NYC DoF NYC-4SEZ 2017 free printable template

Show details

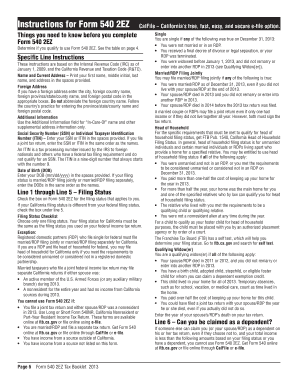

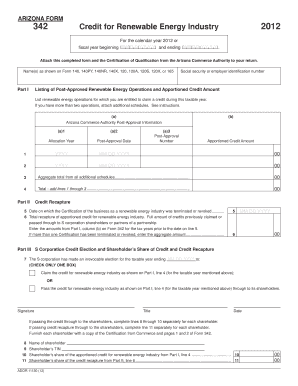

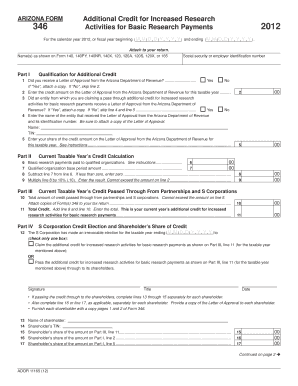

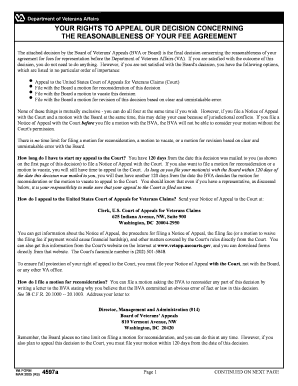

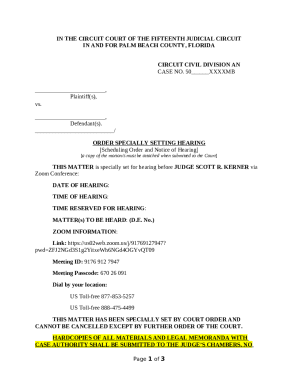

Department of Finance -4SEZ Name GENERAL CORPORATION TAX RETURN 2017 To be filed by S Corporations only. All C Corporations must file Form NYC-2 NYC-2S or NYC-2A For CALENDAR YEAR 2017 or FISCAL YEAR beginning 2017 and ending In Care Of Address number and street City and State Zip Code Business Telephone Number CHECK ALL THAT APPLY 31111791 TM n Address Change Country if not US Taxpayer s Email Address EMPLOYER IDENTIFICATION NUMBER BUSINESS CODE NUMBER AS PER FEDERAL RETURN Date business...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC DoF NYC-4SEZ

Edit your NYC DoF NYC-4SEZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC DoF NYC-4SEZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NYC DoF NYC-4SEZ online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NYC DoF NYC-4SEZ. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC DoF NYC-4SEZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC DoF NYC-4SEZ

How to fill out NYC DoF NYC-4SEZ

01

Gather all necessary financial documents, including income statements and tax returns.

02

Obtain the NYC DoF NYC-4SEZ form from the NYC Department of Finance website or office.

03

Fill out the applicant information section, including name, address, and contact details.

04

Complete the income section, providing accurate details of all sources of income.

05

Attach required supporting documents, such as proof of income and any other necessary eligibility documentation.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form and supporting documents to the appropriate NYC Department of Finance office or via their online portal.

Who needs NYC DoF NYC-4SEZ?

01

Individuals or households seeking financial assistance or exemptions related to property taxes in New York City.

02

Property owners who meet income eligibility criteria and want to apply for exemptions.

03

Those involved in programs designed to support low-income families in NYC.

Instructions and Help about NYC DoF NYC-4SEZ

Fill

form

: Try Risk Free

People Also Ask about

What form do I use for 2018 taxes?

The revised form consolidates Forms 1040, 1040-A and 1040-EZ into one form that all individual taxpayers will use to file their 2018 federal income tax return. Forms 1040-A and 1040-EZ are no longer available to file 2018 taxes. Taxpayers who used one of these forms in the past will now file Form 1040.

Who files NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

Who is subject to NYC income tax?

All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax.

What is form NYC-4S?

NYC-4S - General Corporation Tax Return.

Who is eligible for NYC tax?

You are a New York State resident if your domicile is New York State OR: you maintain a permanent place of abode in New York State for substantially all of the taxable year; and. you spend 184 days or more in New York State during the taxable year.

Who is subject to NYC unincorporated business tax?

What Activities are Subject to This Tax? Unincorporated Businesses include: trades, professions, and certain occupations of an individual, partnership, limited liability company, fiduciary, association, estate or trust.

What is form nyc-4S?

NYC-4S - General Corporation Tax Return.

How to avoid NYC city tax?

For example, you can avoid NYC income taxes if you live in New Jersey and commute to work in the city. And you can reach Manhattan in as little as thirty minutes from cities like Hoboken, Jersey City, or the many suburban towns in NJ.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in NYC DoF NYC-4SEZ without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing NYC DoF NYC-4SEZ and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit NYC DoF NYC-4SEZ on an iOS device?

Use the pdfFiller mobile app to create, edit, and share NYC DoF NYC-4SEZ from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I edit NYC DoF NYC-4SEZ on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute NYC DoF NYC-4SEZ from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is NYC DoF NYC-4SEZ?

NYC DoF NYC-4SEZ is a form used by property owners in New York City to report information related to properties in a Special Economic Zone (SEZ).

Who is required to file NYC DoF NYC-4SEZ?

Property owners and managers of properties located within designated Special Economic Zones in New York City are required to file NYC DoF NYC-4SEZ.

How to fill out NYC DoF NYC-4SEZ?

To fill out NYC DoF NYC-4SEZ, property owners should follow the instructions provided with the form, ensuring that all required information is completed accurately and submitted by the deadline.

What is the purpose of NYC DoF NYC-4SEZ?

The purpose of NYC DoF NYC-4SEZ is to collect data and ensure compliance with regulations related to property management and economic activities in Special Economic Zones.

What information must be reported on NYC DoF NYC-4SEZ?

Information that must be reported on NYC DoF NYC-4SEZ includes property details, owner information, financial data related to the property, and any specific metrics required for SEZ compliance.

Fill out your NYC DoF NYC-4SEZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC DoF NYC-4sez is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.