MA DoR 355SBC 2017 free printable template

Show details

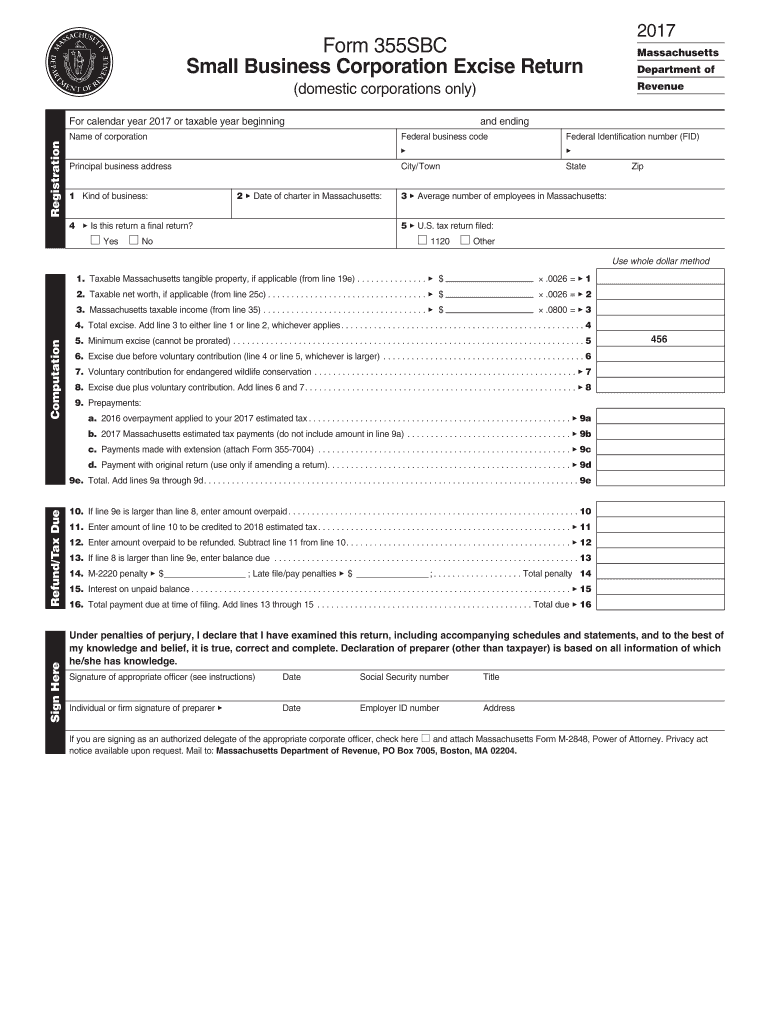

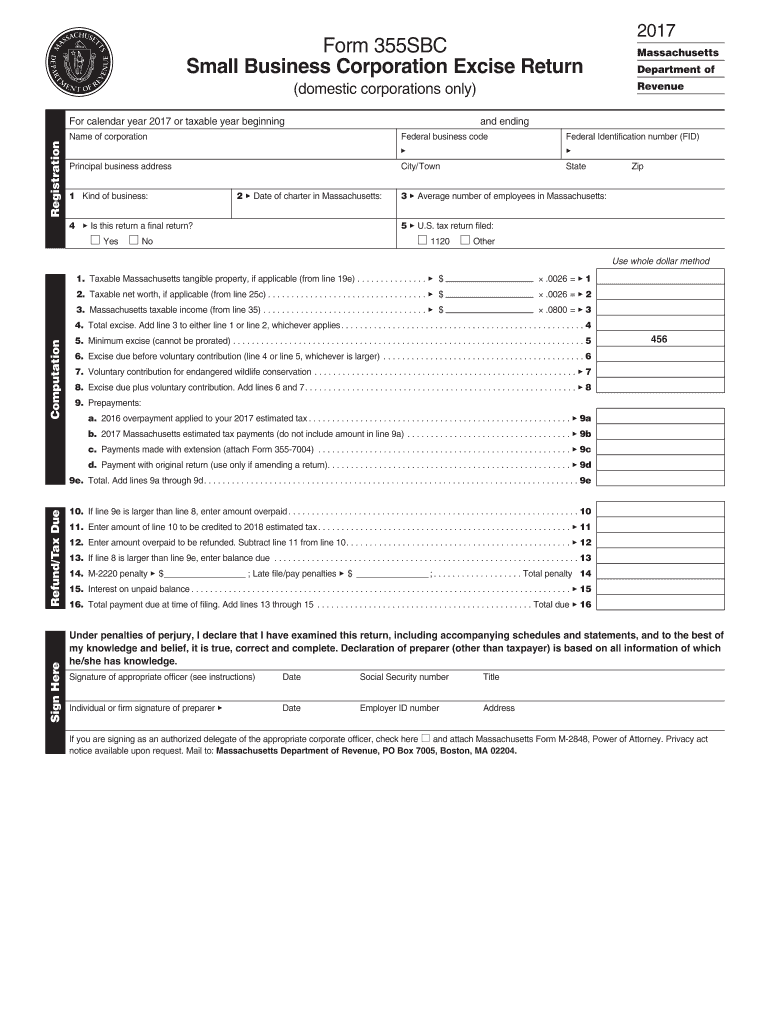

Form 355SBC Small Business Corporation Excise Return Registration Principal business address 2 3 Date of charter in Massachusetts 4 3 Is this return a final return Yes Department of and ending Name of corporation 1 Kind of business Massachusetts Revenue domestic corporations only For calendar year 2017 or taxable year beginning Federal business code Federal Identification number FID City/Town State Zip 3 3 Average number of employees in Massachusetts 5 3 U.S. tax return filed No Other Use...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR 355SBC

Edit your MA DoR 355SBC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR 355SBC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA DoR 355SBC online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MA DoR 355SBC. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR 355SBC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR 355SBC

How to fill out MA DoR 355SBC

01

Gather necessary financial documents and information related to your business.

02

Obtain the MA DoR 355SBC form from the Massachusetts Department of Revenue website or your local office.

03

Fill out Section A with your business name, address, and identification number.

04

Complete Section B by providing details on your business activities and the types of income generated.

05

In Section C, calculate and report any applicable deductions or credits.

06

Review the filled form for accuracy and completeness to avoid errors.

07

Sign and date the form in Section D, indicating your acknowledgment of the information provided.

08

Submit the completed form according to the instructions provided, either electronically or through mail.

Who needs MA DoR 355SBC?

01

Businesses operating in Massachusetts that earn income and need to report for corporate excise tax purposes.

02

Taxpayers claiming eligibility for specific tax credits or deductions related to their business activities.

03

Limited liability companies, partnerships, and other entities that meet the criteria outlined by the Massachusetts Department of Revenue.

Instructions and Help about MA DoR 355SBC

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum income for an S corp?

Though the Internal Revenue Service does have a number of requirements that the company must meet to make the election, there is no income limit on how much an S corporation can make and keep its election.

What is the form for a Massachusetts S Corp?

Massachusetts S corporations must annually file Form 355S or Form 63 FI. A Massachusetts S corporation that is included in a 355U also files Form 355S or 63FI but that return will generally be informational only. S corporations must also include with the annual filing: A Massachusetts Schedule S.

At what income level is S corp worth it?

So, when they understand the self-employment tax savings, the S-Corp becomes a no-brainer for them, even at a low-income tax level of $30,000 or $40,000. But for most clients, having an S Corp when a business owner has a profit of less than $50,000 doesn't make much sense.

What is the MA income tax for S corp?

An S corporation financial institution is taxed at 9.0% on any income that is taxable at the federal level. An S corporation financial institution with gross receipts that are $6 million or more but less than $9 million is subject to the corporate excise at a rate of 2.67% on net income subject to tax.

What are the rules for filing as an S corp?

To qualify for S corporation status, the corporation must meet the following requirements: Be a domestic corporation. Have only allowable shareholders. Have no more than 100 shareholders. Have only one class of stock.

Are LLCs taxed as S Corp in Massachusetts?

Massachusetts LLCs taxed as S-corp S-corps are taxed as pass-through entities and don't have to pay corporate taxes. Additionally, S-corp owners don't need to pay the 15.3% self-employment tax on any distributions they receive from the business. However, S-corp owners still need to pay self-employment tax on salary.

What are yearly fees for S corp?

The annual tax for S corporations is the greater of 1.5% of the corporation's net income or $800.

Is there an income limit for S Corp?

Though the Internal Revenue Service does have a number of requirements that the company must meet to make the election, there is no income limit on how much an S corporation can make and keep its election.

What is the annual fee for S Corp?

S corporations are subject to the annual $800 minimum franchise tax.

What is the entity level tax for an S Corp in Massachusetts?

An S corporation financial institution is taxed at 9.0% on any income that is taxable at the federal level. An S corporation financial institution with gross receipts that are $6 million or more but less than $9 million is subject to the corporate excise at a rate of 2.67% on net income subject to tax.

Is there an annual fee for S corp?

S corporations are subject to the annual $800 minimum franchise tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MA DoR 355SBC without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including MA DoR 355SBC, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in MA DoR 355SBC without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit MA DoR 355SBC and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my MA DoR 355SBC in Gmail?

Create your eSignature using pdfFiller and then eSign your MA DoR 355SBC immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is MA DoR 355SBC?

MA DoR 355SBC is a state tax form used for reporting corporate excise tax by manufacturers and specific types of businesses in Massachusetts.

Who is required to file MA DoR 355SBC?

Businesses that are classified as manufacturers in Massachusetts and meet certain size and revenue requirements are required to file the MA DoR 355SBC.

How to fill out MA DoR 355SBC?

To fill out MA DoR 355SBC, businesses should gather their financial records, complete the form with accurate income and expense data, and submit it by the designated filing deadline.

What is the purpose of MA DoR 355SBC?

The purpose of MA DoR 355SBC is to assess and collect corporate excise tax from qualifying manufacturing businesses, ensuring compliance with state tax regulations.

What information must be reported on MA DoR 355SBC?

Information that must be reported on MA DoR 355SBC includes details about the business's income, deductions, and credits, along with any other applicable financial information as specified in the form instructions.

Fill out your MA DoR 355SBC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR 355sbc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.