VT HS-122 & HI-144 2017 free printable template

Show details

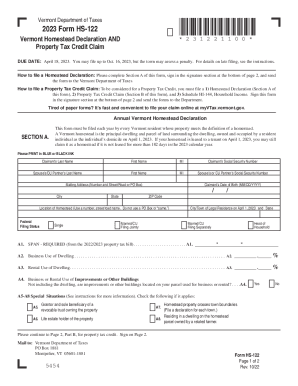

B7. B8. Household Income Schedule HI-144 Line y. Schedule HI-144 MUST be included.. B8. B8a. If Amended Schedule HI-144 Household Income is included check here. Please specify. m. INCOME n. Total Income Add Lines a through m.. n. continued on back Schedule HI-144 1. Include Schedule HI-144 To qualify you must meet the requirements for filing a homestead declaration in addition to the following requirements. How to file a Property Tax Adjustment Claim To be considered for a Property Tax...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VT HS-122 HI-144

Edit your VT HS-122 HI-144 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VT HS-122 HI-144 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VT HS-122 HI-144 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit VT HS-122 HI-144. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT HS-122 & HI-144 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VT HS-122 HI-144

How to fill out VT HS-122 & HI-144

01

Begin by downloading the VT HS-122 and HI-144 forms from the official website.

02

Fill in the personal information section such as your name, address, and contact details.

03

For the VT HS-122, indicate the type of tax return you are filing.

04

Complete the income section accurately, ensuring all sources of income are included.

05

For deductions and credits, refer to the provided instructions to maximize your benefits.

06

Review the filled form for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the completed forms by the designated deadline either electronically or via mail.

Who needs VT HS-122 & HI-144?

01

Individuals and businesses filing their income tax returns in Vermont and Hawaii.

02

Tax professionals assisting clients with state tax filings.

03

Anyone needing to report specific tax-related information for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is hi 144 in Vermont?

VT Homestead Declaration and Property Tax Credit Claim: Forms HS-122 and HI-144. This set of forms is used to tell the state of Vermont that you live in the house you own (homestead declaration) and to ask for help paying your property taxes (property tax credit claim).

How do I file for homestead exemption in Vermont?

How to File. Online - Taxpayers may file returns using myVTax, our free, secure, online filing site. Paper Returns - If you cannot file and pay through myVTax, you may still use the paper forms. The Homestead Declaration is filed using Form HS-122, the Homestead Declaration and Property Tax Credit Claim.

What is the income limit for property tax adjustment in Vermont?

You meet the “household income” criteria (up to $136,900 for calendar year 2021). * Domicile is a legal concept that has implications for Vermont income tax, the statewide education tax, and property tax credit.

What is a schedule hi 144?

Vermont Schedule HI-144: Determining Household Income 1. This fact sheet will help you prepare your household income information when filing Schedule HI-144, Household Income, which must be submitted with Property Tax Credit claims.

What is the income limit for homestead declaration in Vermont?

You occupy the property as your homestead as of April 1, 2022. You meet the “household income” criteria (up to $136,900 for calendar year 2021). * Domicile is a legal concept that has implications for Vermont income tax, the statewide education tax, and property tax credit.

What is the income limit for the property tax credit in Vermont?

You occupy the property as your homestead as of April 1, 2022. You meet the “household income” criteria (up to $136,900 for calendar year 2021).

What is the property tax break for seniors in Vermont?

Vermont Real Property Taxes In Vermont, the median property tax rate is $1,730 per $100,000 of assessed home value. For 2022, senior homeowners with 2021 household income of $136,900 or less may qualify for a property tax credit of up to $8,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete VT HS-122 HI-144 online?

pdfFiller has made it simple to fill out and eSign VT HS-122 HI-144. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the VT HS-122 HI-144 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your VT HS-122 HI-144 and you'll be done in minutes.

How do I edit VT HS-122 HI-144 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share VT HS-122 HI-144 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is VT HS-122 & HI-144?

VT HS-122 refers to the Vermont Health Care Provider Tax returns, and HI-144 refers to the Health Insurance Tax returns required in the state of Vermont.

Who is required to file VT HS-122 & HI-144?

Health care providers and entities that are subject to the health care provider tax are required to file VT HS-122. In addition, entities responsible for paying health insurance premiums need to file HI-144.

How to fill out VT HS-122 & HI-144?

To fill out VT HS-122 & HI-144, filers must provide the necessary financial information, including total revenue from health services or premiums collected. Detailed instructions can be found on the Vermont Department of Taxes website.

What is the purpose of VT HS-122 & HI-144?

The purpose of VT HS-122 & HI-144 is to assess and collect taxes from health care providers and insurance companies to fund health-related programs and services in Vermont.

What information must be reported on VT HS-122 & HI-144?

VT HS-122 requires reporting of gross receipts from health services, while HI-144 requires reporting of total health insurance premiums collected and applicable deductions.

Fill out your VT HS-122 HI-144 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VT HS-122 HI-144 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.