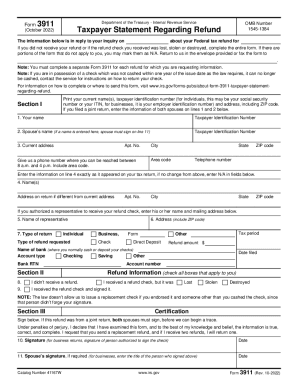

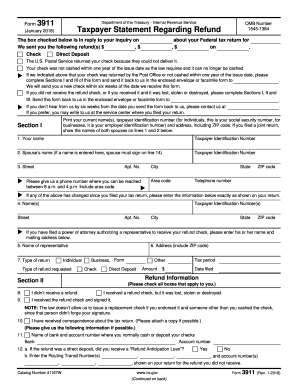

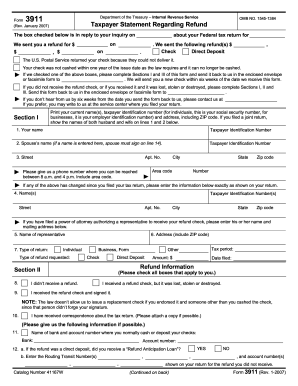

IRS 3911 2005 free printable template

Instructions and Help about IRS 3911

How to edit IRS 3911

How to fill out IRS 3911

About IRS 3 previous version

What is IRS 3911?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 3911

What should I do if I realize I made a mistake after mailing my form?

If you notice an error after mailing your where to mail form, you can submit an amended form to rectify the mistake. It's crucial to follow the specific instructions for amending your form to ensure proper processing. This might involve checking the guidelines provided by the relevant authority to avoid complications.

How can I confirm that my mailed where to mail form has been received?

To verify the receipt of your mailed where to mail form, you can contact the issuing agency directly. Many organizations provide a way to track submissions or may allow you to check the status online. Keep in mind that processing times may vary.

Are there specific guidelines for using an e-signature when submitting my form?

Using an e-signature for your where to mail form is typically acceptable, but it's essential to check the rules set by the relevant authority. Properly executed e-signatures can facilitate smoother processing, ensuring that your submission adheres to legal requirements.

What should I consider if I am filing on behalf of someone else?

When filing the where to mail form on behalf of another individual, it's important to have the appropriate authorization, such as a Power of Attorney. This ensures that you are legally allowed to submit the form and handle any associated communications on their behalf.

Can errors in e-filing lead to submission rejection, and how can I avoid this?

Yes, errors in e-filing your where to mail form can result in submission rejection. To avoid this, double-check all entered information and ensure compatibility with required software. Additionally, familiarize yourself with common rejection codes to rectify issues swiftly.

See what our users say