NYC DoF NYC-4SEZ 2014 free printable template

Show details

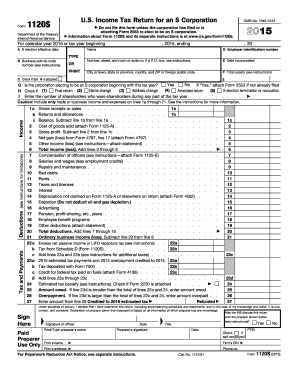

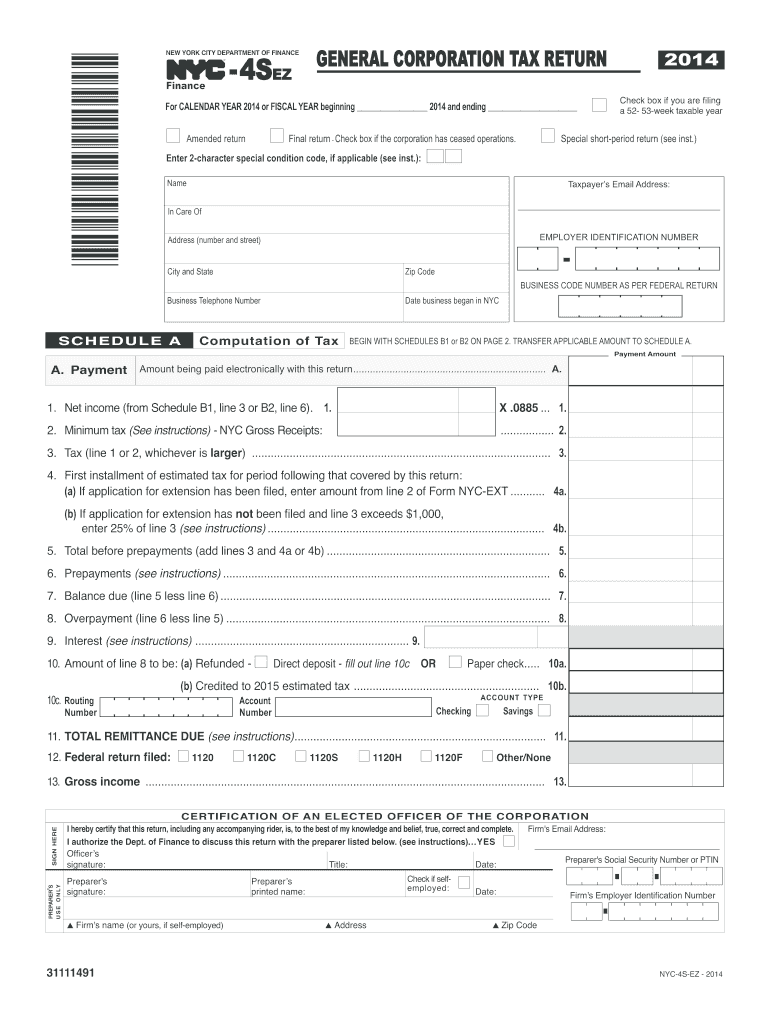

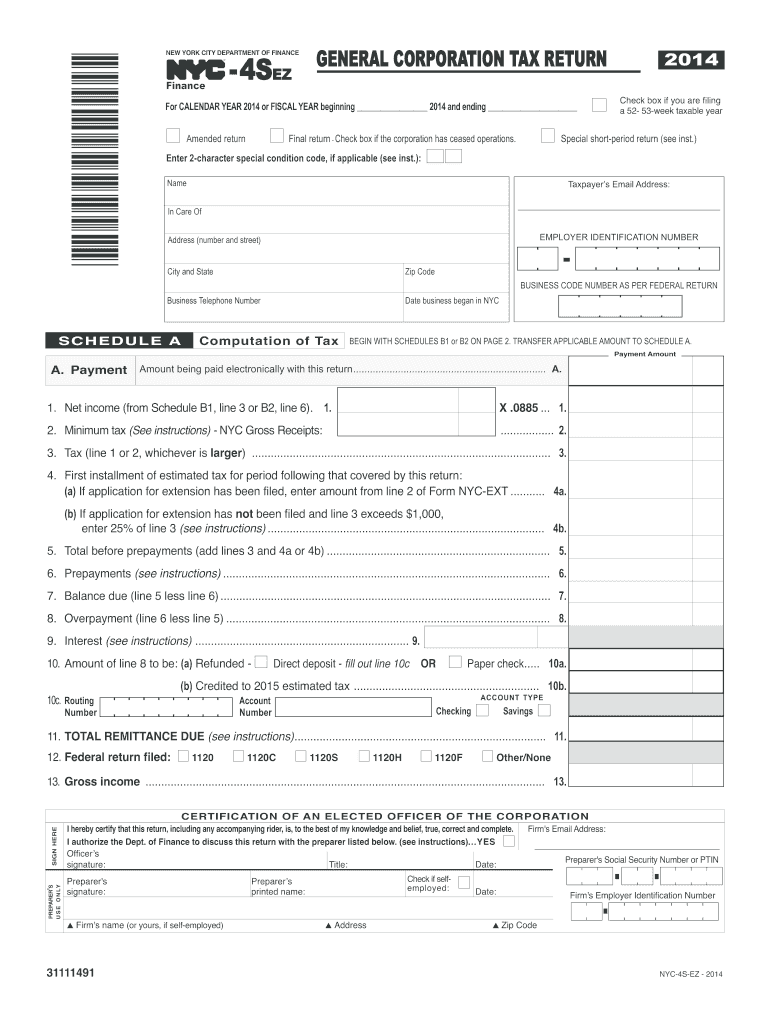

Taxpayer s Email Address In Care Of EMPLOYER IDENTIFICATION NUMBER Address number and street City and State Zip Code Business Telephone Number Date business began in NYC SCHEDULE A A. Payment -4SEZ NEW YORK CITY DEPARTMENT OF FINANCE Computation of Tax BUSINESS CODE NUMBER AS PER FEDERAL RETURN BEGIN WITH SCHEDULES B1 or B2 ON PAGE 2. Payment -4SEZ NEW YORK CITY DEPARTMENT OF FINANCE Computation of Tax BUSINESS CODE NUMBER AS PER FEDERAL RETURN BEGIN WITH SCHEDULES B1 or B2 ON PAGE 2....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC DoF NYC-4SEZ

Edit your NYC DoF NYC-4SEZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC DoF NYC-4SEZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NYC DoF NYC-4SEZ online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NYC DoF NYC-4SEZ. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC DoF NYC-4SEZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC DoF NYC-4SEZ

How to fill out NYC DoF NYC-4SEZ

01

Start with the header: Enter your name, address, and contact information.

02

Indicate the type of property you are applying for by checking the appropriate boxes.

03

Provide the property tax block and lot number for the building.

04

Fill in details related to the zoning lot and any special zoning considerations if applicable.

05

Include the owner's name and signature to verify the application.

06

Submit any required supporting documents that validate your claims.

07

Review the form for completeness and accuracy before submission.

Who needs NYC DoF NYC-4SEZ?

01

Property owners seeking tax exemptions or benefits related to their property in New York City.

02

Individuals or organizations involved in affordable housing projects within NYC.

03

Developers planning to apply for tax incentives under the NYC-4SEZ program.

Instructions and Help about NYC DoF NYC-4SEZ

Fill

form

: Try Risk Free

People Also Ask about

What is an Iowa tax ID?

The Iowa State Tax ID: This is the 9 digit Permit Number you'll receive from the state after you register for a sales tax license in Iowa. The Permit Number you provide for AutoFile should be associated with your Iowa Business Tax Account.

How do I pay the Iowa Department of Revenue?

Payment methods include credit card, direct debit from a checking account, or mailing a paper check with the Department provided payment voucher. When paying by credit card, a convenience fee will be charged based on the amount of the payment.

Why did I get a letter from Iowa Department of Revenue?

We send letters for the following reasons: You have a balance due. We have a question about your tax return. We need to verify your identity.

When can you start filing taxes in Iowa?

Filing an Income Tax Return Tax season officially begins the same day as Federal return processing (January 23, 2023) and tax Iowa tax returns are due May 1. Filing Made Easy provides a quick look at the process of filing an Iowa income tax return, including Common Mistakes to avoid.

How do I get a tax license in Iowa?

A sales tax permit can be obtained by completing the Iowa Business Tax Permit Registration online with the Iowa Department of Revenue. Information needed to register includes: Federal Employer Identification Number (FEIN), or SSN if a sole proprietorship with no employees. Business name, address, and phone number.

How do I get a tax number in Iowa?

You can apply for an FEIN online or you can use form SS-4 (pdf); this will become your state number for withholding tax purposes. Have each employee fill out a Federal W-4 (pdf) and an Iowa W-4 (access by filtering by Withholding Tax, search keyword W-4 and current year).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NYC DoF NYC-4SEZ online?

pdfFiller makes it easy to finish and sign NYC DoF NYC-4SEZ online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in NYC DoF NYC-4SEZ without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing NYC DoF NYC-4SEZ and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit NYC DoF NYC-4SEZ straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit NYC DoF NYC-4SEZ.

What is NYC DoF NYC-4SEZ?

NYC DoF NYC-4SEZ is a form used by property owners in New York City to report information regarding the tax exemption for properties located in certain special zoning areas.

Who is required to file NYC DoF NYC-4SEZ?

Property owners who have properties located in designated special zoning areas and are claiming a tax exemption must file the NYC DoF NYC-4SEZ.

How to fill out NYC DoF NYC-4SEZ?

To fill out the NYC DoF NYC-4SEZ, property owners must provide detailed information about the property, including property identification, boundaries, and any applicable exemption claims, following the instructions provided by the NYC Department of Finance.

What is the purpose of NYC DoF NYC-4SEZ?

The purpose of NYC DoF NYC-4SEZ is to enable property owners to apply for and receive tax exemptions for properties situated in specified special zoning areas within New York City.

What information must be reported on NYC DoF NYC-4SEZ?

The information that must be reported on NYC DoF NYC-4SEZ includes property details such as the tax block and lot number, ownership details, the specific exemption being claimed, and any other relevant property characteristics.

Fill out your NYC DoF NYC-4SEZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC DoF NYC-4sez is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.