Get the free Quarterly Tax Return for 2014. Quarterly Tax Return for 2014 - boonecountyky

Show details

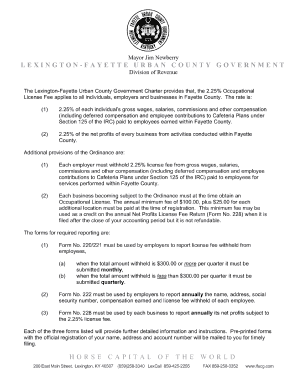

Boone County Fiscal Court www.BooneCountyKy.org 2950 Washington Street PO Box 960 Burlington, KY 41005 (859) 334-2144 (859) 334-3914 Fax license boonecountyky.org Quarterly Withholding Tax Return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quarterly tax return for

Edit your quarterly tax return for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quarterly tax return for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing quarterly tax return for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit quarterly tax return for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quarterly tax return for

How to fill out a quarterly tax return:

01

Gather your financial information: Collect all relevant financial documents, including income statements, expense records, and receipts. Organize them in a systematic manner to make the filling process easier.

02

Determine your filing status: Determine whether you are a sole proprietor, a partnership, an S corporation, or a limited liability company (LLC). Your filing status will dictate the specific forms you need to fill out.

03

Select the appropriate form: Based on your filing status, choose the correct form for your quarterly tax return. For example, if you're a sole proprietor, you would use Form 1040-ES, while a partnership would use Form 1065.

04

Fill out personal information: Provide your name, address, Social Security number (or Employer Identification Number for businesses), and other requested personal information on the form.

05

Calculate your quarterly income: Determine your total income for the quarter and include it in the appropriate section of the form. This may include income from self-employment, dividends, rent, or any other sources.

06

Deduct allowable expenses: Subtract any eligible expenses from your total income to determine your taxable income. Make sure to keep accurate records of your expenses and ensure they are legitimate deductions.

07

Calculate and pay estimated tax: Use the IRS's tax tables or online calculators to determine your estimated tax liability for the quarter. Make a payment of this amount using one of the accepted payment methods, such as writing a check or making an electronic payment.

08

Complete tax-related schedules: Depending on your filing status and any additional income sources, you may need to complete additional schedules or forms. These can include Schedule C for self-employment income or Schedule K-1 for partnership income.

09

Review and double-check your return: Carefully review all the information you have entered to ensure accuracy. Mistakes or missing information could lead to penalties or delays in processing your return.

10

Sign and file your return: Sign and date your completed return, and submit it to the appropriate tax authority by the designated deadline. This can usually be done electronically or by mail.

Who needs a quarterly tax return:

01

Self-employed individuals: If you own a business as a sole proprietor, partnership, LLC, or S corporation, you are typically required to file a quarterly tax return. This ensures that you fulfill your tax obligations throughout the year rather than waiting until the end.

02

Freelancers and gig workers: Individuals who work in the gig economy, as freelancers, or as independent contractors often need to file quarterly tax returns to report their income and pay the necessary taxes.

03

Individuals with significant investment income: If you earn a substantial amount of income from investments, interest, dividends, or capital gains, you may need to file quarterly tax returns to meet your tax obligations on these earnings.

04

High-income earners who have additional tax liabilities: Individuals with high incomes may also need to file quarterly tax returns if their regular paycheck withholdings do not adequately cover their tax liability. This ensures they meet their tax obligations throughout the year.

Remember, tax laws can be complex, and it's always advisable to consult with a tax professional or use reliable tax software to ensure accuracy and compliance with the latest regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is quarterly tax return for?

Quarterly tax return is for reporting income and paying estimated taxes on a quarterly basis to avoid owing a large amount at the end of the year.

Who is required to file quarterly tax return for?

Those who are self-employed, freelancers, independent contractors, and individuals with substantial investment income are often required to file quarterly tax returns.

How to fill out quarterly tax return for?

To fill out a quarterly tax return, you need to estimate your income, deductions, and credits for the quarter and submit the form to the IRS or relevant tax authority.

What is the purpose of quarterly tax return for?

The purpose of quarterly tax return is to ensure that taxpayers pay their taxes in a timely manner throughout the year rather than in one lump sum at the end of the year.

What information must be reported on quarterly tax return for?

Information such as income, deductions, credits, and tax payments made during the quarter must be reported on a quarterly tax return.

How can I modify quarterly tax return for without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including quarterly tax return for, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get quarterly tax return for?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the quarterly tax return for. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in quarterly tax return for without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your quarterly tax return for, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Fill out your quarterly tax return for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quarterly Tax Return For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.