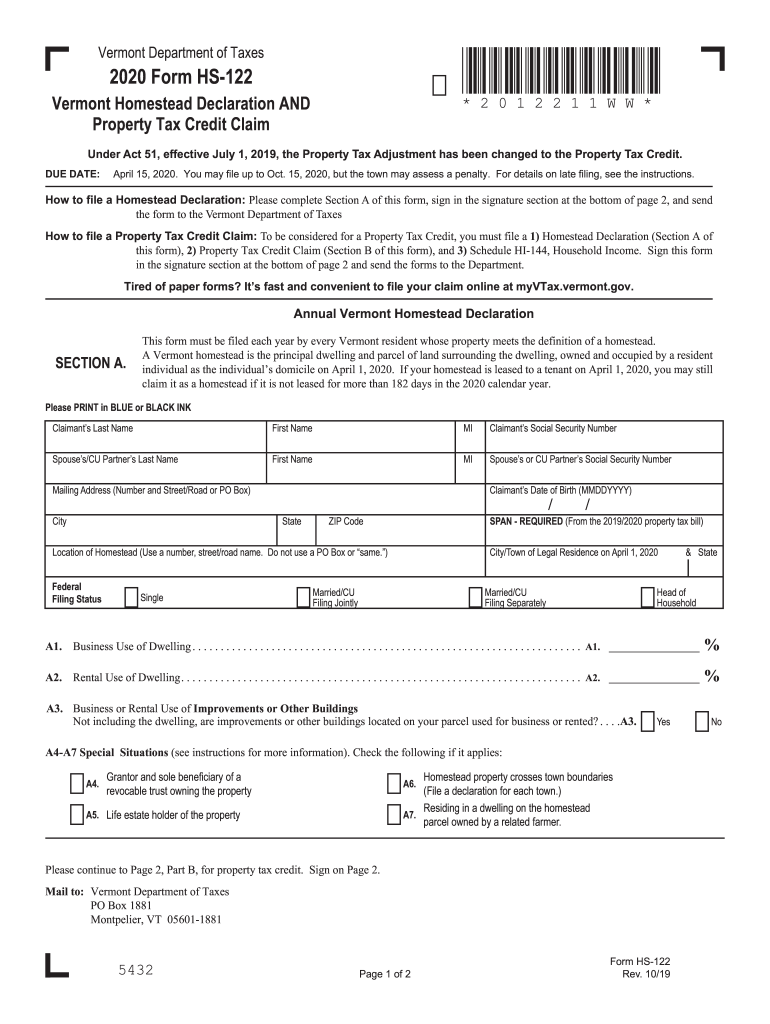

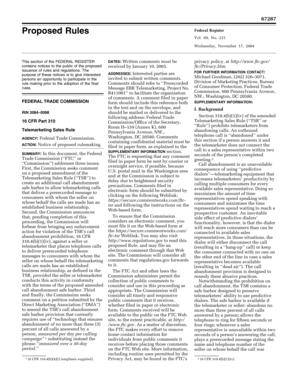

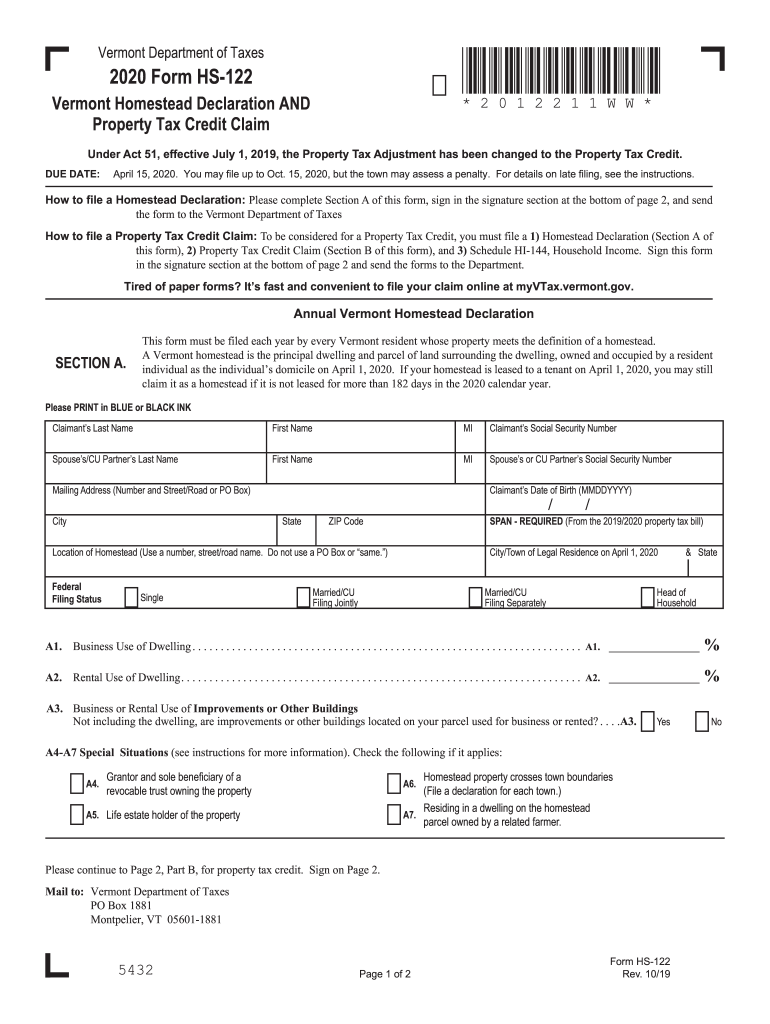

VT HS-122 & HI-144 2020 free printable template

Get, Create, Make and Sign VT HS-122 HI-144

Editing VT HS-122 HI-144 online

Uncompromising security for your PDF editing and eSignature needs

VT HS-122 & HI-144 Form Versions

How to fill out VT HS-122 HI-144

How to fill out VT HS-122 & HI-144

Who needs VT HS-122 & HI-144?

Instructions and Help about VT HS-122 HI-144

I think trying to homestead out here Ina northern climate it's a lot like Star Trek doo-doo-doo-doo hey nobody Hey look HDMI don't have any more treats for you, so I was away from the farm for the Dayan I am just getting back I know some of you have to go to bed the answer is Haven done it lately it's not because they're not trained like they go to be done their own look at this they get kind of freaked out when I shine the lighting alright goodnight ducks is what's frozen salad cracked bummer look it's a little barn cat she's out here watching me do choristers Pablo away on the distance hey guys I'll feed you in a minute good night Ex here's water so my friends Ben and Meg over at theHollar Homestead have been doing this long 10-month road trip across America really trying to explore the country and figure out where they wanted to ultimately live they started out in California and really know just kind fig tag their way across the US and I think it hit most of the states I think they were like three or four that they missed, but you know you got to give him lot of credit for being able to do all that in 10 months, so I was just watching their video the other day when they announced where they were going to live anywhere they were planning on moving to, and it's just an awesome video I will leave a link for it right up here its totally worth checking out for you guys who aren't familiar with them, but I'm sure most of you are a great story it's an amazing to see this family come together as they go across the country its well told watch it, but there was this one moment in their video which made me say wait a minute, and it was basically Meg talking about how when they were up here in New England I think they were in Maine at the time when they kind of came to this conclusion their growing season is from June to Septemberthats kind of note they didn't want to live here because really our growing season is from June to September and then outside that you're pretty much done ski and I can't dispute that fact, so that is very much true here like you really shouldn't be planting anything that's not in a high tunnel before Memorial Day, and then you know come the day of the equinox in September yeahyoure you're we should be expecting snow in any minute, so it is entirely true that we don't have a long growing season this that is just what it is but will say this if you think about it kind of nice having a short growing season I'm gonna fully acknowledge living up here in a cold climate and trying to be self-sufficient in a cold climate it isn't for everybody there's a lot of things you've got to consider that you know people in a warmer climatelike if you're in down south, or you're out west in California or even if you rein a more temperate place like you know the Pacific Northwest you know readjust a lot of stuff you don't have to consider you don't have to think about Mean it's not like you have to split a thousand of these things when you're...

People Also Ask about

What is the non homestead tax in Vermont?

What is the difference between homestead and non homestead taxes Vermont?

What is Vermont Form HS 122?

What is the income limit for homestead declaration in Vermont?

What is the income limit for property tax adjustment in Vermont?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my VT HS-122 HI-144 in Gmail?

How can I send VT HS-122 HI-144 for eSignature?

How do I edit VT HS-122 HI-144 in Chrome?

What is VT HS-122 & HI-144?

Who is required to file VT HS-122 & HI-144?

How to fill out VT HS-122 & HI-144?

What is the purpose of VT HS-122 & HI-144?

What information must be reported on VT HS-122 & HI-144?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.