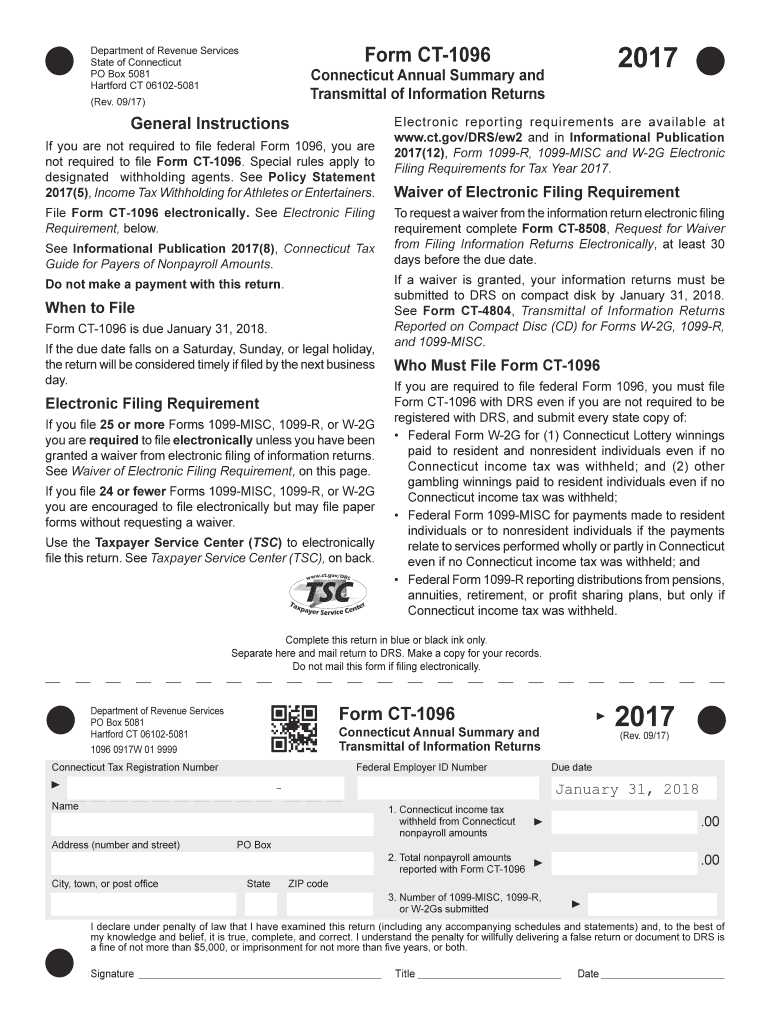

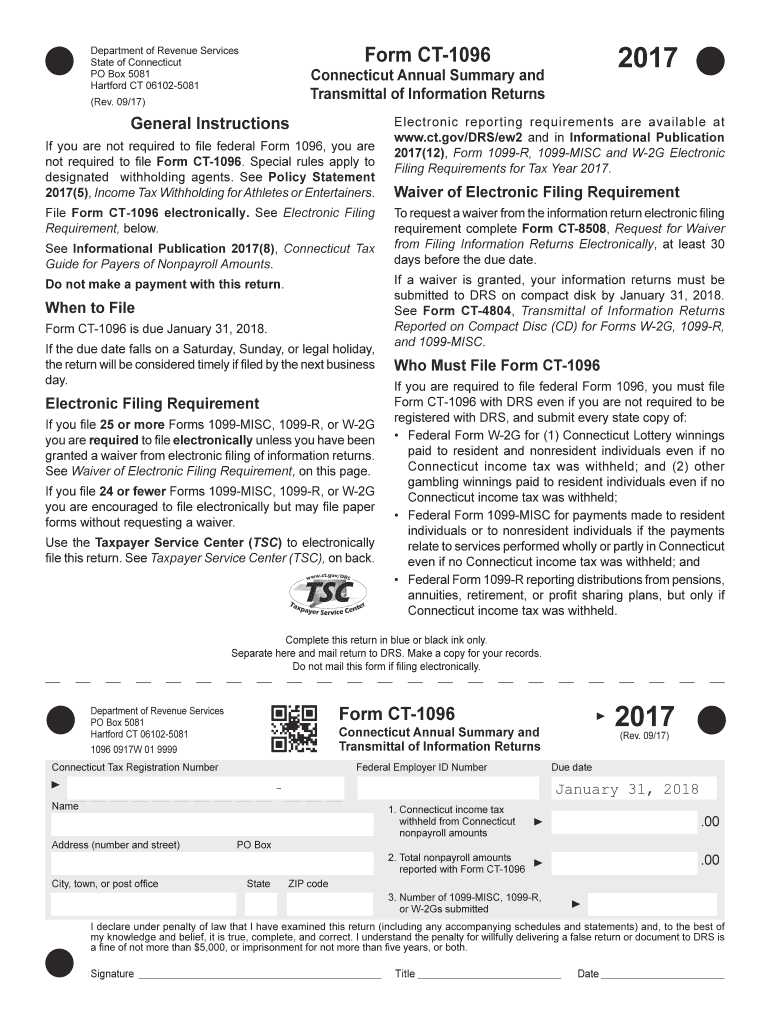

CT DRS CT-1096 2017 free printable template

Get, Create, Make and Sign ct 1096 2017 form

Editing ct 1096 2017 form online

Uncompromising security for your PDF editing and eSignature needs

CT DRS CT-1096 Form Versions

How to fill out ct 1096 2017 form

How to fill out CT DRS CT-1096

Who needs CT DRS CT-1096?

Instructions and Help about ct 1096 2017 form

Well Charlie Tango 1086 have just been listening out on channel 34 telling late some the 466 they're on me and chase them absolutely no Fink absolutely dreadful they have been going to 32 been going to 34 keep giving shouts out I get a little more see how it goes and use them a little yes away to 17 there a little at Offset Air Force at six, and I've got me bazooka up there which I brought with me today just to give it a law, so it's not likely today and that not so far from home and just not go outside there a few ounces in background because of walked a bit further down because if we're a bit cold and I keep giving a good see how it goes you never know a few local stations and from Bradford and Jules breeding places like that, but that's all I can report today to be sir to be honest are open about to a gallery or somebody like that but to nobody today a shame really okay so free spike

People Also Ask about

Where do I file my CT 1099-NEC?

Do you need to file 1096 with 1099-NEC?

What is a CT-1096 form?

Do I need to file a 1096 form?

What is the difference between 1096 and 1099?

Who needs a 1096?

Is 1099 and 1096 the same?

How do I file a CT-1096 online?

Why do I need Form 1096?

What is a form 1096s?

Do I need to file 1099-NEC with Connecticut?

Who needs to file a 1096?

Is a 1096 required?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ct 1096 2017 form to be eSigned by others?

How do I edit ct 1096 2017 form online?

How do I fill out ct 1096 2017 form on an Android device?

What is CT DRS CT-1096?

Who is required to file CT DRS CT-1096?

How to fill out CT DRS CT-1096?

What is the purpose of CT DRS CT-1096?

What information must be reported on CT DRS CT-1096?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.