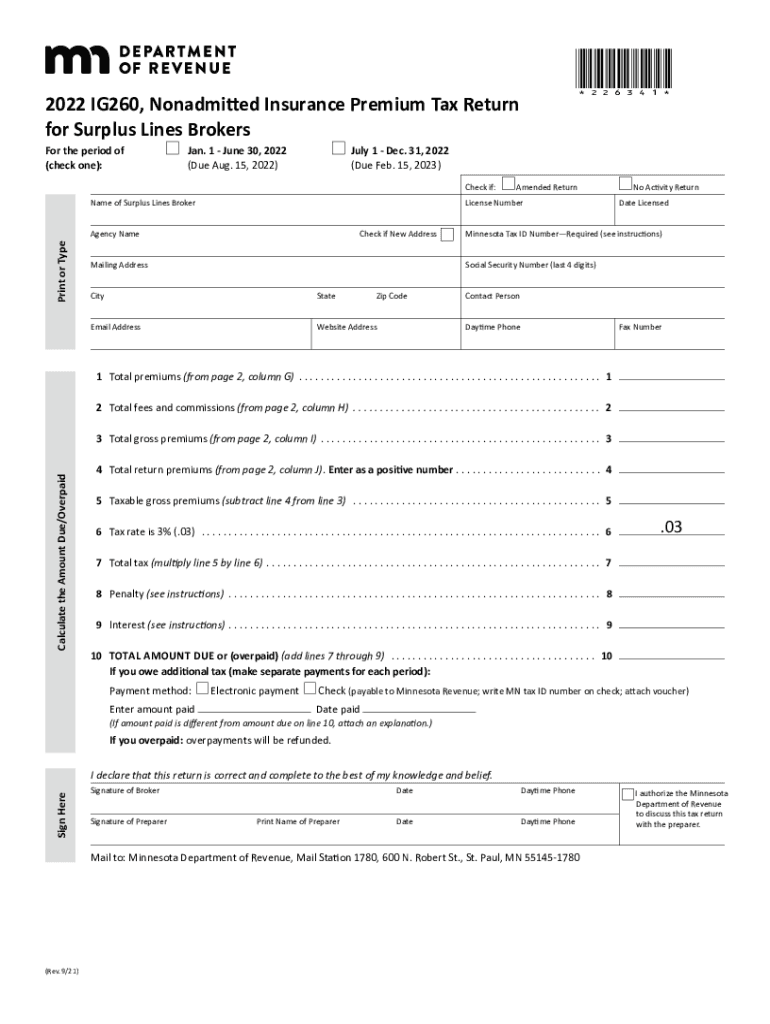

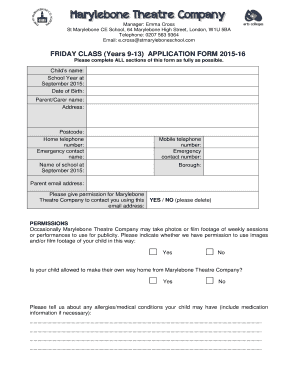

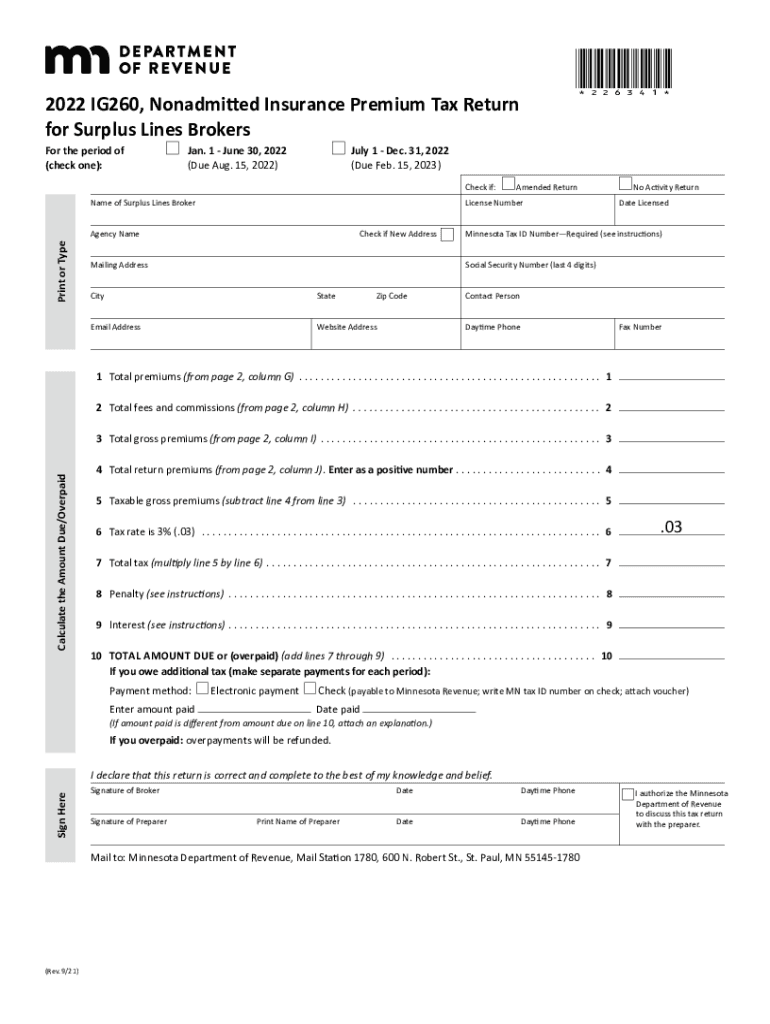

MN DoR IG260 2022 free printable template

Get, Create, Make and Sign minnesota revenue tax return

How to edit minnesota revenue tax return online

Uncompromising security for your PDF editing and eSignature needs

MN DoR IG260 Form Versions

How to fill out minnesota revenue tax return

How to fill out MN DoR IG260

Who needs MN DoR IG260?

Instructions and Help about minnesota revenue tax return

In this video you will learn what the retailers' responsibility is during a cigarette and tobacco products retail inspection By law the Minnesota Department of Revenue administers the cigarette and tobacco program The department issues licenses to cigarette and tobacco distributors collects taxes and enforces tobacco laws In this video the term tobacco or tobacco products refers to cigarettes moist snuff cigars Shiva vapor products and all other products made or derived from tobacco Every Minnesota retailer must purchase tobacco products from a licensed Minnesota distributor Retailers must keep itemized invoices forgone year from the date of purchase The department enforces tobacco laws through unannounced inspections of retail locations Inspectors from the department may enter any tobacco products wholesaler sub-jobber or retailer without a search warrant and inspect the premises associated records and tobacco products These inspections can occur anytime during the normal business hours of the business Upon arrival at your business inspector swill identify and introduce themselves They will show their Minnesota Department of Revenue ID hand out their business cards and explain the purpose of the inspection The inspectors will review the Cigarette tobacco products fact sheet 1 and 2 with the employee The inspectors will ask the employee in charge for their name job position and details on the day-to-day operation of the business The inspectors will also review the retail tobacco license issued by the municipality or county They will ask where the cigarette and tobacco products are stored and request permission to inspect these areas including secured or locked storage They will then inspect cigarette product sand associated stamps attached to the cigarette packages Minnesota law requires all cigarette packages for sale to have a valid Minnesota cigarette stamp It is important to keep records related to tobacco products such as purchase invoices and other related documents Your purchase invoices serve as proof that the appropriate excise tax is paid You must keep all tobacco product invoice sat the business or a centralized location and provide these invoices within one hour of request By law all tobacco products are considereduntaxed unless proof of excise tax payment is provided Inspectors will verify that your purchase invoices are valid and from a licensed Minnesota Department of Revenue tobacco products distributor We recommend you do not purchase any tobacco products from a seller who is unable or unwilling to provide a valid purchase invoice Please check the departments' website to confirm that your tobacco vendor is a current licensed Minnesota distributor Here is an example of a valid purchase invoice It includes the retailers name and address purchase date a detailed and itemized list of products and quantities purchased and the name address and phone number of the tobacco products distributor Here is an example of an invalid purchase...

People Also Ask about

Where can I get Minnesota income tax forms?

Can I get tax forms from IRS?

Does Minnesota have state income tax?

What is Minnesota Form M1?

What kind of insurance is usually written through surplus lines?

What does surplus lines cover?

How much is the surplus line stamping fee in North Dakota?

What does surplus lines mean in insurance?

How much is the stamping fee for surplus lines in Minnesota?

What are surplus lines taxes and fees?

How often must surplus lines brokers submit taxes?

What is a surplus line tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find minnesota revenue tax return?

How do I make edits in minnesota revenue tax return without leaving Chrome?

Can I edit minnesota revenue tax return on an Android device?

What is MN DoR IG260?

Who is required to file MN DoR IG260?

How to fill out MN DoR IG260?

What is the purpose of MN DoR IG260?

What information must be reported on MN DoR IG260?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.