IN DLGF HC10 2020 free printable template

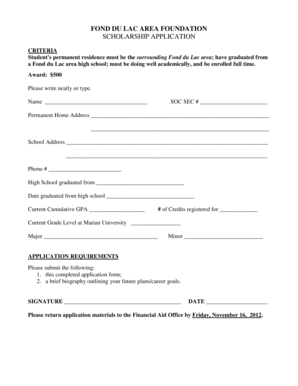

Get, Create, Make and Sign IN DLGF HC10

Editing IN DLGF HC10 online

Uncompromising security for your PDF editing and eSignature needs

IN DLGF HC10 Form Versions

How to fill out IN DLGF HC10

How to fill out IN DLGF HC10

Who needs IN DLGF HC10?

Instructions and Help about IN DLGF HC10

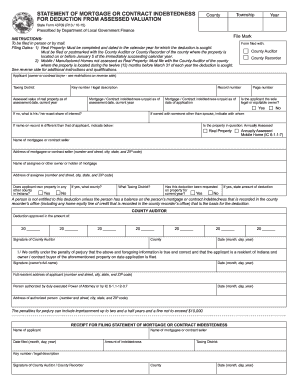

It was talking about the homestead exemption a homestead generally refers to the primary residence owned and occupied by a person or family, so a homestead exemption is a legal provision designed to protect the value in a principal dwelling place thus homestead exemptions can provide asset protection from creditors for at least some part of the value of the homestead typically no creditors except a mortgage holder taxing agency or mechanic's lien that has liens placed by those who provide a home improvement services for example they seized more than the of the equity in the homestead laws allow now to give you a little background I've been in the asset protection field since 1991 and our company started in 1906 I believe we currently have about 65000 clients that are in our database, and we are the leading asset protection firm nationally so feel free to call us for a free consultation the homestead exemption may also refer to statues in some jurisdiction that offer property tax reductions for a personal residence now in Florida a person must have the consent of both spouses in order to sell a primary residence even if the property was paid for and is in the name of only one spouse upon death the surviving spouse can enjoy a life of state and use the home until passing, and it allows very indifferent States alternatively a widow may elect to timely file a 50 interest in the home and the remaining 50 is held in a life estate for the benefit of the decedent's children in particular this video focuses on the amount of equity that one can protect from judgment creditors in each jurisdiction homestead exemption statutes vary by state for example some states such as Florida Iowa Kansas Oklahoma South Dakota and Texas have provisions that followed properly allowing 100 percent of the equity to be protected and other states such as New Jersey and Pennsylvania they do not offer any homestead protection whereas the degree of protection in the New York varies county by county what is more with the tooth five federal bankruptcy code revision residences purchased within 40 months that is three years and four months of a bankruptcy filing as of this writing receive the maximum exemption of 125000 regardless of whether the exemption in that state is much higher in addition there is a great diversity in homestead protection state-by-state some states allow you to protect 100 of your home as we said others protect a little to none some states allow married couples to double their exemption others do not have that provision some states make you file a declaration of homestead before filing for bankruptcy others it's automatic the majority of states require you to follow the state homestead rules and some allow you to choose between the state and federal homestead exemption rules on our website I believe it is the first only list we could find online that includes not only us states in DC but also US territories so can I keep my house if I file for bankruptcy now...

People Also Ask about

Do you have to file homestead exemption every year in Indiana?

How do I file for homestead exemption in Indiana?

How much does the homestead exemption save you in Indiana?

How often do you have to do Homestead?

At what age do you stop paying property taxes in Indiana?

How much is Indiana's homestead exemption?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IN DLGF HC10 without leaving Google Drive?

Can I create an electronic signature for the IN DLGF HC10 in Chrome?

Can I create an electronic signature for signing my IN DLGF HC10 in Gmail?

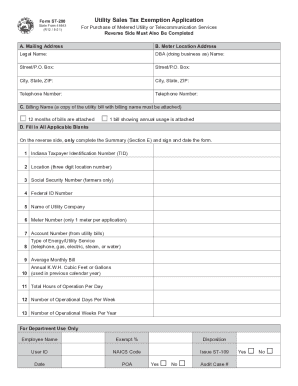

What is IN DLGF HC10?

Who is required to file IN DLGF HC10?

How to fill out IN DLGF HC10?

What is the purpose of IN DLGF HC10?

What information must be reported on IN DLGF HC10?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.