CT DRS CT-W3 2011 free printable template

Show details

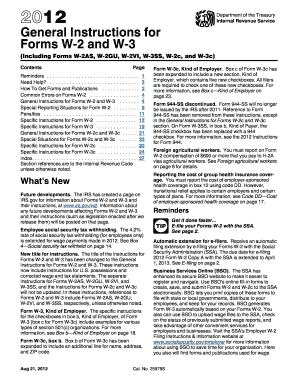

TTY TDD and Text Telephone users only may transmit inquiries by calling 860-297-4911. To amend Form CT-W3 submit a revised Form CT-W3 clearly labeled AMENDED. Signature Title Date Amending Form CT-W3 Taxpayers who le 25 or more Forms W-2 reporting Connecticut wages paid are required to le Form CT-W3 DRS and every Copy 1 of federal Form W-2 electronically. Do not use Form CT-941X to amend Form CT-W3 or Form CT-1096 Connecticut Annual Summary and Transmittal of Information Returns. The total...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form ct-w3 - ctgov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ct-w3 - ctgov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form ct-w3 - ctgov online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form ct-w3 - ctgov. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

CT DRS CT-W3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form ct-w3 - ctgov

How to fill out form ct-w3 - ctgov:

01

The first step is to visit the official website of ctgov.

02

Look for the form ct-w3 on the website.

03

Download the form ct-w3 from the website.

04

Open the downloaded form on your computer or print it out if you prefer to fill it out manually.

05

Fill in the required information on the form, such as your name, address, and employer identification number.

06

Provide details about the wages and tax withheld for each employee in the designated sections.

07

Double-check all the information you have entered to ensure its accuracy.

08

Sign the form ct-w3 and date it.

09

Submit the completed form ct-w3 to the appropriate authority as per the guidelines provided by ctgov.

Who needs form ct-w3 - ctgov:

01

Form ct-w3 - ctgov is required by employers in the state of Connecticut.

02

Employers who have employees working in Connecticut and are subject to the state's income tax withholding must file form ct-w3.

03

The form is used to report the wages paid to employees, the tax withheld, and to reconcile the amount of tax withheld with the amount remitted.

Please note that this information is provided as a general guideline and it is recommended to refer to the official instructions and guidelines provided by ctgov for complete and accurate information on filling out form ct-w3 - ctgov.

Fill form : Try Risk Free

People Also Ask about form ct-w3 - ctgov

What is a CT w3 form for?

What are the tax changes for 2023 in CT?

What is the withholding limit for 2023?

What is the CT tax withholding for 2023?

What is the CT payroll tax withholding form?

Who do I make my CT state tax check out to?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

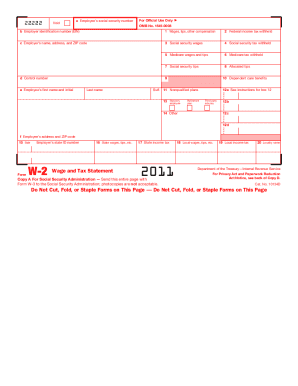

What is form ct-w3 - ctgov?

The form CT-W3 is a tax form used in the state of Connecticut, USA. It is often referred to as the "Annual Reconciliation of Withholding" form. Employers in Connecticut use this form to report the total amount of income tax withheld from employees' wages throughout the year. The form is submitted along with copies of employees' W-2 forms to the Connecticut Department of Revenue Services (DRS). The CT-W3 form helps the DRS ensure that employees' income tax withholding matches the amounts reported on their W-2 forms.

Who is required to file form ct-w3 - ctgov?

Employers in the state of Connecticut are required to file Form CT-W3, also known as the Connecticut Annual Reconciliation of Withholding, with the Connecticut Department of Revenue Services. This form is used to report the total amount of state income tax withheld from employees' wages throughout the year.

How to fill out form ct-w3 - ctgov?

Here are the steps to fill out Form CT-W3 on the Connecticut state government website:

1. Access the form: Go to the Connecticut Department of Revenue Services website at https://portal.ct.gov/drs and search for "Form CT-W3" in the search bar. Click on the appropriate search result to open the form.

2. Download the form: Click on the link to download the CT-W3 form in PDF format. Save it to your computer or print a physical copy to fill out manually.

3. Provide general information: Fill out the top section of the form, including the employer's FEIN (Federal Employer Identification Number), employer's name, and address.

4. Employer information: Enter your employer information, including the state ID number, state name abbreviation, and total wages paid during the year.

5. Employee information: Fill in the total number of employees and the total number of W-2 forms attached to Form CT-W3.

6. Income tax withheld: Enter the total amount of Connecticut income tax withheld from the employees' wages.

7. Social Security wages: Write the total Social Security wages paid to employees during the year.

8. Medicare wages: Specify the total Medicare wages paid to employees during the year.

9. Attach W-2 forms: Separate the W-2 forms for each employee and attach them to Form CT-W3. Make sure the W-2 forms are filled out accurately and completely.

10. Sign and submit: After completing the form and attaching the W-2 forms, sign and date the CT-W3 form. Keep a copy for your records and submit the original form to the Connecticut Department of Revenue Services as per their instructions. This may involve mailing the form or submitting it electronically through their online portal.

It is essential to review the form instructions provided by the Connecticut Department of Revenue Services for any additional guidance or specific requirements.

What is the purpose of form ct-w3 - ctgov?

The Form CT-W3 is a withholding reconciliation form used in the state of Connecticut. Its purpose is to report the total amount of state income tax withheld from employee wages for a specific calendar year. Employers are required to file this form along with copies of all W-2 forms issued to employees. This helps the Connecticut Department of Revenue Services ensure accurate reporting of income taxes withheld and reconcile it with the individual income tax returns filed by employees.

What information must be reported on form ct-w3 - ctgov?

Form CT-W3, also known as the Annual Reconciliation of Withholding report, is used by employers in Connecticut to report employee wages and withholding taxes for a calendar year. The form is submitted along with the Form W-2s issued to employees.

The information that must be reported on Form CT-W3 includes:

1. Employer's Information: The employer's name, address, and federal employer identification number (FEIN).

2. Total Number of W-2s: The total number of Form W-2s issued by the employer for the calendar year being reported.

3. Total Withholding Amount: The total amount of Connecticut income tax withheld from employee wages for the year.

4. Total Remitted: The total amount of Connecticut income tax withheld and remitted to the Department of Revenue Services (DRS) for the year.

5. Signature: The form must be signed and dated by an authorized representative of the employer.

It's important to note that the Form CT-W3 is a summary of the information reported on individual Form W-2s. Therefore, the detailed information such as employee names, Social Security numbers, wages, and withholding amounts are not reported on Form CT-W3 itself but are included on the accompanying Form W-2s.

When is the deadline to file form ct-w3 - ctgov in 2023?

The deadline to file Form CT-W3 with the state of Connecticut for the tax year 2023 is February 28, 2024. However, it is always recommended to confirm this information with the Connecticut Department of Revenue Services or consult with a tax professional to ensure accuracy.

What is the penalty for the late filing of form ct-w3 - ctgov?

The penalty for the late filing of Form CT-W3 (Connecticut Annual Reconciliation of Withholding) varies depending on the duration of the delay. As of 2021, the penalty structure is as follows:

1. If filed within 30 days of the due date: $50

2. If filed more than 30 days late but within 60 days of the due date: $100

3. If filed more than 60 days late but within 90 days of the due date: $200

4. If filed more than 90 days late or not filed at all: $250 (plus 25% of the tax shown, or which would have been shown, on the Form CT-W3)

It is important to note that these penalty amounts are subject to change, so it is advisable to consult the official Connecticut tax authorities or the instructions provided with the form for the most up-to-date penalty information.

How do I complete form ct-w3 - ctgov online?

pdfFiller has made filling out and eSigning form ct-w3 - ctgov easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in form ct-w3 - ctgov without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your form ct-w3 - ctgov, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the form ct-w3 - ctgov in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your form ct-w3 - ctgov and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your form ct-w3 - ctgov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.