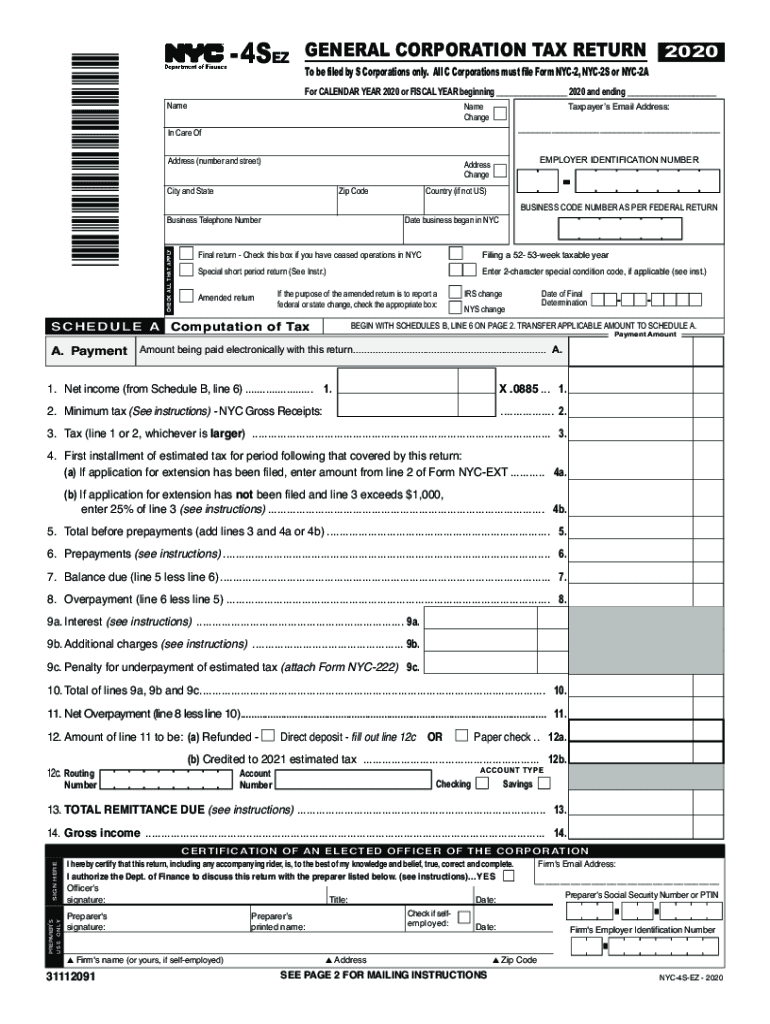

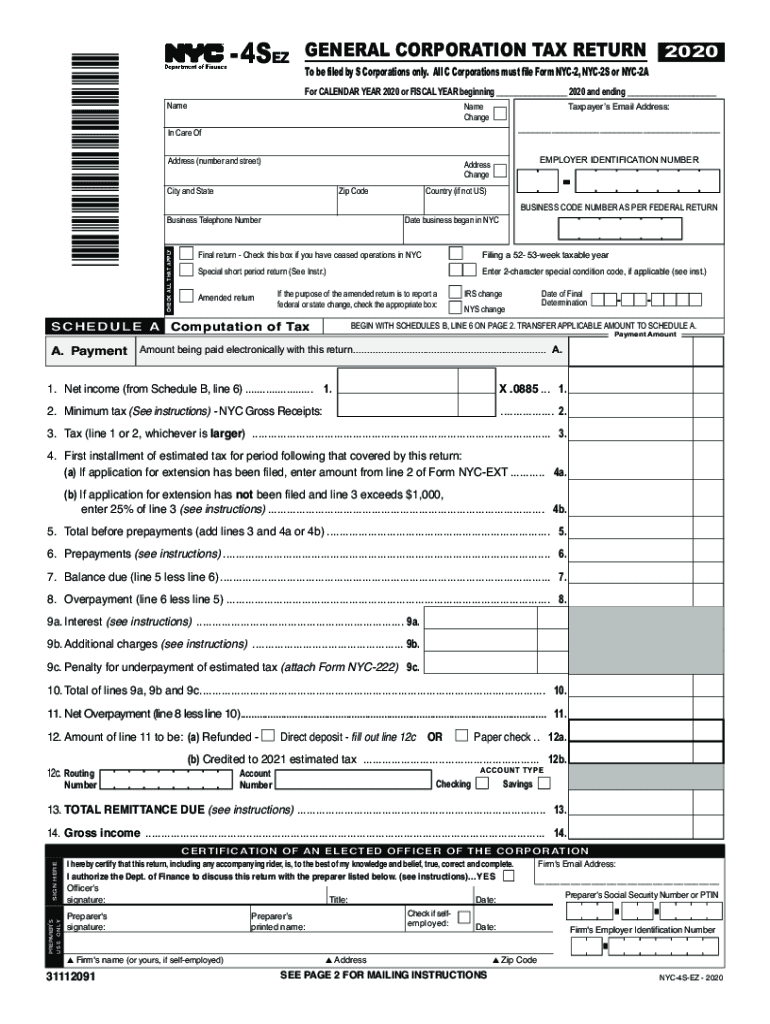

NYC DoF NYC-4SEZ 2020 free printable template

Get, Create, Make and Sign NYC DoF NYC-4SEZ

Editing NYC DoF NYC-4SEZ online

Uncompromising security for your PDF editing and eSignature needs

NYC DoF NYC-4SEZ Form Versions

How to fill out NYC DoF NYC-4SEZ

How to fill out NYC DoF NYC-4SEZ

Who needs NYC DoF NYC-4SEZ?

Instructions and Help about NYC DoF NYC-4SEZ

What's up Members of the Barrio Its Jon And some of you watching this video Are the types of travelers who like to go off the beaten path Maybe you've been to New York a few times Maybe you're tired of tourist traps Maybe YouTube just kept recommending this video, and you decided to click Either way We're going to be sharing 10 Hidden Gems For Your Next Trip To New York City Guys were going to be covering everything from hidden art Places to eat And even some secret parks This is going to be fun Lets go Were in front of the Parker New York Hotel Where a room will run you 400 dollars a night But I've got some good news You can find one of New York's the best burgers For only 9 dollars Well that is If you can find it Just follow the Big Burger Now I admit while this is a hidden gem It's not really unknown A lot of people know how good the burgers are So I advise not going during peak dinner times It was pretty crowded when we went but Oh my goodness Was that a good burger I ordered a cheeseburger with the works Look at this thing MMM Definitely one of the best burgers I've ever had in New York City Seriously Team Adriana even got in on the act on this one Oh my goodness Mummy But seriously you are going to impress people If you take them here Because the quality of the burgers to me Is more impressive Than the fact that its actually pretty tough to find This is one of my favorite hidden parks In New York City We're going to cover a bunch of them today Just find these non describe stairs at 55 Water Street And follow me Guy there's a rule in New York City Whenever I'm anywhere the escalators aren't working But we have reached the Elevated Acre This is my favorite hidden park In New York Let me show you Honestly what I like best about this park Is that there's usually nobody here Or just a handful of people So you have this little forest In the heart of the financial district Surrounded by buildings all around you But you just feel some peace Right behind me is one of the best views of the Brooklyn Bridge That a lot of people have no idea about So make sure to bring your camera Really cool insider tip for you Bring a towel there's usually not a lot of people Nobody here in fact right now On this fake turf Hit up one of the food trucks Literally around the corner off of Water Street And you have this scenic New York lunch Something to definitely consider Were in front of the Irish Hunger Memorial Dedicated to the Great Irish Famine In the 1840s and 1850s And this has got to be One of the most overlooked places to visit In Battery Park In fact I've lived in New York almost 10 years I've never even been inside So why don't we go check it out For the first time together This is kind of surreal Its like were walking inside an Irish Cottage In the middle of the Financial District How did I never visit here guys How did I never visit here It even doesn't smell like New York in here The grass is from Western Ireland It smells good Surprisingly The actual...

People Also Ask about

What form do I use for 2018 taxes?

Who files NYC 204?

Who is subject to NYC income tax?

What is form NYC-4S?

Who is eligible for NYC tax?

Who is subject to NYC unincorporated business tax?

What is form nyc-4S?

How to avoid NYC city tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NYC DoF NYC-4SEZ directly from Gmail?

Where do I find NYC DoF NYC-4SEZ?

How can I edit NYC DoF NYC-4SEZ on a smartphone?

What is NYC DoF NYC-4SEZ?

Who is required to file NYC DoF NYC-4SEZ?

How to fill out NYC DoF NYC-4SEZ?

What is the purpose of NYC DoF NYC-4SEZ?

What information must be reported on NYC DoF NYC-4SEZ?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.