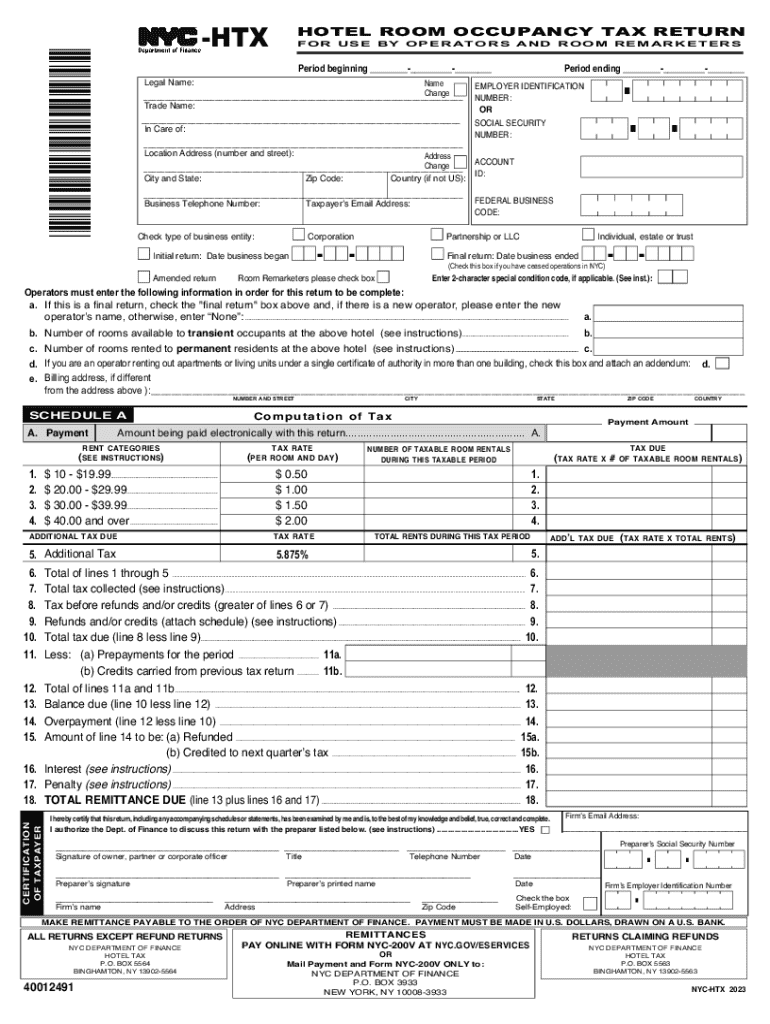

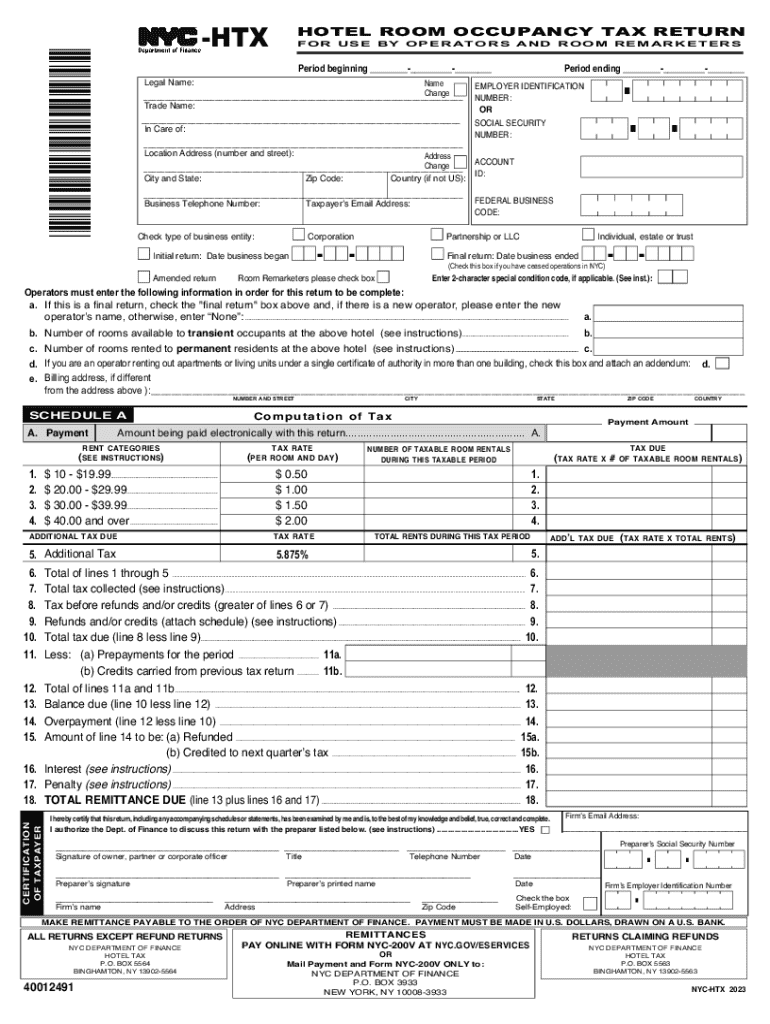

NY NYC-HTX 2023-2025 free printable template

Show details

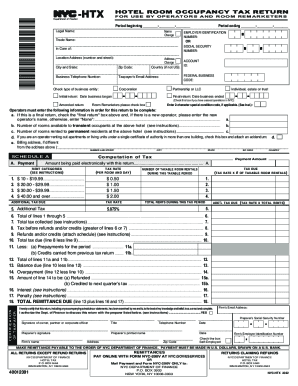

*40012491*HTXHOTEL ROOM OCCUPANCY TAX RETURNFOR USE BY OPERATORS AND ROOM REMARKETERSPeriod beginning _________nLegal Name:Period ending _________Name Change ___ Trade Name:EMPLOYER IDENTIFICATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ny occupancy tax form

Edit your ny occupancy tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyc htx tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ny occupancy tax form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new york occupancy tax form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYC-HTX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nyc htx online form

How to fill out NY NYC-HTX

01

Gather all relevant personal information, including your name, address, and contact details.

02

Collect your tax information, such as W-2s, 1099s, and any other income statements.

03

Review the guidelines for NY NYC-HTX to ensure you meet the eligibility requirements.

04

Start filling out the form by entering your personal details in the designated sections.

05

Input your income information accurately, making sure to include all sources of income.

06

Use the appropriate codes and deductions as outlined in the instructions for NY NYC-HTX.

07

Double-check all entries for accuracy before proceeding to sign the document.

08

Submit the completed form via the specified method, either online or by mailing it to the appropriate address.

Who needs NY NYC-HTX?

01

Individuals who have earned income in New York City and are required to file taxes.

02

Residents of New York City seeking to claim city-specific tax credits or deductions.

03

Those who are self-employed or have additional income that needs to be reported.

04

Tax preparers who assist clients with filing taxes in New York City.

Fill

nyc htx form

: Try Risk Free

People Also Ask about new york nyc htx fill

Do I have to pay hotel tax in USA?

A hotel tax or lodging tax is charged in most of the United States, to travelers when they rent accommodations (a room, rooms, entire home, or other living space) in a hotel, inn, tourist home or house, motel, or other lodging, generally unless the stay is for a period of 30 days or more.

Does New York have a hotel tax?

As of September 1, 2021, the full hotel room occupancy tax should be collected and remitted. One of three taxes and one fee that apply to hotel room rentals in New York City. The Department of Finance collects the New York City Hotel Room Occupancy Tax, also known as the Hotel Tax.

What are the taxes on a hotel room in NYC?

Each room night is charged New York State tax of 8.875%, a New York City tax of 5.875%, a New York City Occupancy Tax of $4.00, and a New York State hotel unit fee of $1.50. These may be prepaid with your reservation, depending on the type of reservation booked.

Do you have to pay tourist tax in New York?

There is no “tourist tax”. margaret, what is a "tourist tax"? There is no such thing in NYC. There are a number of different taxes and fees that must be added for every hotel stay.

What is the NYC HTX hotel room occupancy tax return?

On May 18, 2021, Mayor Bill de Blasio signed an executive order that eliminated the 5.875% portion of New York City's hotel room occupancy tax rate for the three-month period from June 1 to August 31, 2021. As of September 1, 2021, the full hotel room occupancy tax should be collected and remitted.

Do you have to pay tax on hotels in New York?

The room rate or rental charge is the amount that guests must pay to stay in the hotel room (or to have the right to use the hotel room). This amount is taxable at the full state and local sales tax rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get room tax return search?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the ny room tax return latest in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit room tax return get straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit ny occupancy tax return.

How do I edit nyc htx occupancy tax return latest on an Android device?

The pdfFiller app for Android allows you to edit PDF files like ny occupancy tax template. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is NY NYC-HTX?

NY NYC-HTX is a tax form used for reporting certain financial information related to New York City.

Who is required to file NY NYC-HTX?

Individuals and entities that have specific income or activities in New York City are required to file the NY NYC-HTX.

How to fill out NY NYC-HTX?

To fill out NY NYC-HTX, taxpayers should gather their financial records, follow the instructions on the form, and provide accurate reported information related to their income and activities in New York City.

What is the purpose of NY NYC-HTX?

The purpose of NY NYC-HTX is to ensure compliance with New York City tax regulations by accurately reporting financial information and determining tax liabilities.

What information must be reported on NY NYC-HTX?

Information that must be reported on NY NYC-HTX includes income earned, deductions, and any applicable credits related to activities conducted in New York City.

Fill out your new york occupancy tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Occupancy Tax Return Latest is not the form you're looking for?Search for another form here.

Keywords relevant to ny hotel tax return latest

Related to new york nyc htx occupancy return search

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.