NY NYC-HTX 2017 free printable template

Show details

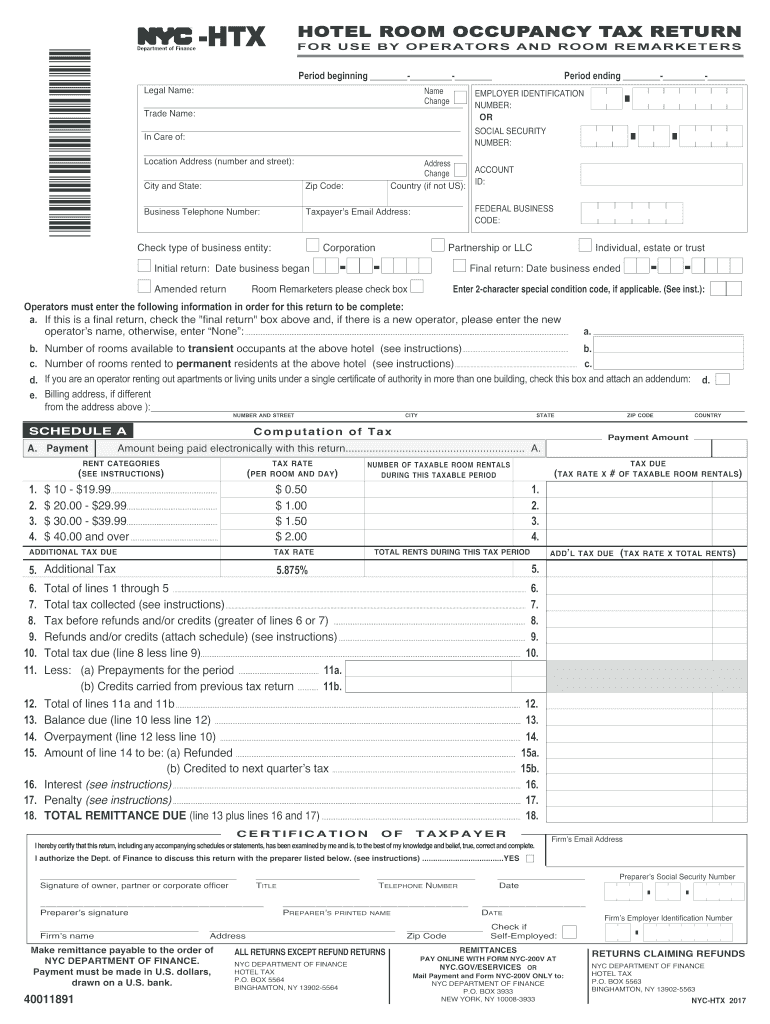

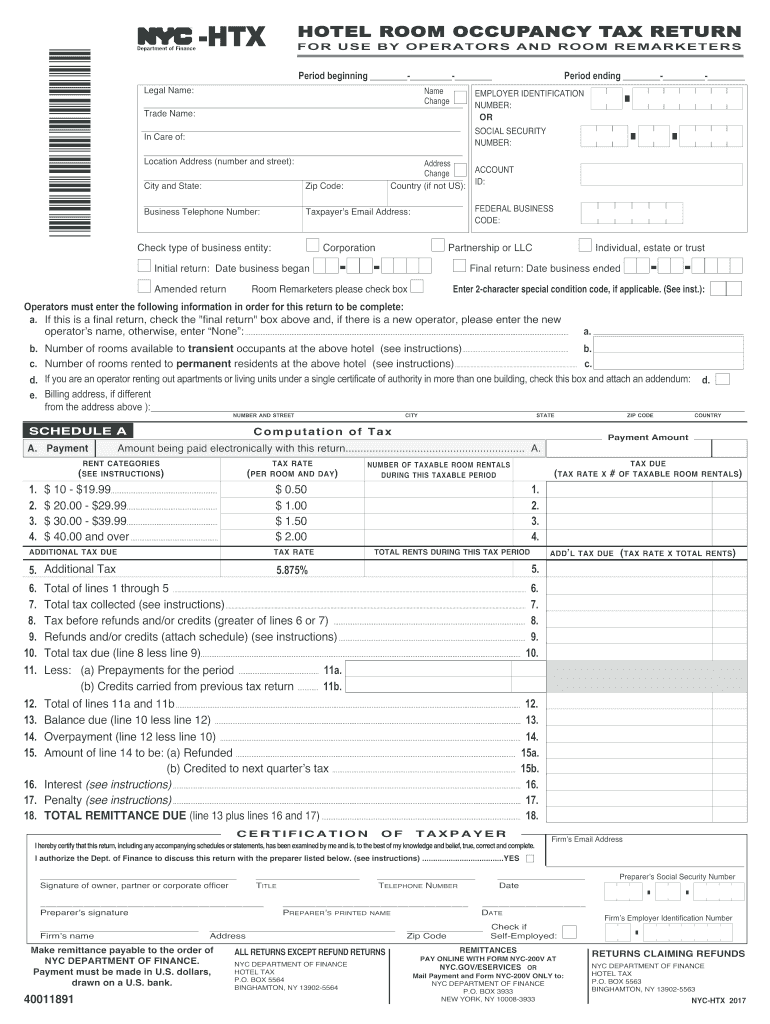

TM×40011891×Department of FinanceHTXHOTEL ROOM OCCUPANCY TAX RETURNER USE BY OPERATORS AND ROOM REMARKETERSPeriod beginning Legal Name:name Change Trade Name: In Care of: Location Address (number

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY NYC-HTX

Edit your NY NYC-HTX form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYC-HTX form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY NYC-HTX online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY NYC-HTX. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYC-HTX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY NYC-HTX

How to fill out NY NYC-HTX

01

Obtain the NY NYC-HTX form from the official website or relevant agency.

02

Read the instructions carefully to understand the requirements.

03

Gather necessary documents and information such as income, residency, and identification.

04

Enter your personal information in the designated fields accurately.

05

Provide any required financial information, including previous tax returns if applicable.

06

Review your entries for clarity and correctness.

07

Sign and date the form where required.

08

Submit the completed form through the designated method (online or by mail).

09

Keep a copy of the submitted form for your records.

Who needs NY NYC-HTX?

01

Individuals residing in New York City who are applying for housing assistance.

02

Residents seeking to document their income for public assistance programs.

03

Low-income families needing support for rent or housing-related costs.

04

Applicants for certain tax credits or deductions related to housing.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay hotel tax in USA?

A hotel tax or lodging tax is charged in most of the United States, to travelers when they rent accommodations (a room, rooms, entire home, or other living space) in a hotel, inn, tourist home or house, motel, or other lodging, generally unless the stay is for a period of 30 days or more.

Does New York have a hotel tax?

As of September 1, 2021, the full hotel room occupancy tax should be collected and remitted. One of three taxes and one fee that apply to hotel room rentals in New York City. The Department of Finance collects the New York City Hotel Room Occupancy Tax, also known as the Hotel Tax.

What are the taxes on a hotel room in NYC?

Each room night is charged New York State tax of 8.875%, a New York City tax of 5.875%, a New York City Occupancy Tax of $4.00, and a New York State hotel unit fee of $1.50. These may be prepaid with your reservation, depending on the type of reservation booked.

Do you have to pay tourist tax in New York?

There is no “tourist tax”. margaret, what is a "tourist tax"? There is no such thing in NYC. There are a number of different taxes and fees that must be added for every hotel stay.

What is the NYC HTX hotel room occupancy tax return?

On May 18, 2021, Mayor Bill de Blasio signed an executive order that eliminated the 5.875% portion of New York City's hotel room occupancy tax rate for the three-month period from June 1 to August 31, 2021. As of September 1, 2021, the full hotel room occupancy tax should be collected and remitted.

Do you have to pay tax on hotels in New York?

The room rate or rental charge is the amount that guests must pay to stay in the hotel room (or to have the right to use the hotel room). This amount is taxable at the full state and local sales tax rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY NYC-HTX in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your NY NYC-HTX as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I sign the NY NYC-HTX electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your NY NYC-HTX in seconds.

How can I fill out NY NYC-HTX on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your NY NYC-HTX. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is NY NYC-HTX?

NY NYC-HTX is a tax form used in New York City for reporting certain taxes related to hospitality and tourism.

Who is required to file NY NYC-HTX?

Businesses engaged in providing temporary lodging or accommodations in New York City must file NY NYC-HTX.

How to fill out NY NYC-HTX?

To fill out NY NYC-HTX, provide the required business information, calculate the applicable taxes, and submit the form to the city tax authority.

What is the purpose of NY NYC-HTX?

The purpose of NY NYC-HTX is to ensure proper reporting and payment of taxes related to the hospitality industry in New York City.

What information must be reported on NY NYC-HTX?

The information that must be reported includes business identification details, gross receipts from lodging, and any taxes collected.

Fill out your NY NYC-HTX online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYC-HTX is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.