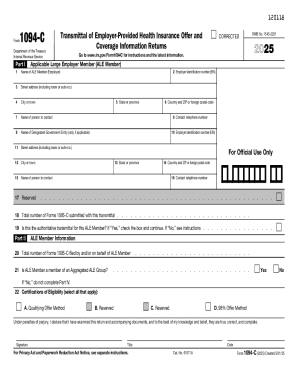

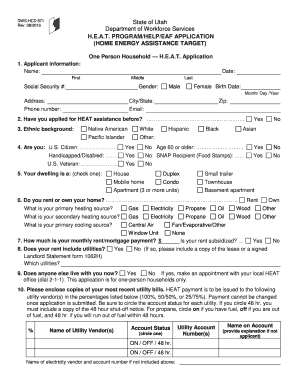

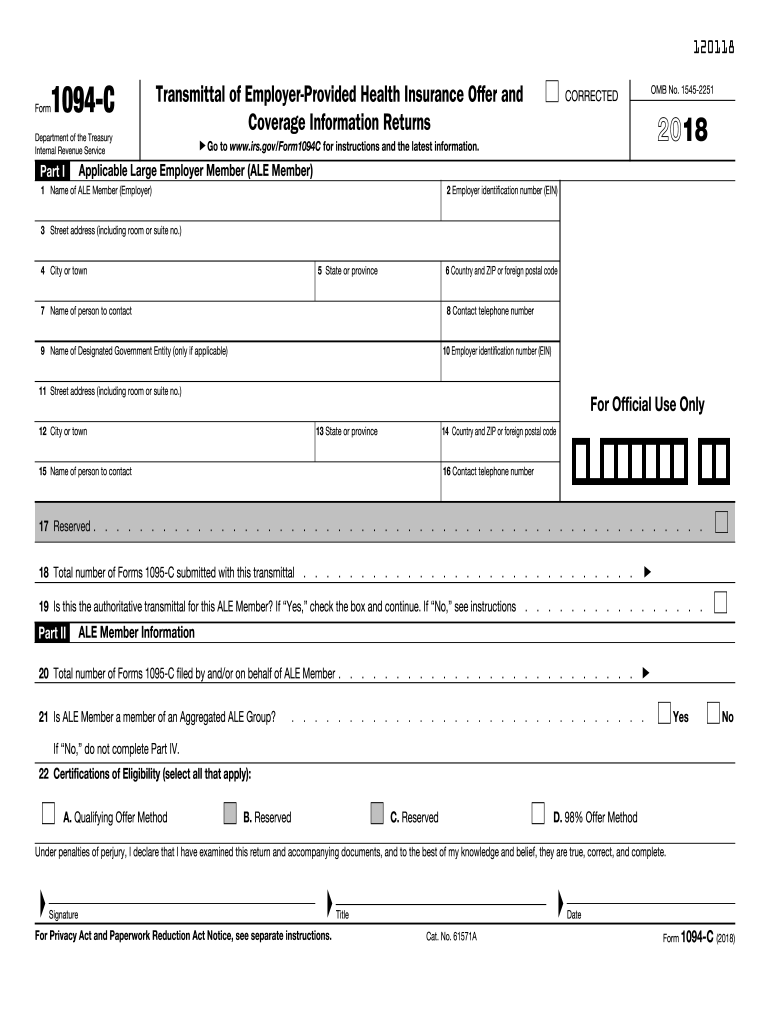

IRS 1094-C 2018 free printable template

Instructions and Help about IRS 1094-C

How to edit IRS 1094-C

How to fill out IRS 1094-C

About IRS 1094-C 2018 previous version

What is IRS 1094-C?

Who needs the form?

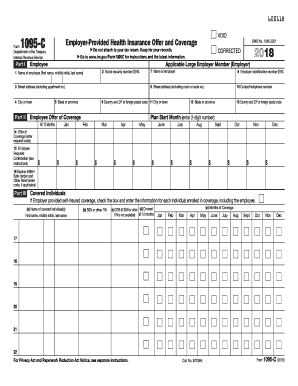

Components of the form

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1094-C

What should I do if I realize there’s an error on my submitted IRS 1094-C?

If you find an error after filing your IRS 1094-C, you should submit a corrected form as soon as possible. It’s essential to indicate that you're filing a correction by checking the appropriate box on the form. Keeping accurate records of your submissions is vital, so ensure you have the original filed form and any amendments to maintain compliance.

How can I verify that my IRS 1094-C was received and processed by the IRS?

To verify the receipt and processing of your IRS 1094-C, you may contact the IRS directly or check your e-filing software for any tracking features. Understanding common e-file rejection codes can also help you identify any issues that might have arisen during processing.

What are some common mistakes people make when filing the IRS 1094-C, and how can I avoid them?

Common mistakes include incorrect data entry, such as misreporting employee counts or failing to check the appropriate forms for corrections. To avoid these mistakes, double-check all entries before submission and utilize validation tools offered by e-filing services.

Are there any specific security measures I should take when filing my IRS 1094-C electronically?

When filing your IRS 1094-C electronically, it's crucial to use secure software that complies with IRS requirements. Ensure that your internet connection is secure, and avoid using public networks. Additionally, consider enabling e-signature features available in your software to enhance security.

What should I do if I receive a notice from the IRS regarding my IRS 1094-C?

If you receive a notice from the IRS regarding your IRS 1094-C, read it carefully to understand the issue. Gather any necessary documentation related to your submission, and follow the instructions provided in the notice. It may also be advisable to consult with a tax professional for assistance or clarification on how to respond properly.