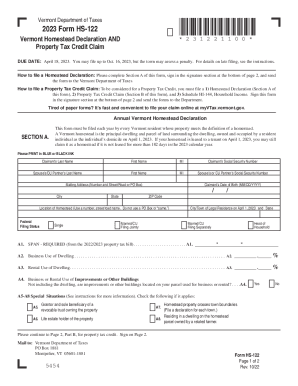

B7. B8. Household Income Schedule HI-144 Line y. Schedule HI-144 MUST be included.. B8. B8a. If Amended Schedule HI-144 Household Income is included check here. Please specify. m. INCOME n. Total Income Add Lines a through m.. n. continued on back Schedule HI-144 1. How to file a Property Tax Adjustment Claim To be considered for a Property Tax Adjustment you must file a form and 3 Schedule HI-144 Household Income. Complete and attach Schedule HI-144. To qualify you must meet the requirements...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VT HS-122 HI-144

Edit your VT HS-122 HI-144 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VT HS-122 HI-144 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VT HS-122 HI-144 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit VT HS-122 HI-144. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT HS-122 & HI-144 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VT HS-122 HI-144

How to fill out VT HS-122 & HI-144

01

Gather the necessary personal information, including your name, address, and Social Security number.

02

For VT HS-122, indicate the type of tax return you are filing and the tax period.

03

Fill out the income section by reporting all sources of income accurately.

04

Deduct any eligible expenses or credits in the designated sections.

05

Review the completed form for any errors or missing information.

06

Sign and date the form at the bottom before submission.

07

For HI-144, start by entering your business information if applicable.

08

Similarly report all income and expenses relevant to Hawaii tax laws.

09

Complete the necessary sections specific to Hawaii tax deductions.

10

Ensure to attach any required additional documentation or schedules.

11

Double-check all information and calculations before submitting.

Who needs VT HS-122 & HI-144?

01

Individuals and businesses filing taxes in Vermont who need to report income and deductions.

02

Residents and entities earning income in Hawaii who are required to file state tax returns.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

How does the Vermont property tax credit work?

If you meet certain income and residency requirements, the State of Vermont can help pay your property taxes. You could be eligible for up to $8,000 of Property Tax Credit. File for these credits when you file your income taxes. If you don't file income taxes, you may still qualify for a credit.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

How much is Vermont homestead exemption?

In Vermont, the maximum value of exempt property is $125,000. The legal value of the property is the amount appearing on the last completed county assessment roll at the county treasurer's office.

Do I need to file a Vermont tax return?

You must file an income tax return in Vermont: if you are a resident, part-year resident of Vermont, or a nonresident but earned Vermont income, and. if you are required to file a federal income tax return, and. you earned or received more than $100 in Vermont income, or.

Where can I get Illinois tax forms?

Submit a request to have forms or publications mailed to you. You can also request certain forms and publications by calling our 24-hour forms order hotline at 1 800 356-6302.

How much do you have to make to file taxes in Vermont?

If the result is net income of more than $100 or gross income (income before any losses) of more than $1,000, then you must file a Vermont income tax return.

How to file a tax return in Vermont?

You may file your Vermont income tax return either on a paper form or electronically through commercial vendor software. You also may choose to hire a tax professional to prepare the return for you, either on paper or e-file.

What is a Hi-144 form?

VT Homestead Declaration and Property Tax Credit Claim: Forms HS-122 and HI-144. This set of forms is used to tell the state of Vermont that you live in the house you own (homestead declaration) and to ask for help paying your property taxes (property tax credit claim).

Can I file my tax return by myself?

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It's safe, easy and no cost to you for a federal return.

What qualifies as a homestead in Vermont?

In Vermont, all property is subject to education property tax to pay for the state's schools. For this purpose, property is categorized as either nonhomestead or homestead. A homestead is the principal dwelling and parcel of land surrounding the dwelling, owned and occupied by the resident as the person's domicile.

Where can I pick up IRS forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

How do I qualify for homestead exemption in Vermont?

Eligibility Your property qualifies as a homestead, and you have filed a Homestead Declaration for the current year's grand list. You were domiciled in Vermont for the full prior calendar year. You were not claimed as a dependent of another taxpayer. You have the property as your homestead as of April 1.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send VT HS-122 HI-144 for eSignature?

When you're ready to share your VT HS-122 HI-144, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out the VT HS-122 HI-144 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign VT HS-122 HI-144 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete VT HS-122 HI-144 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your VT HS-122 HI-144 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is VT HS-122 & HI-144?

VT HS-122 and HI-144 are tax forms used in Vermont to report health care-related information, specifically concerning health insurance premiums and information regarding health care coverage.

Who is required to file VT HS-122 & HI-144?

Individuals or entities that provide health insurance or are required to report health insurance information, such as employers and health insurance providers in Vermont, are required to file these forms.

How to fill out VT HS-122 & HI-144?

To fill out VT HS-122 and HI-144, one should collect necessary information regarding health insurance coverage, premiums paid, and other relevant details, and then accurately complete the forms according to the instructions provided by the Vermont Department of Taxes.

What is the purpose of VT HS-122 & HI-144?

The purpose of VT HS-122 and HI-144 is to collect data on health insurance coverage and premiums, ensuring compliance with state health care regulations and facilitating public health initiatives.

What information must be reported on VT HS-122 & HI-144?

The information that must be reported on VT HS-122 and HI-144 includes details about the insured individual's identity, insurance provider information, premium amounts, and coverage periods.

Fill out your VT HS-122 HI-144 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VT HS-122 HI-144 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.