IN DLGF HC10 2015 free printable template

Show details

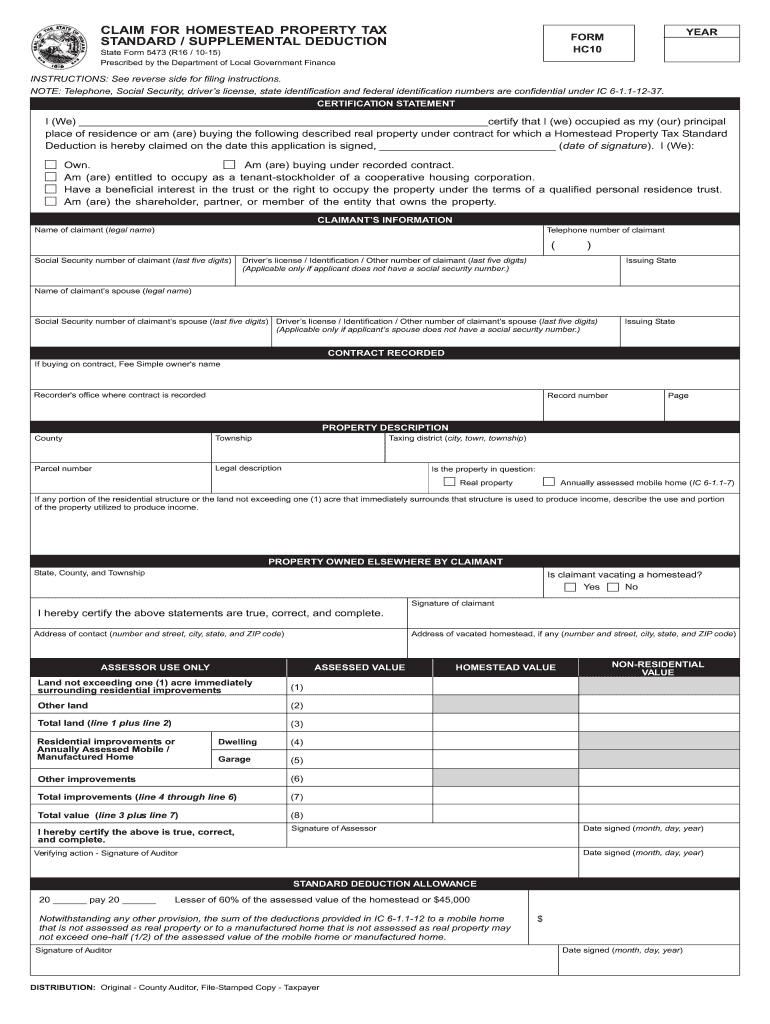

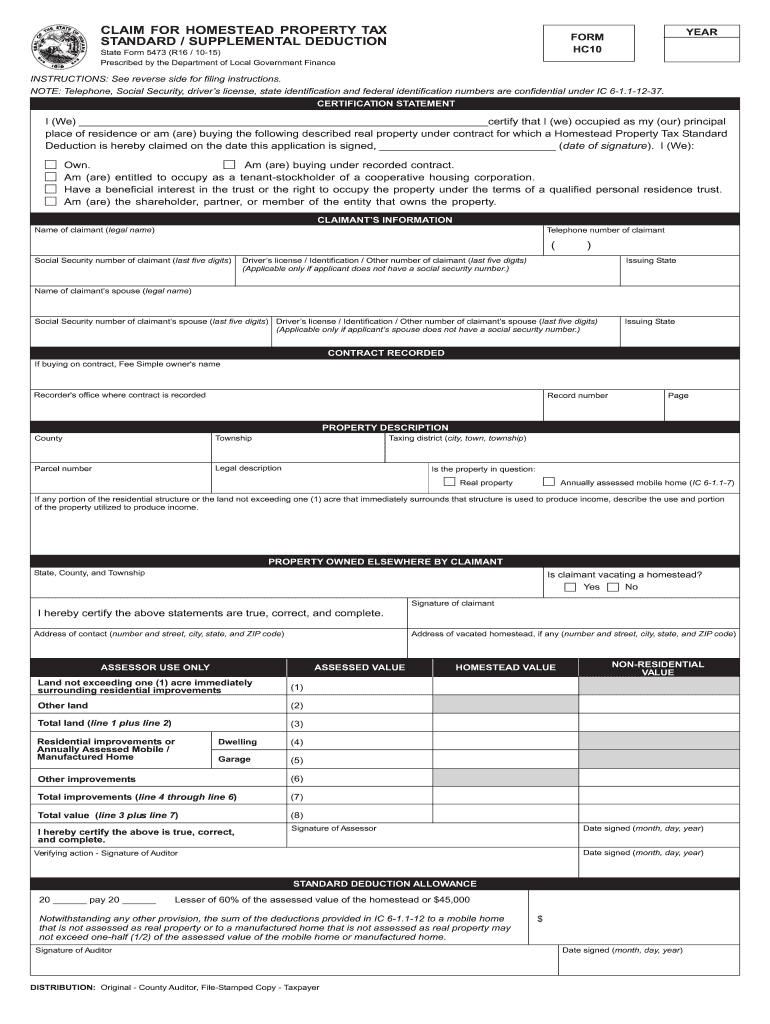

1-12-37 h. NOTE If after March 1 a person moves from his Indiana homestead receiving a homestead deduction that existed on March 1 to a homestead that did not exist on March 1 the person could apply for a homestead deduction for the new property for that tax cycle but then the homestead deduction on the first property must be cancelled for that tax cycle. 1-12-37 The homestead standard deduction has been enacted to allow a property tax deduction for each qualified homestead. Read carefully...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN DLGF HC10

Edit your IN DLGF HC10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN DLGF HC10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IN DLGF HC10 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IN DLGF HC10. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN DLGF HC10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN DLGF HC10

How to fill out IN DLGF HC10

01

Obtain the IN DLGF HC10 form from the official DLGF website or your local government office.

02

Read the instructions carefully to understand the purpose of the form.

03

Begin filling out the form by entering your identifying information, such as your name, address, and contact details.

04

Fill in the specific financial data requested in the corresponding sections, ensuring accuracy.

05

Double-check all entries for potential errors or omissions.

06

Sign and date the form as required.

07

Submit the completed form to the appropriate department by the designated deadline.

Who needs IN DLGF HC10?

01

Local government officials who are responsible for property tax assessments.

02

Tax assessors and other personnel involved in property valuation.

03

Property owners who need to understand their property tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

How much does the homestead exemption save you in Indiana?

Reduce the property tax on your home The standard homestead deduction is either 60% of your property's assessed value or a maximum of $45,000, whichever is less.

What is needed to file homestead exemption in Indiana?

In order to receive a homestead deduction on the Indiana property, the individual/married couple must establish that the property is their principal place of residence and that a homestead-type deduction is not received by the individual/married couple in any other county or state.

What age do you stop paying property taxes in Indiana?

You must meet these requirements to receive the deduction: Turned 65 or older by December 31 of the prior year. You can also receive the deduction if your spouse was 65 or older at the time of death. You must be 60 or older and have not remarried.

Do I have to file homestead exemption every year in Indiana?

Paperwork. Homeowners must fill out a claim for homestead property tax standard/supplemental deduction, State Form 5473. The form must be filled out each time the property title changes, including for the transfer of your property into your trust.

How long do you have to file homestead exemption in Indiana?

You must file an application to receive the homestead deductions. Applications completed by December 31 will be effective for the current year and will reflect on the following years tax bill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IN DLGF HC10 in Chrome?

Install the pdfFiller Google Chrome Extension to edit IN DLGF HC10 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my IN DLGF HC10 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your IN DLGF HC10 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit IN DLGF HC10 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit IN DLGF HC10.

What is IN DLGF HC10?

IN DLGF HC10 is a form used by local government units in Indiana to report their compliance with various state requirements related to property tax and budget management.

Who is required to file IN DLGF HC10?

Local government units, including counties, cities, towns, and other public entities in Indiana, are required to file the IN DLGF HC10.

How to fill out IN DLGF HC10?

To fill out IN DLGF HC10, follow the provided instructions carefully, enter the required financial data accurately, and ensure all necessary sections are completed before submission.

What is the purpose of IN DLGF HC10?

The purpose of IN DLGF HC10 is to ensure transparency and accountability in local government finances by providing a standard reporting template for financial data.

What information must be reported on IN DLGF HC10?

The information that must be reported on IN DLGF HC10 includes budget estimates, actual expenditures, property tax levies, and any other relevant financial metrics for the reporting period.

Fill out your IN DLGF HC10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN DLGF hc10 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.