CT DRS CT-W3 2018 free printable template

Show details

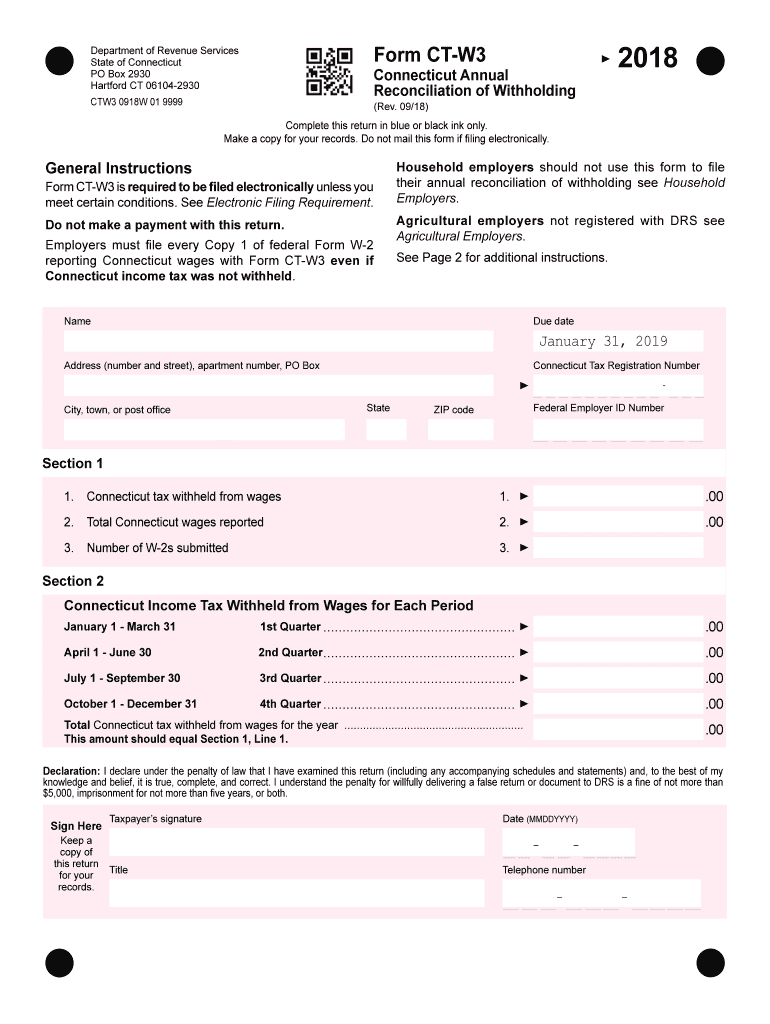

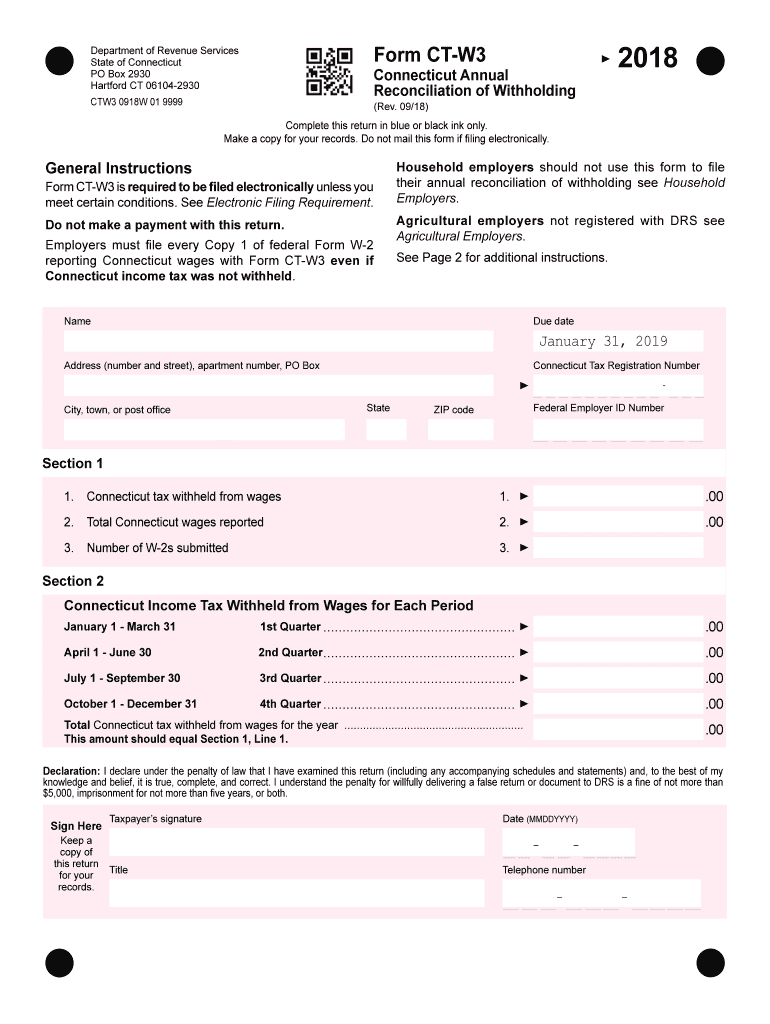

To amend Form CT-W3 by paper submit a revised Form CT-W3 clearly labeled AMENDED. The total Connecticut tax withheld for all four quarters on Form CT-941 or Form CT-941X Line 3 must agree with the total reported on Form CT-W3 Line 1. Line Instructions Connecticut wages you may amend Form CT-W3 and submit Forms W-2c using paper forms. Or upload their Form CT-W3 and Forms W-2 electronically through the TSC. Electronic reporting requirements are available on the DRS website at www. The total...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-W3

Edit your CT DRS CT-W3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-W3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT DRS CT-W3 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT DRS CT-W3. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-W3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-W3

How to fill out CT DRS CT-W3

01

Obtain the CT-W3 form from the Connecticut Department of Revenue Services website or local office.

02

Fill in your business name, address, and federal employer identification number (FEIN).

03

Specify the tax year for which you are reporting.

04

Report the total amount of wages paid to employees in Connecticut during the tax year.

05

Calculate and enter the total Connecticut income tax withheld from employees’ wages.

06

Provide details about any other taxes or deductions applicable.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form to the DRS by the deadline, along with any required payments.

Who needs CT DRS CT-W3?

01

Employers in Connecticut who withhold income tax from employee wages.

02

Businesses required to report wage information for state tax purposes.

03

Payroll service providers handling tax filings for Connecticut-based employers.

Fill

form

: Try Risk Free

People Also Ask about

Is there a w3 form?

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.

How do I get my tax forms from previous years?

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

Can you file W3 online?

E-file online Using the BSO portal, you'll have two options for filling out Form W-3: Create a fill-in version of the form and print out copies to submit OR. Upload wage files from your tax or payroll software (BSO will automatically generate the corresponding Form W-3).

Can I look up my old tax returns online?

You can view your tax records now in your Online Account.This is the fastest, easiest way to: Find out how much you owe. Look at your payment history. See your prior year adjusted gross income (AGI) View other tax records.

What is the difference between a W-2 and W3 form?

The key difference is that Form W-2 reports information like total wages and taxes withheld for each individual employee. A W-3 form, by contrast, reports the total employee wages, taxable wages, and tax withheld.

Can W-3 be printed on plain paper?

Printing on Plain Paper (Yes, you can!) Since tax year 2001, the SSA has allowed W-2 and W-3 forms to be printed on plain paper, black ink/toner, using a jet or laser printer, from pre- approved software.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CT DRS CT-W3 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your CT DRS CT-W3 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete CT DRS CT-W3 online?

pdfFiller has made it simple to fill out and eSign CT DRS CT-W3. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the CT DRS CT-W3 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your CT DRS CT-W3 in minutes.

What is CT DRS CT-W3?

CT DRS CT-W3 is a form used by employers in Connecticut to report wage information and withholding taxes to the state.

Who is required to file CT DRS CT-W3?

Employers who have employees and are required to withhold Connecticut income tax from their wages must file the CT DRS CT-W3.

How to fill out CT DRS CT-W3?

To fill out the CT DRS CT-W3, employers need to provide information such as total wages paid, total withholding tax, and identification details like the employer's tax ID number.

What is the purpose of CT DRS CT-W3?

The purpose of CT DRS CT-W3 is to summarize and report the wages paid and taxes withheld for employees to ensure compliance with state tax laws.

What information must be reported on CT DRS CT-W3?

CT DRS CT-W3 must report information including total wages paid, total Connecticut income tax withheld, the employer's identification number, and the total number of employees.

Fill out your CT DRS CT-W3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-w3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.