MA DoR 355SBC 2020 free printable template

Show details

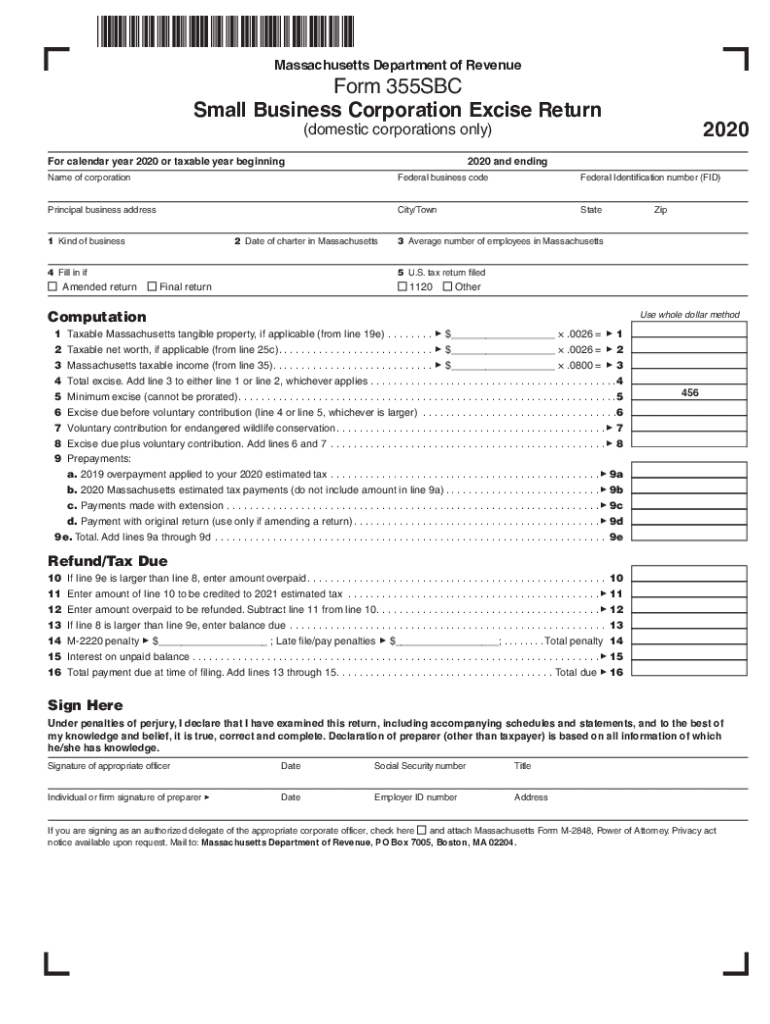

Form 355SBC Small Business Corporation Excise Return Registration Principal business address 2 3 Date of charter in Massachusetts 4 3 Fill in if Amended return Department of 2018 and ending Name of corporation 1 Kind of business Massachusetts Revenue domestic corporations only For calendar year 2018 or taxable year beginning Federal business code Federal Identification number FID City/Town State Zip 3 3 Average number of employees in Massachusetts 5 3 U.S. tax return filed Final return Other...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR 355SBC

Edit your MA DoR 355SBC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR 355SBC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA DoR 355SBC online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MA DoR 355SBC. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR 355SBC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR 355SBC

How to fill out MA DoR 355SBC

01

Obtain the MA DoR 355SBC form from the Massachusetts Department of Revenue website or your local tax office.

02

Fill in your personal information such as your name, address, and Social Security number.

03

Provide details about your income sources, including wages, investments, and other earnings.

04

List any deductions or credits you are eligible for that may reduce your taxable income.

05

Double-check all entered information for accuracy and completeness.

06

Sign and date the form at the designated section.

07

Submit the completed form to the appropriate tax authority, either electronically or by mail.

Who needs MA DoR 355SBC?

01

Individuals who meet specific income criteria and are applying for a tax exemption or credit in Massachusetts.

02

Business owners who need to report certain financial details for tax purposes.

03

Non-profit organizations seeking to claim tax status or exemptions.

Instructions and Help about MA DoR 355SBC

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum income for an S corp?

Though the Internal Revenue Service does have a number of requirements that the company must meet to make the election, there is no income limit on how much an S corporation can make and keep its election.

What is the form for a Massachusetts S Corp?

Massachusetts S corporations must annually file Form 355S or Form 63 FI. A Massachusetts S corporation that is included in a 355U also files Form 355S or 63FI but that return will generally be informational only. S corporations must also include with the annual filing: A Massachusetts Schedule S.

At what income level is S corp worth it?

So, when they understand the self-employment tax savings, the S-Corp becomes a no-brainer for them, even at a low-income tax level of $30,000 or $40,000. But for most clients, having an S Corp when a business owner has a profit of less than $50,000 doesn't make much sense.

What is the MA income tax for S corp?

An S corporation financial institution is taxed at 9.0% on any income that is taxable at the federal level. An S corporation financial institution with gross receipts that are $6 million or more but less than $9 million is subject to the corporate excise at a rate of 2.67% on net income subject to tax.

What are the rules for filing as an S corp?

To qualify for S corporation status, the corporation must meet the following requirements: Be a domestic corporation. Have only allowable shareholders. Have no more than 100 shareholders. Have only one class of stock.

Are LLCs taxed as S Corp in Massachusetts?

Massachusetts LLCs taxed as S-corp S-corps are taxed as pass-through entities and don't have to pay corporate taxes. Additionally, S-corp owners don't need to pay the 15.3% self-employment tax on any distributions they receive from the business. However, S-corp owners still need to pay self-employment tax on salary.

What are yearly fees for S corp?

The annual tax for S corporations is the greater of 1.5% of the corporation's net income or $800.

Is there an income limit for S Corp?

Though the Internal Revenue Service does have a number of requirements that the company must meet to make the election, there is no income limit on how much an S corporation can make and keep its election.

What is the annual fee for S Corp?

S corporations are subject to the annual $800 minimum franchise tax.

What is the entity level tax for an S Corp in Massachusetts?

An S corporation financial institution is taxed at 9.0% on any income that is taxable at the federal level. An S corporation financial institution with gross receipts that are $6 million or more but less than $9 million is subject to the corporate excise at a rate of 2.67% on net income subject to tax.

Is there an annual fee for S corp?

S corporations are subject to the annual $800 minimum franchise tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in MA DoR 355SBC?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your MA DoR 355SBC to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete MA DoR 355SBC on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your MA DoR 355SBC, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit MA DoR 355SBC on an Android device?

With the pdfFiller Android app, you can edit, sign, and share MA DoR 355SBC on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MA DoR 355SBC?

MA DoR 355SBC is a form used in Massachusetts for small business corporations to report their income, deductions, and credits to the Department of Revenue.

Who is required to file MA DoR 355SBC?

Small business corporations that operate in Massachusetts and have income subject to taxation are required to file MA DoR 355SBC.

How to fill out MA DoR 355SBC?

To fill out MA DoR 355SBC, taxpayers must provide information such as their business name, federal identification number, income amounts, deductions, and credits. It is important to follow the instructions provided with the form.

What is the purpose of MA DoR 355SBC?

The purpose of MA DoR 355SBC is to report the income and other financial information of small business corporations to the state for tax assessment and compliance.

What information must be reported on MA DoR 355SBC?

The MA DoR 355SBC requires reporting of information such as gross income, deductions for business expenses, applicable credits, and other financial details related to the operation of the corporation.

Fill out your MA DoR 355SBC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR 355sbc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.