MA DoR 355SBC 2014 free printable template

Show details

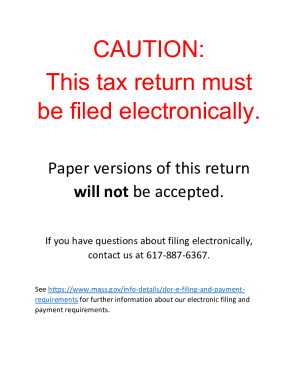

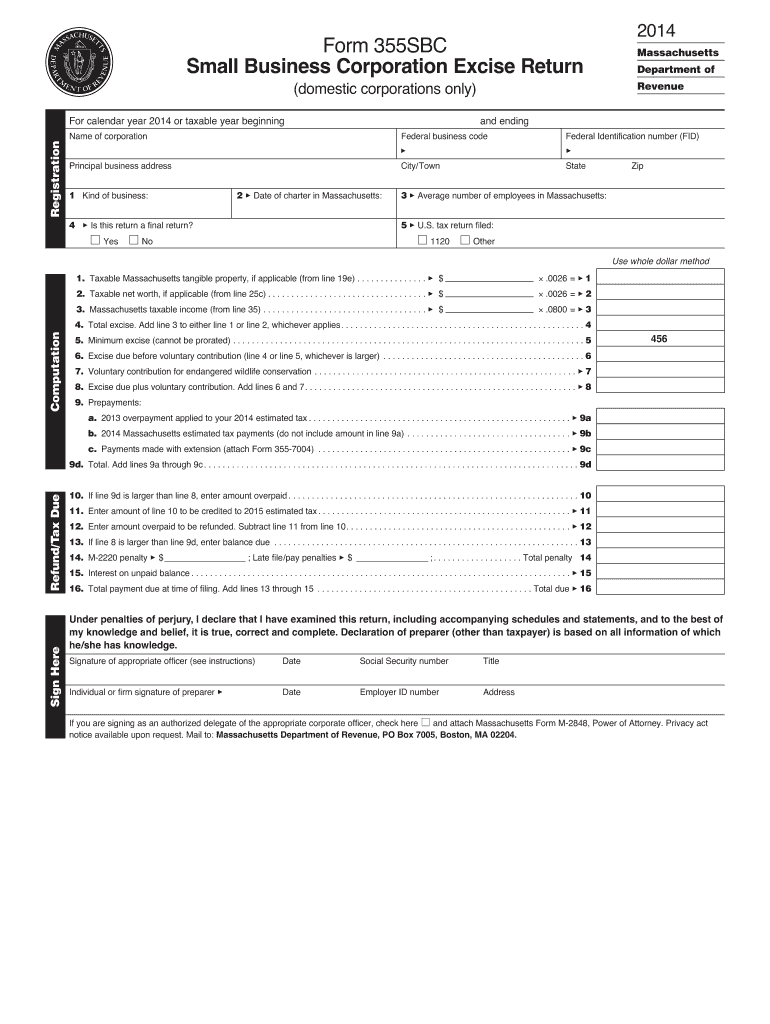

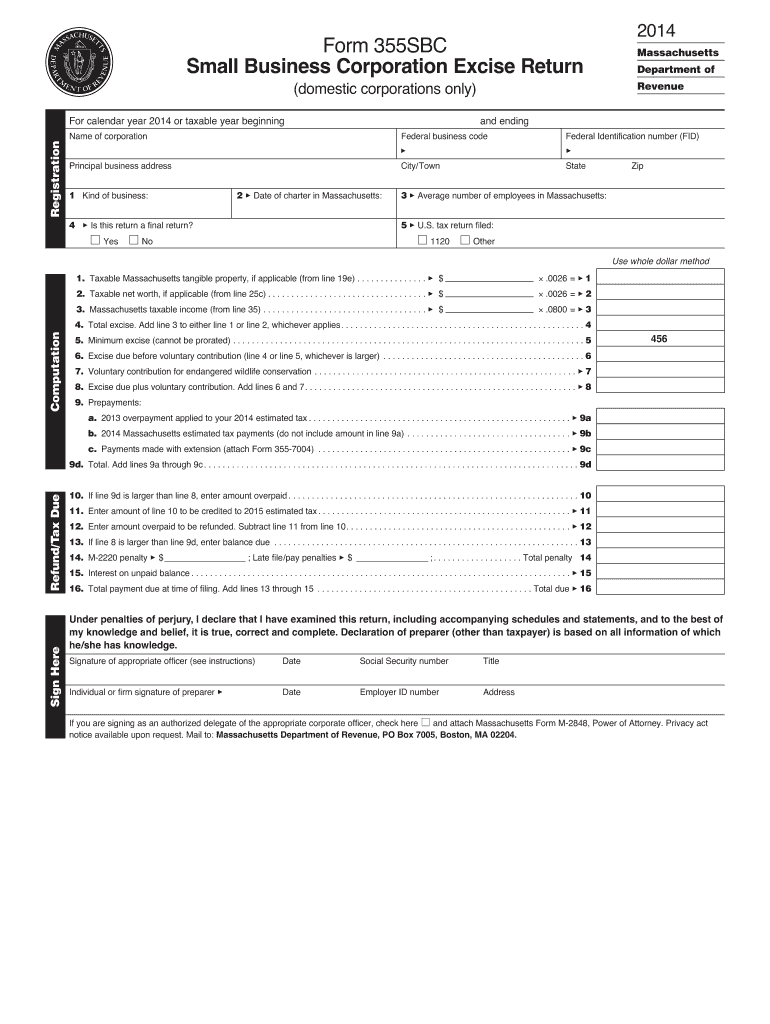

Form 355SBC Small Business Corporation Excise Return Registration Federal business code Federal Identification number FID 2 3 Date of charter in Massachusetts Yes City/Town Principal business address 4 3 Is this return a final return Department of and ending Name of corporation 1 Kind of business Massachusetts Revenue domestic corporations only For calendar year 2014 or taxable year beginning State Zip 3 3 Average number of employees in Massachusetts 5 3 U.S. tax return filed No Other Use...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR 355SBC

Edit your MA DoR 355SBC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR 355SBC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA DoR 355SBC online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MA DoR 355SBC. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR 355SBC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR 355SBC

How to fill out MA DoR 355SBC

01

Obtain the MA DoR 355SBC form from the Massachusetts Department of Revenue website.

02

Provide your identification information including name, address, and Social Security number.

03

Enter the appropriate tax year for the submission.

04

Indicate the type of entity that you are filing for (individual, corporation, etc.).

05

Fill in the relevant financial information, including income and deductions.

06

Review all entries for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form either electronically or by mail to the designated address.

Who needs MA DoR 355SBC?

01

Individuals or businesses in Massachusetts who are applying for or making changes to their tax status might need to fill out the MA DoR 355SBC form.

Instructions and Help about MA DoR 355SBC

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum income for an S corp?

Though the Internal Revenue Service does have a number of requirements that the company must meet to make the election, there is no income limit on how much an S corporation can make and keep its election.

What is the form for a Massachusetts S Corp?

Massachusetts S corporations must annually file Form 355S or Form 63 FI. A Massachusetts S corporation that is included in a 355U also files Form 355S or 63FI but that return will generally be informational only. S corporations must also include with the annual filing: A Massachusetts Schedule S.

At what income level is S corp worth it?

So, when they understand the self-employment tax savings, the S-Corp becomes a no-brainer for them, even at a low-income tax level of $30,000 or $40,000. But for most clients, having an S Corp when a business owner has a profit of less than $50,000 doesn't make much sense.

What is the MA income tax for S corp?

An S corporation financial institution is taxed at 9.0% on any income that is taxable at the federal level. An S corporation financial institution with gross receipts that are $6 million or more but less than $9 million is subject to the corporate excise at a rate of 2.67% on net income subject to tax.

What are the rules for filing as an S corp?

To qualify for S corporation status, the corporation must meet the following requirements: Be a domestic corporation. Have only allowable shareholders. Have no more than 100 shareholders. Have only one class of stock.

Are LLCs taxed as S Corp in Massachusetts?

Massachusetts LLCs taxed as S-corp S-corps are taxed as pass-through entities and don't have to pay corporate taxes. Additionally, S-corp owners don't need to pay the 15.3% self-employment tax on any distributions they receive from the business. However, S-corp owners still need to pay self-employment tax on salary.

What are yearly fees for S corp?

The annual tax for S corporations is the greater of 1.5% of the corporation's net income or $800.

Is there an income limit for S Corp?

Though the Internal Revenue Service does have a number of requirements that the company must meet to make the election, there is no income limit on how much an S corporation can make and keep its election.

What is the annual fee for S Corp?

S corporations are subject to the annual $800 minimum franchise tax.

What is the entity level tax for an S Corp in Massachusetts?

An S corporation financial institution is taxed at 9.0% on any income that is taxable at the federal level. An S corporation financial institution with gross receipts that are $6 million or more but less than $9 million is subject to the corporate excise at a rate of 2.67% on net income subject to tax.

Is there an annual fee for S corp?

S corporations are subject to the annual $800 minimum franchise tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MA DoR 355SBC in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your MA DoR 355SBC along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get MA DoR 355SBC?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific MA DoR 355SBC and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit MA DoR 355SBC straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing MA DoR 355SBC right away.

What is MA DoR 355SBC?

MA DoR 355SBC is a tax form used in Massachusetts for reporting income and calculating tax obligations for certain businesses.

Who is required to file MA DoR 355SBC?

Businesses that operate as pass-through entities such as S corporations, partnerships, and limited liability companies (LLCs) are required to file MA DoR 355SBC.

How to fill out MA DoR 355SBC?

To fill out MA DoR 355SBC, tax filers must provide their business information, report income and deductions, and calculate the resulting tax liability based on instructions provided by the Massachusetts Department of Revenue.

What is the purpose of MA DoR 355SBC?

The purpose of MA DoR 355SBC is to report the income and tax obligations of pass-through entities and to ensure compliance with state tax laws.

What information must be reported on MA DoR 355SBC?

The MA DoR 355SBC requires the reporting of business income, deductions, credits, and any applicable tax liabilities related to the business operations.

Fill out your MA DoR 355SBC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR 355sbc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.