IN DLGF HC10 2014 free printable template

Show details

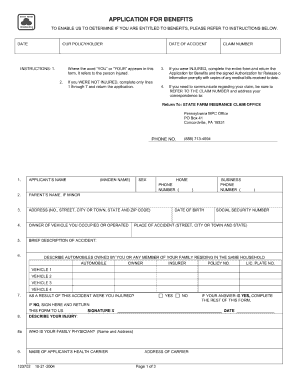

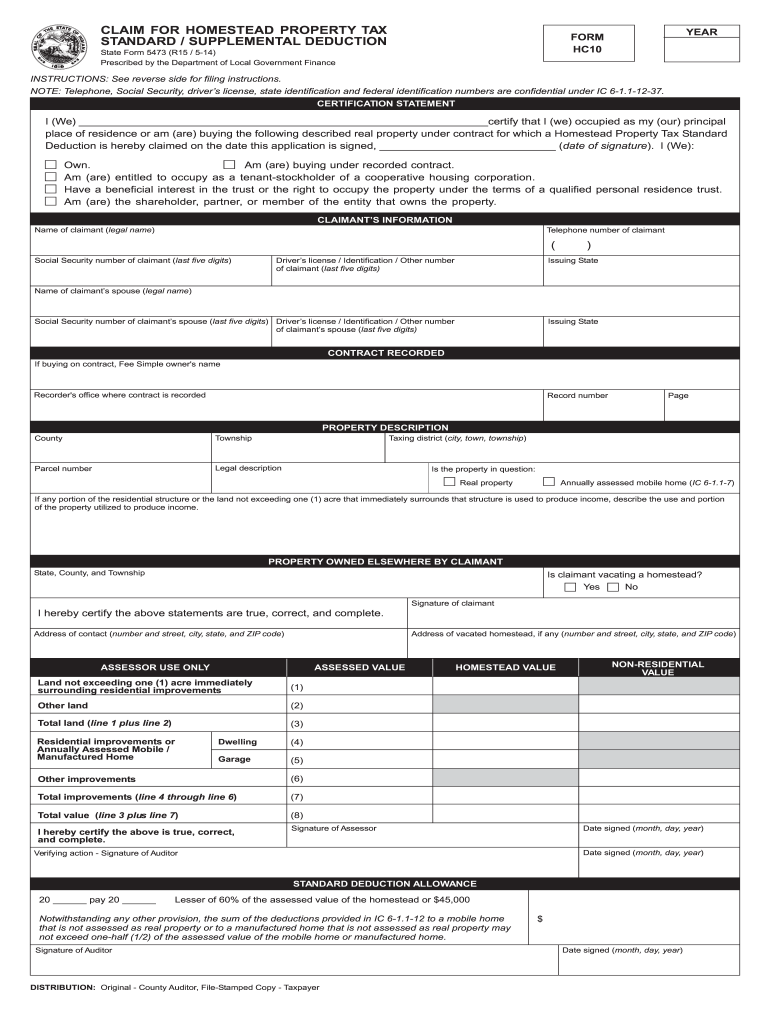

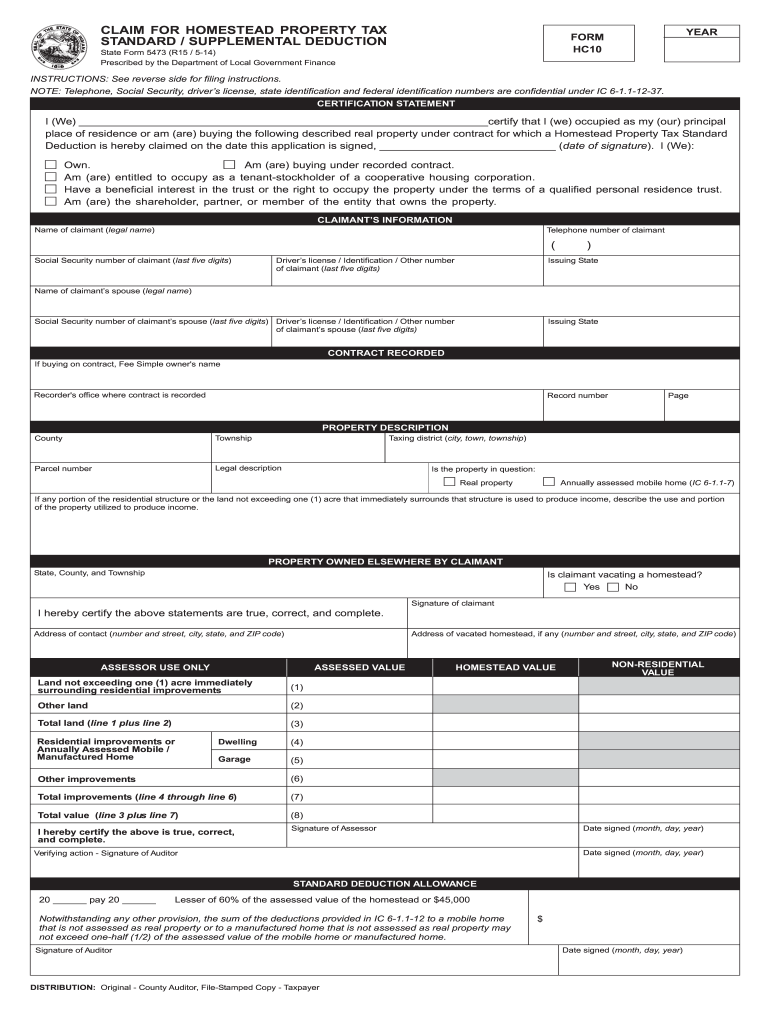

1-12-37 h. NOTE If after March 1 a person moves from his Indiana homestead receiving a homestead deduction that existed on March 1 to a homestead that did not exist on March 1 the person could apply for a homestead deduction for the new property for that tax cycle but then the homestead deduction on the first property must be cancelled for that tax cycle. 1-12-37 The homestead standard deduction has been enacted to allow a property tax deduction for each qualified homestead. Read carefully...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN DLGF HC10

Edit your IN DLGF HC10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN DLGF HC10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN DLGF HC10 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IN DLGF HC10. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN DLGF HC10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN DLGF HC10

How to fill out IN DLGF HC10

01

Gather required information, including prior year data and any necessary supporting documents.

02

Begin filling out the form by entering your agency's name and contact information on the top of the form.

03

Complete the sections detailing the funds for the current fiscal year, ensuring accuracy in the numbers reported.

04

Enter any amendments or adjustments from previous years if applicable.

05

Review each section thoroughly to ensure all calculations are correct and all necessary fields are completed.

06

Attach any additional required documentation that supports the information provided in the form.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate DLGF office by the specified deadline.

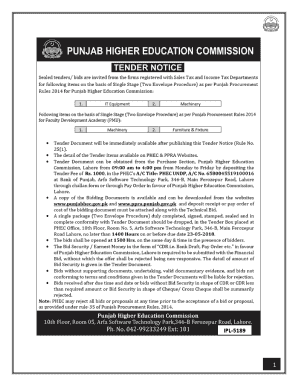

Who needs IN DLGF HC10?

01

Local government units and agencies required to report fiscal data to the Department of Local Government Finance (DLGF) in Indiana.

02

Finance officers, budget officers, or any department responsible for local budgeting and financial reporting.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to have a mortgage to get the homestead exemption in Indiana?

A person is not entitled to this deduction unless the person has a balance on the person's mortgage or contract indebtedness that is recorded in the county recorder's office (including any home equity line of credit that is recorded in the county recorder's office) that is the basis for the deduction.

What is the standard deduction for homestead in Indiana?

Reduce the property tax on your home These deductions may also apply if you are buying a home on a recorded contract. The standard homestead deduction is either 60% of your property's assessed value or a maximum of $45,000, whichever is less.

Who qualifies for supplemental homestead deduction Indiana?

The standard homestead deduction is either 60% of your property's assessed value or a maximum of $45,000, whichever is less. The supplemental homestead deduction is based on the assessed value of your property and equals: 35% of the assessed value of a property that is less than $600,000.

How much do you save with homestead exemption in South Carolina?

The Homestead Exemption Program is a State funded program authorized under Section 12-37-250 of the South Carolina Code of Laws. The program exempts the first $50,000 fair market value of primary residence from all property taxes.

How do I file a homestead standard deduction in Indiana?

Homeowners must fill out a claim for homestead property tax standard/supplemental deduction, State Form 5473. The form must be filled out each time the property title changes, including for the transfer of your property into your trust.

Who can claim homestead credit in Wisconsin?

You may be able to claim homestead credit if: You occupied and owned or rented a home, apartment, or other dwelling that is subject to Wisconsin property taxes during 2022. You are a legal resident of Wisconsin for all of 2022. You are 18 years of age or older on December 31, 2022.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the IN DLGF HC10 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your IN DLGF HC10.

How do I edit IN DLGF HC10 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share IN DLGF HC10 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit IN DLGF HC10 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like IN DLGF HC10. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

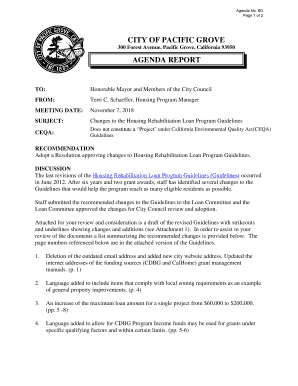

What is IN DLGF HC10?

IN DLGF HC10 is a form used by local government units in Indiana to report certain financial information to the Department of Local Government Finance (DLGF).

Who is required to file IN DLGF HC10?

Local government units in Indiana, including counties, municipalities, and other political subdivisions, are required to file the IN DLGF HC10 form.

How to fill out IN DLGF HC10?

To fill out IN DLGF HC10, local government units must provide detailed financial data, ensure accuracy in reporting, and follow the guidelines provided in the form instructions.

What is the purpose of IN DLGF HC10?

The purpose of IN DLGF HC10 is to provide the DLGF with essential financial information for regulatory compliance and to facilitate the review of local government budgets.

What information must be reported on IN DLGF HC10?

IN DLGF HC10 requires reporting on revenues, expenditures, debt obligations, and other financial metrics relevant to the operation of local government units.

Fill out your IN DLGF HC10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN DLGF hc10 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.