NY NYC-HTX 2019 free printable template

Show details

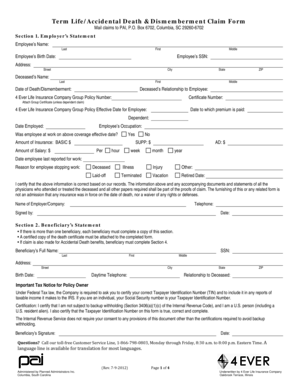

*40012091* -HEX HOTEL ROOM OCCUPANCY TAX RETURN FOR USE BY OPERATORS AND ROOM MARKETERS Period beginning — — n Legal Name: Period ending — — Name Change Trade Name: EMPLOYER IDENTIFICATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY NYC-HTX

Edit your NY NYC-HTX form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYC-HTX form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY NYC-HTX online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY NYC-HTX. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYC-HTX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY NYC-HTX

How to fill out NY NYC-HTX

01

Gather necessary personal information, including your name, address, and contact details.

02

Collect all relevant documentation such as proof of income, tax returns, and other financial information.

03

Download the NY NYC-HTX form from the official website or visit your local office to obtain a physical copy.

04

Carefully read the instructions provided with the form to understand the requirements.

05

Start filling out the form, ensuring that all sections are completed accurately.

06

Double-check all entered information for accuracy and completeness.

07

Submit the form either online or by mailing it to the appropriate address as indicated in the instructions.

Who needs NY NYC-HTX?

01

Individuals or families applying for housing assistance programs in New York City.

02

People seeking financial aid for rent or housing-related costs due to hardship.

03

Residents needing to document their eligibility for public housing benefits.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay hotel tax in USA?

A hotel tax or lodging tax is charged in most of the United States, to travelers when they rent accommodations (a room, rooms, entire home, or other living space) in a hotel, inn, tourist home or house, motel, or other lodging, generally unless the stay is for a period of 30 days or more.

Does New York have a hotel tax?

As of September 1, 2021, the full hotel room occupancy tax should be collected and remitted. One of three taxes and one fee that apply to hotel room rentals in New York City. The Department of Finance collects the New York City Hotel Room Occupancy Tax, also known as the Hotel Tax.

What are the taxes on a hotel room in NYC?

Each room night is charged New York State tax of 8.875%, a New York City tax of 5.875%, a New York City Occupancy Tax of $4.00, and a New York State hotel unit fee of $1.50. These may be prepaid with your reservation, depending on the type of reservation booked.

Do you have to pay tourist tax in New York?

There is no “tourist tax”. margaret, what is a "tourist tax"? There is no such thing in NYC. There are a number of different taxes and fees that must be added for every hotel stay.

What is the NYC HTX hotel room occupancy tax return?

On May 18, 2021, Mayor Bill de Blasio signed an executive order that eliminated the 5.875% portion of New York City's hotel room occupancy tax rate for the three-month period from June 1 to August 31, 2021. As of September 1, 2021, the full hotel room occupancy tax should be collected and remitted.

Do you have to pay tax on hotels in New York?

The room rate or rental charge is the amount that guests must pay to stay in the hotel room (or to have the right to use the hotel room). This amount is taxable at the full state and local sales tax rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY NYC-HTX to be eSigned by others?

To distribute your NY NYC-HTX, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out NY NYC-HTX using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NY NYC-HTX and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete NY NYC-HTX on an Android device?

Complete your NY NYC-HTX and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NY NYC-HTX?

NYC-HTX is a tax form used by certain businesses and employers in New York City to report employee health insurance costs and related tax information.

Who is required to file NY NYC-HTX?

Businesses and employers that provide health insurance to employees in New York City may be required to file NY NYC-HTX if they meet specific criteria set by the New York City Department of Finance.

How to fill out NY NYC-HTX?

To fill out NY NYC-HTX, taxpayers must provide relevant business information, employee details, and accurate reporting of health insurance costs in the specified fields on the form.

What is the purpose of NY NYC-HTX?

The purpose of NY NYC-HTX is to ensure compliance with local tax laws and to collect data regarding health insurance benefits provided to employees in New York City.

What information must be reported on NY NYC-HTX?

NY NYC-HTX requires reporting of employer identification details, employee wage information, health insurance coverage details, and total costs related to health benefits.

Fill out your NY NYC-HTX online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYC-HTX is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.