IRS 1040 - Schedule SE 2018 free printable template

Show details

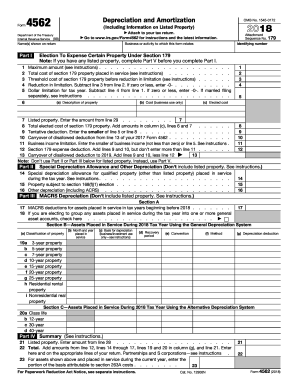

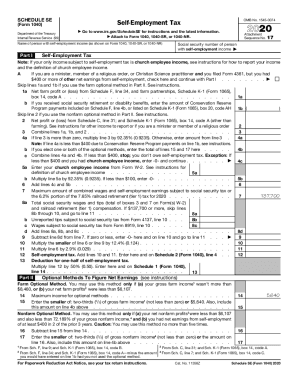

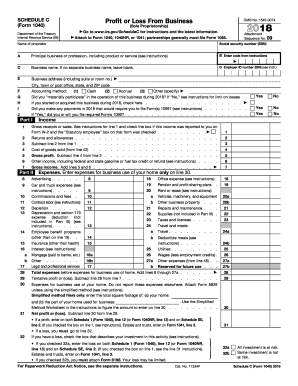

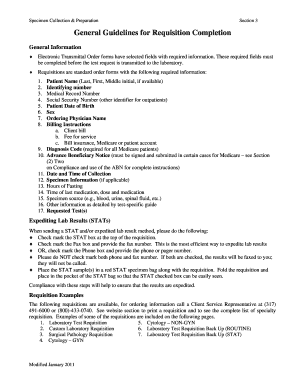

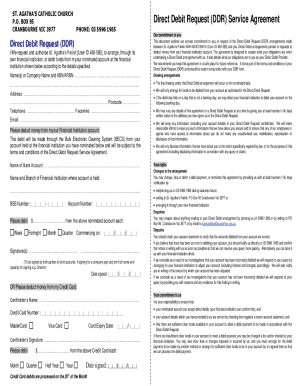

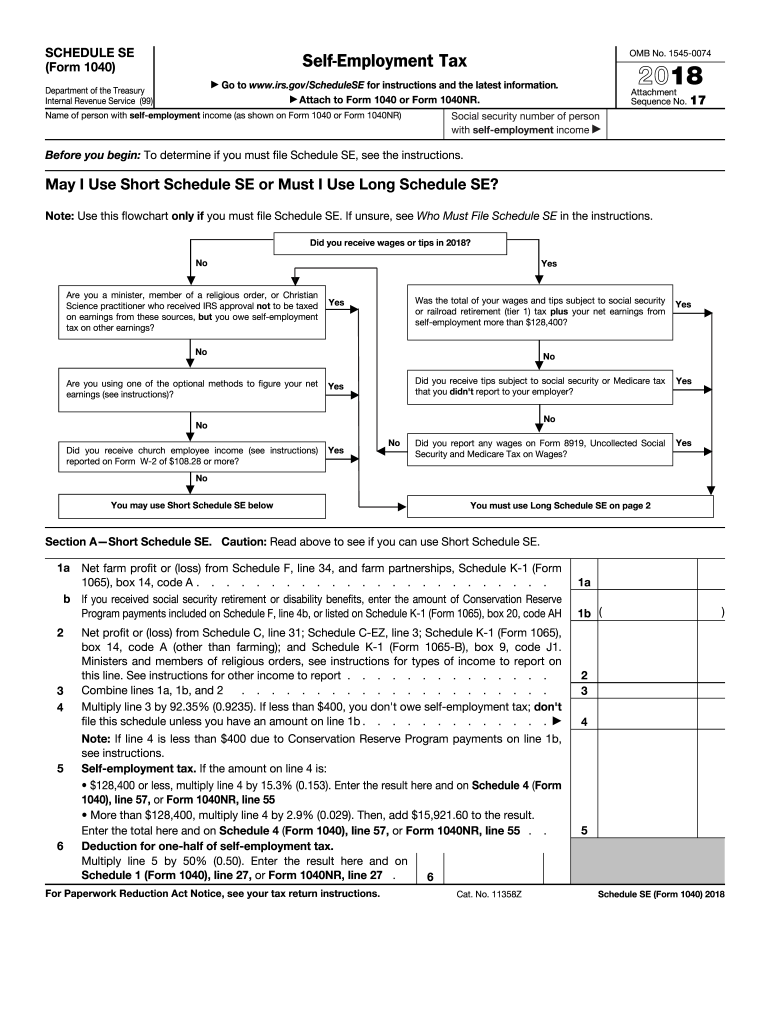

Deduction for one-half of self-employment tax. Schedule 1 Form 1040 line 27 or Form 1040NR line 27. SCHEDULE SE Form 1040 OMB No. 1545-0074 Self-Employment Tax Department of the Treasury Internal Revenue Service 99 Go to www.irs.gov/ScheduleSE for instructions and the latest information. Attach to Form 1040 or Form 1040NR. Name of person with self-employment income as shown on Form 1040 or Form 1040NR Attachment Sequence No. 17 Social security number of person with self-employment income ...Before you begin To determine if you must file Schedule SE see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE Note Use this flowchart only if you must file Schedule SE. If unsure see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2018 No Yes Are you a minister member of a religious order or Christian Science practitioner who received IRS approval not to be taxed on earnings from these sources but you owe self-employment tax on other...earnings Was the total of your wages and tips subject to social security or railroad retirement tier 1 tax plus your net earnings from that you didn t report to your employer reported on Form W-2 of 108. 9235. If less than 400 you don t owe self-employment tax don t file this schedule unless you have an amount on line 1b. Note If line 4 is less than 400 due to Conservation Reserve Program payments on line 1b see instructions. 128 400 or less multiply line 4 by 15. 3 0. 153. Enter the result here...and on Schedule 4 Form 1040 line 57 or Form 1040NR line 55 More than 128 400 multiply line 4 by 2. Did you receive wages or tips in 2018 No Yes Are you a minister member of a religious order or Christian Science practitioner who received IRS approval not to be taxed on earnings from these sources but you owe self-employment tax on other earnings Was the total of your wages and tips subject to social security or railroad retirement tier 1 tax plus your net earnings from that you didn t report to...your employer reported on Form W-2 of 108. 28 or more Are you using one of the optional methods to figure your net earnings see instructions Did you report any wages on Form 8919 Uncollected Social Security and Medicare Tax on Wages You may use Short Schedule SE below You must use Long Schedule SE on page 2 Section A Short Schedule SE. Caution Read above to see if you can use Short Schedule SE. 1a Net farm profit or loss from Schedule F line 34 and farm partnerships Schedule K-1 Form 1065 box 14...code A. Exception If less than 400 and you had church employee income enter -0- and continue 5a Enter your church employee income from Form W-2. See instructions for definition of church employee income. 5a b Multiply line 5a by 92. 35 0. 9235. If less than 100 enter -0-. Add lines 4c and 5b. Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6. See instructions for definition of church employee income. 5a b Multiply line 5a by 92. 35 0. 9235. If...less than 100 enter -0-. Add lines 4c and 5b. Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6. 2 portion of the 7. 65 railroad retirement tier 1 tax for 2018. 4b 4c 5b 8a Total social security wages and tips total of boxes 3 and 7 on Form s W-2 and railroad retirement tier 1 compensation. If 128 400 or more skip lines 8b through 10 and go to line 11 b Unreported tips subject to social security tax from Form 4137 line 10 8b c Wages subject to...social security tax from Form 8919 line 10 8c d Add lines 8a 8b and 8c. For Paperwork Reduction Act Notice see your tax return instructions. Cat. No. 11358Z 1b Page 2 Attachment Sequence No. 17 Section B Long Schedule SE Part I Note If your only income subject to self-employment tax is church employee income see instructions. Also see instructions for the definition of church employee income. A If you are a minister member of a religious order or Christian Science practitioner and you filed Form...4361 but you had 400 or more of other net earnings from self-employment check here and continue with Part I. optional method see instructions. 4a If line 3 is more than zero multiply line 3 by 92. 35 0. 9235.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

How to fill out IRS 1040 - Schedule SE

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

To edit IRS 1040 - Schedule SE, you can utilize tools that allow for easy modifications. If using pdfFiller, upload your form, and you can directly manipulate text, adjust numbers, or correct any errors. Ensure that all changes are accurate and in compliance with IRS guidelines before saving your revised document.

How to fill out IRS 1040 - Schedule SE

Filling out IRS 1040 - Schedule SE requires careful attention to detail. Start by entering your earnings as a self-employed individual. Next, calculate your net profit or loss from self-employment, and then compute your self-employment tax. Follow the sequential steps laid out in the form for accurate completion.

About IRS 1040 - Schedule SE 2018 previous version

What is IRS 1040 - Schedule SE?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule SE 2018 previous version

What is IRS 1040 - Schedule SE?

IRS 1040 - Schedule SE is a form used by self-employed individuals to calculate their self-employment tax. This tax applies to income earned through self-employment and is mandated by the federal government. Proper reporting using this form is essential for compliance with U.S. tax law.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule SE is to determine the amount of self-employment tax owed on net earnings from self-employment. This form helps ensure that self-employed individuals contribute to Social Security and Medicare through their earnings. It is an important part of filing the annual income tax return.

Who needs the form?

Individuals who are self-employed or have business income must use IRS 1040 - Schedule SE. This includes sole proprietors, independent contractors, and freelancers. If your self-employment earnings total $400 or more, you are required to file this form alongside your income tax return.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1040 - Schedule SE if your self-employment income is below $400. Additionally, if you are a church employee or receive certain types of payment, different rules may apply. Always refer to the IRS guidelines to verify your specific situation.

Components of the form

The components of IRS 1040 - Schedule SE include sections for reporting net earnings from self-employment and computing the corresponding self-employment tax. Key sections include the earnings calculation, deductions, and the tax computation that ultimately informs how much you owe. Understanding each component is crucial for accurate filing.

What are the penalties for not issuing the form?

Failure to file IRS 1040 - Schedule SE when required can result in penalties and interest on unpaid taxes. The IRS may impose a failure-to-file penalty, which can be a percentage of the unpaid tax per month. Moreover, not reporting your self-employment income correctly can lead to more severe consequences, including audits or additional taxes owed.

What information do you need when you file the form?

When filing IRS 1040 - Schedule SE, gather all relevant financial information concerning your self-employment income. This includes income statements, business expenses, and previous year's tax returns. Accurate record-keeping will help facilitate a smooth filing process.

Is the form accompanied by other forms?

IRS 1040 - Schedule SE is typically submitted alongside Form 1040, the main individual income tax return. Depending on your situation, you may also need to include other schedules or forms, such as Schedule C for reporting business income. Verify that you include all necessary documentation to ensure a comprehensive tax return.

Where do I send the form?

After completing IRS 1040 - Schedule SE, submit your form along with your Form 1040 to the designated IRS address based on your location. Always check the current IRS website or instructions provided with the form for the most accurate mailing information.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

So far excellent, could use a text search and replace feature.

I spent approx $70 for PDF Filler, could not find a page rotate icon when I really needed it, then a screen popped up that I would have to spend $120 per year to have this additional function. I was in the midst of needing to reorient some legal documents so paid the additional money. I find this to be less than fair business practice as when I signed up there was no clear breakdown presented on the functions available for different costs.

See what our users say