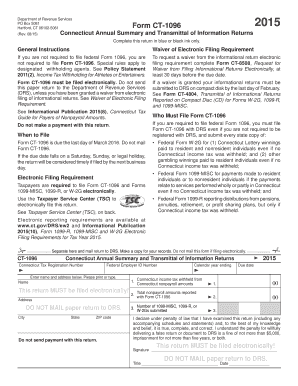

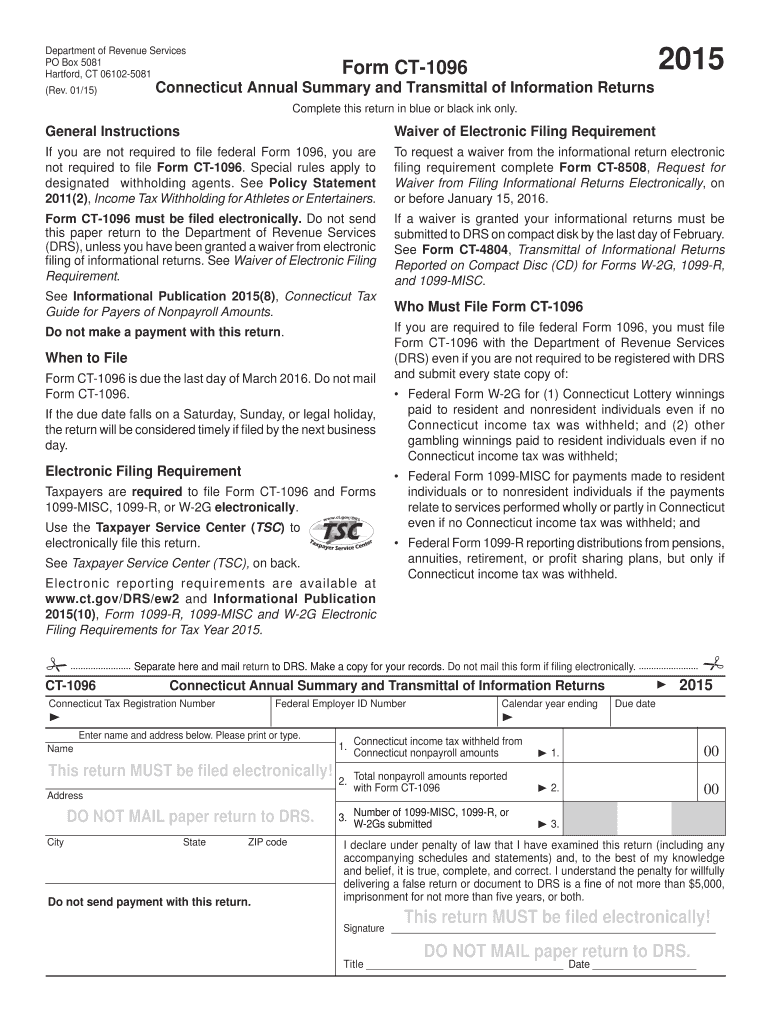

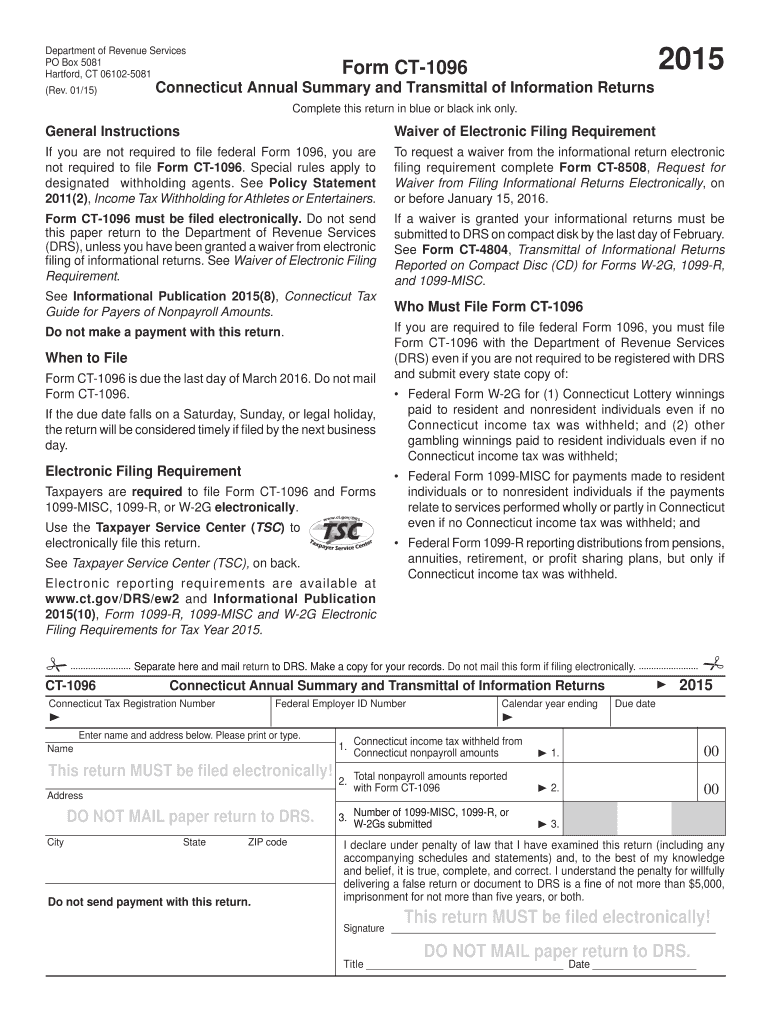

CT DRS CT-1096 2015 free printable template

Show details

If you are not required to file federal Form 1096, you are not required to file Form ... See Informational Publication 2015(8), Connecticut Tax. Guide for Payers of ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form ct 1096 drs

Edit your form ct 1096 drs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ct 1096 drs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form ct 1096 drs online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form ct 1096 drs. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-1096 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form ct 1096 drs

How to fill out CT DRS CT-1096

01

Obtain the CT DRS CT-1096 form from the Connecticut Department of Revenue Services website.

02

Fill in your name, address, and Social Security number at the top of the form.

03

Indicate your filing status as either 'Single' or 'Married'.

04

Enter your total income for the year in the designated field.

05

Calculate your total deductions and enter that amount on the form.

06

Subtract your total deductions from your total income to determine your taxable income.

07

Complete the tax calculation section to determine the amount of taxes owed.

08

Review the filled form for accuracy before submission.

09

Submit the completed form according to the instructions provided by the CT DRS.

Who needs CT DRS CT-1096?

01

Individuals who are residents of Connecticut and need to report their income for tax purposes.

02

Self-employed individuals who are required to file state income tax.

03

Anyone who has earned income and must comply with Connecticut's tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

Where do I file my CT 1099-NEC?

eFile Connecticut W-2, 1099-K, 1099-NEC, 1099-R and 1099-MISC directly to the Connecticut State agency with Tax1099. IRS approved Tax1099 allows you to eFile Connecticut forms online with an easy and secure filing process.

Do you need to file 1096 with 1099-NEC?

Sometimes, you need to hire workers who aren't employees to complete certain tasks at your business. When you hire contractors or vendors, you must prepare Forms 1099-NEC or 1099-MISC so they can accurately file their personal tax returns. You also need to submit Form 1096 with the Forms 1099 you send to the IRS.

What is a CT-1096 form?

Form CT-1096 - Connecticut Annual Summary and Transmittal of Information Returns.

Do I need to file a 1096 form?

Keep in mind IRS Form 1096 is only necessary for the mail transmittal of U.S. information returns; if you plan to go the e-file route and file your information returns electronically, you don't need to worry about attaching Form 1096.

What is the difference between 1096 and 1099?

Like Form W-2, Form 1099-NEC shows workers how much they were paid. And like Form W-3, Form 1096 summarizes the payments you made to independent contractors. Form 1096 is also used to summarize other returns, like Forms 1099-DIV and 1099-INT. You must complete a separate Form 1096 for each kind of return you file.

Who needs a 1096?

Who files IRS Form 1096? This form is exclusively for any business owner who files paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G. If you file any of those forms—and paper file—you'll likely have to file IRS Form 1096. Employees don't need to file this form.

Is 1099 and 1096 the same?

Like Form W-2, Form 1099-NEC shows workers how much they were paid. And like Form W-3, Form 1096 summarizes the payments you made to independent contractors. Form 1096 is also used to summarize other returns, like Forms 1099-DIV and 1099-INT. You must complete a separate Form 1096 for each kind of return you file.

How do I file a CT-1096 online?

Taxpayers that are not able to log into myconneCT and need to submit Form 1099-MISC/CT-1096 may do so on-line by using myconneCT. Visit the myconneCT Welcome Page and select File 1099-MISC/CT-1096 hyperlink from the panel. Choose how you would like to submit your 1099-Misc data.

Why do I need Form 1096?

Use Form 1096 to transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service. Do not use this form to transmit electronically.

What is a form 1096s?

What is Form 1096? Form 1096 is a cover sheet used to mail forms for reporting non-employee income to the IRS. If you're a small business, odds are you'll mainly be using it to submit Form 1099-NEC, the form you use to tell the IRS whenever you've paid an independent contractor more than $600 in a financial year.

Do I need to file 1099-NEC with Connecticut?

Businesses are required to submit W-2s/1099s to Connecticut Dept. of Revenue by January 31.

Who needs to file a 1096?

Who files IRS Form 1096? This form is exclusively for any business owner who files paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G. If you file any of those forms—and paper file—you'll likely have to file IRS Form 1096. Employees don't need to file this form.

Is a 1096 required?

Keep in mind IRS Form 1096 is only necessary for the mail transmittal of U.S. information returns; if you plan to go the e-file route and file your information returns electronically, you don't need to worry about attaching Form 1096.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form ct 1096 drs in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your form ct 1096 drs along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I execute form ct 1096 drs online?

Completing and signing form ct 1096 drs online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit form ct 1096 drs on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute form ct 1096 drs from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is CT DRS CT-1096?

CT DRS CT-1096 is a form used by the Connecticut Department of Revenue Services for reporting and reconciling certain taxes.

Who is required to file CT DRS CT-1096?

Businesses that are required to report and pay specific taxes to the Connecticut Department of Revenue Services must file CT DRS CT-1096.

How to fill out CT DRS CT-1096?

To fill out CT DRS CT-1096, businesses must provide their identifying information, report taxable amounts, calculate total taxes due, and sign the form as required.

What is the purpose of CT DRS CT-1096?

The purpose of CT DRS CT-1096 is to ensure compliance with Connecticut tax laws by allowing businesses to report and reconcile their tax obligations.

What information must be reported on CT DRS CT-1096?

CT DRS CT-1096 requires reporting of business identification details, total income, tax rates applied, and any tax credits claimed, among other relevant financial information.

Fill out your form ct 1096 drs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ct 1096 Drs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.