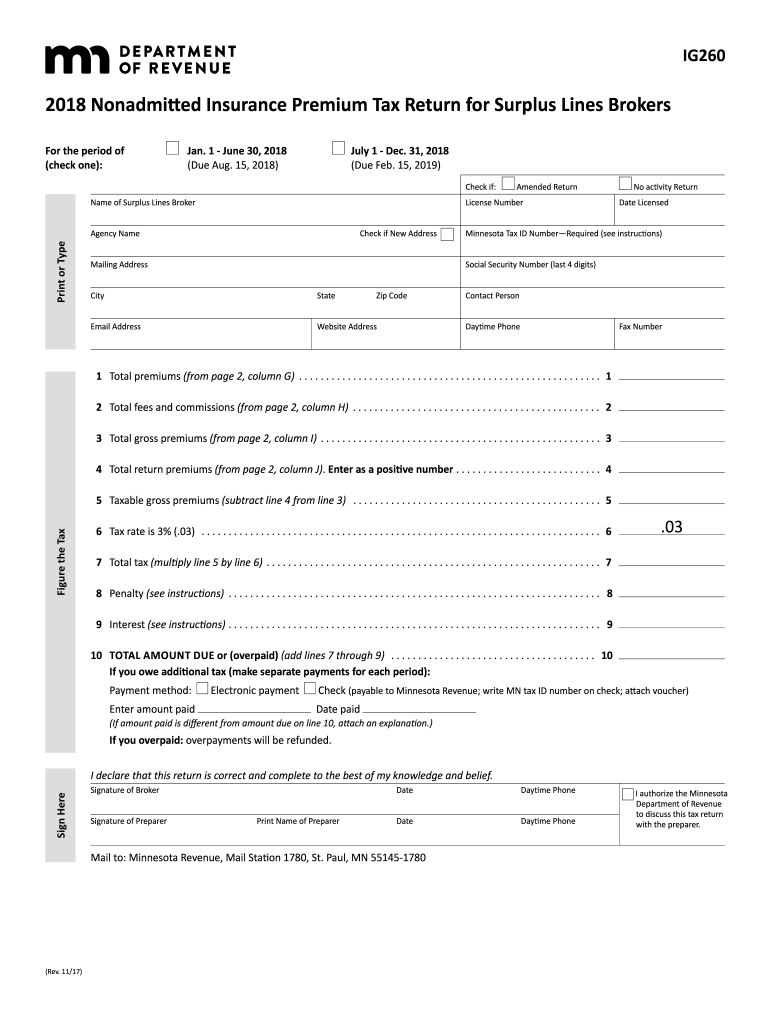

MN DoR IG260 2018 free printable template

Show details

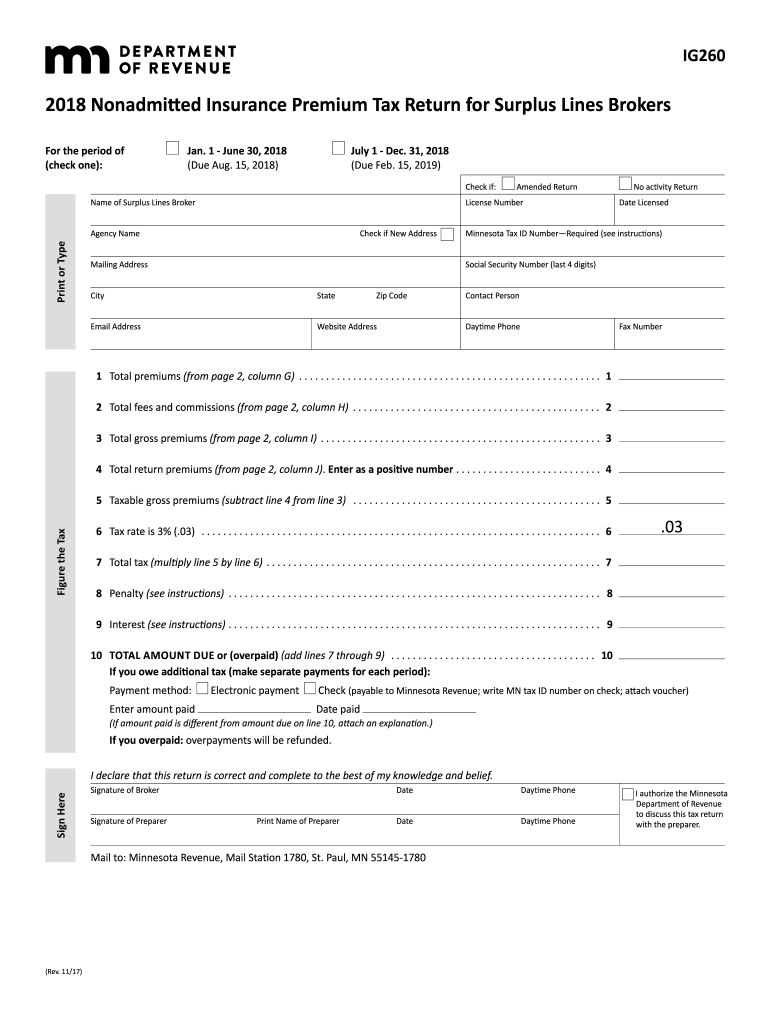

Total. Enter on appropriate lines on page 1. G Total Premiums H All Fees/ Commissions I Total Gross J Return 2018 Form IG260 Instructions For insurance tax laws see Minnesota Statutes Chapter 297I at www. This is not a Social Security number or agency Minnesota tax ID number. File Form IG260 with all required attachments and pay any tax due by Submit separate payments for each return. Check Payments The U.S. postmark date or date recorded or marked by a designated delivery service is...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign minnesota ig260 2018

Edit your minnesota ig260 2018 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your minnesota ig260 2018 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit minnesota ig260 2018 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit minnesota ig260 2018. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN DoR IG260 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out minnesota ig260 2018

How to fill out MN DoR IG260

01

Gather the necessary personal information, including your name, address, and identification number.

02

Obtain the form MN DoR IG260 from the Minnesota Department of Revenue website or local office.

03

Carefully read the instructions provided with the form to understand the requirements.

04

Fill out the form section by section, ensuring all information is accurate and complete.

05

Double-check all entries for any errors or omissions before submitting.

06

Submit the completed form to the designated department or address as instructed.

Who needs MN DoR IG260?

01

Individuals who are applying for certain benefits or services through the Minnesota Department of Revenue.

02

Taxpayers needing to report specific information related to tax liabilities or claims.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get Minnesota income tax forms?

Minnesota State Income Tax Forms If you need Minnesota income tax forms: Download forms from the Minnesota Department of Revenue. Photocopy the forms you need at a library. Call 800-657-3676 or 651-296-4444 to place an order.

Can I get tax forms from IRS?

If you know what form or publication you need, call the IRS toll-free forms number at 1-800-TAX-FORM (1-800-829-3676). If you're not sure what to order, get Publication 910, "Guide to Free Tax Services," which lists publications and related forms, with descriptions and a subject matter index.

Does Minnesota have state income tax?

Minnesota's income tax is a graduated tax, with four rates: 5.35 percent, 7.05 percent, 7.85 percent, and 9.85 percent. The rates are applied to income brackets that vary by filing status.

What is Minnesota Form M1?

2022 Form M1, Individual Income Tax.

What kind of insurance is usually written through surplus lines?

Excess and surplus (E&S) lines insurance is a type of coverage for financial risks that are too high to insure through the standard market and is obtained from an insurer that is not licensed in your state.

What does surplus lines cover?

Surplus lines insurance protects against a financial risk that a regular insurance company will not take on. Surplus lines insurance policies are available in a variety of types for both individuals and businesses. Surplus lines insurance is generally more expensive than regular insurance because the risks are higher.

How much is the surplus line stamping fee in North Dakota?

Surplus lines tax: 1.75% if the insured's home state is ND. Properties, risks, or exposures located or to be performed in this state or another state. (26. 1-44-03.1).

What does surplus lines mean in insurance?

Surplus lines insurance is a special type of insurance that covers unique risks. It fills a gap in the standard market by covering things that most companies can't or won't insure.

How much is the stamping fee for surplus lines in Minnesota?

Stamping fee: . 04%, payable to the Minnesota Surplus Lines Association.

What are surplus lines taxes and fees?

Every surplus line broker must make an annual state tax filing. The amount of state tax is 3% of the California taxable surplus line premium transacted by the broker, for California home state insureds, from January 1st to December 31st of the previous year.

How often must surplus lines brokers submit taxes?

Every surplus line broker and special lines surplus line broker must make an annual state tax filing. This filing is due to the Insurance Commissioner on or before March 1st of each year.

What is a surplus line tax?

SURPLUS LINES TAXES In other words, the premium tax is embedded into an admitted policy's premium but not called out as a separate line item. It's there – just hidden. The tax rate in each state varies and can change from year to year, and is set by the state's insurance department.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my minnesota ig260 2018 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your minnesota ig260 2018 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit minnesota ig260 2018 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit minnesota ig260 2018.

How do I fill out the minnesota ig260 2018 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign minnesota ig260 2018 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is MN DoR IG260?

MN DoR IG260 is a form used by the Minnesota Department of Revenue for reporting specific tax information and compliance by certain entities.

Who is required to file MN DoR IG260?

Any business or entity operating in Minnesota that meets certain criteria specified by the Minnesota Department of Revenue is required to file MN DoR IG260.

How to fill out MN DoR IG260?

To fill out MN DoR IG260, follow the instructions provided on the form carefully, ensuring all required fields are completed accurately, and submit it by the designated deadline.

What is the purpose of MN DoR IG260?

The purpose of MN DoR IG260 is to collect necessary tax information and ensure compliance with state tax laws.

What information must be reported on MN DoR IG260?

The information that must be reported on MN DoR IG260 typically includes business identification details, financial data, tax statements, and any specific activity requiring compliance.

Fill out your minnesota ig260 2018 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Minnesota ig260 2018 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.