TX Comptroller AP-152 2015 free printable template

Show details

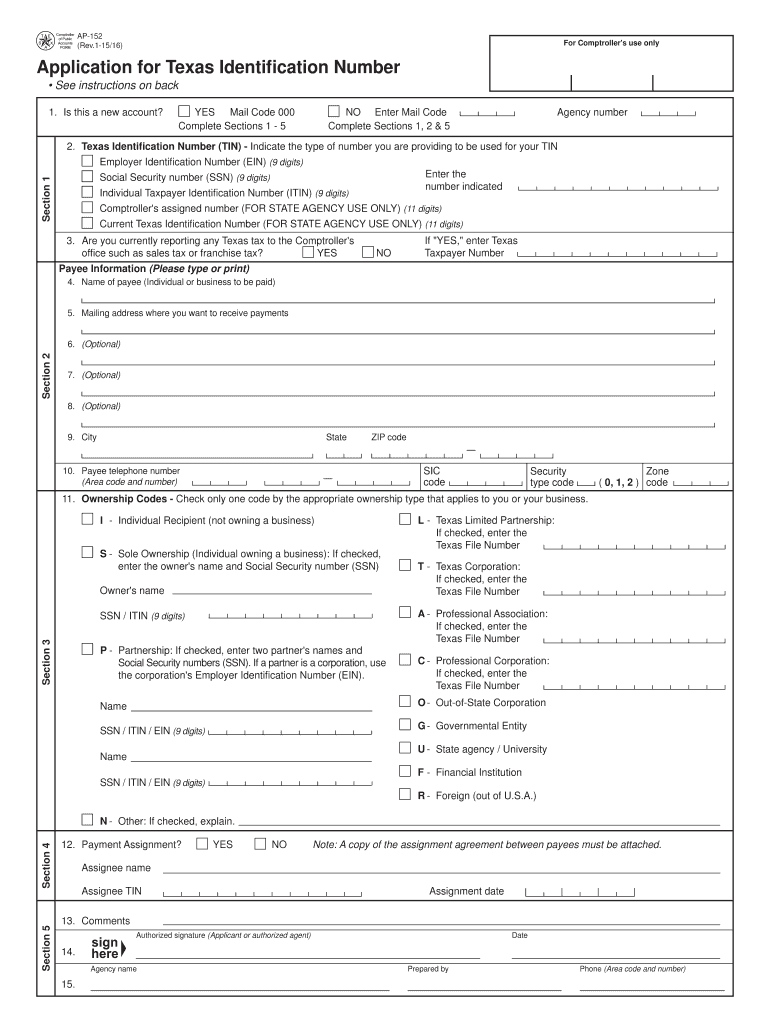

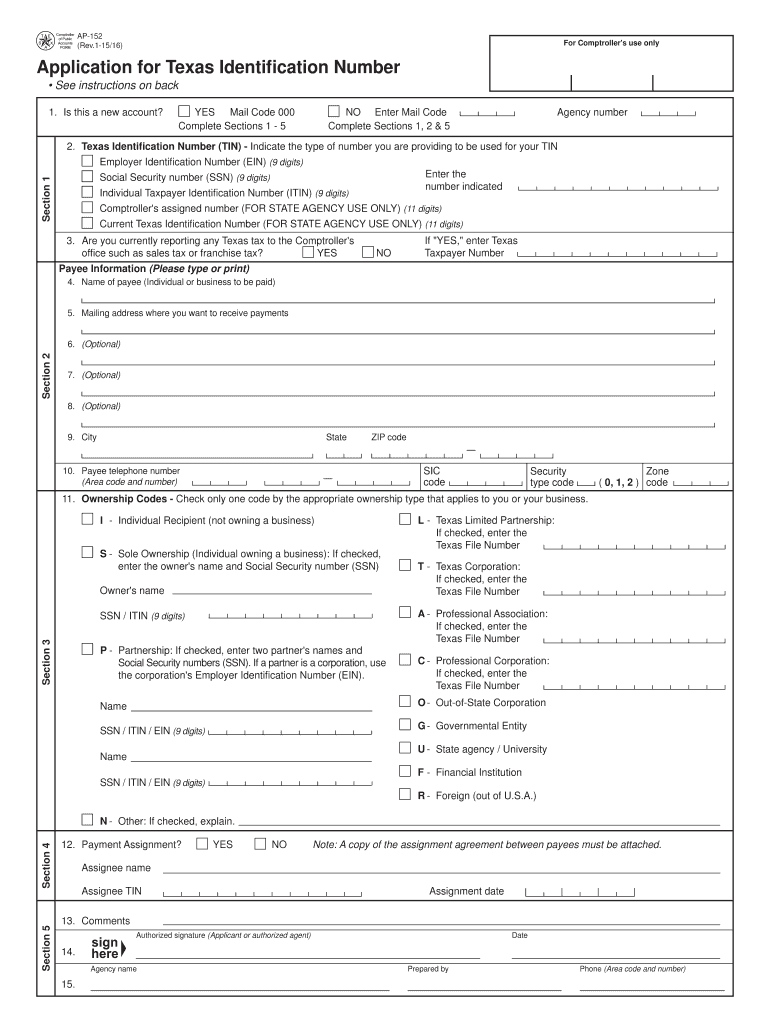

PRINT FORM AP152 (Rev.115/16)CLEAR Former Comptroller's use onlyApplication for Texas Identification Number See instructions on bisection 11. Is this a new account?YES Mail Code 000 Complete Sections

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller AP-152

Edit your TX Comptroller AP-152 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller AP-152 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller AP-152 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller AP-152. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller AP-152 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller AP-152

How to fill out TX Comptroller AP-152

01

Obtain Form AP-152 from the Texas Comptroller's website or your local tax office.

02

Fill in your name and business information at the top of the form.

03

Enter your Texas sales and use tax permit number in the specified section.

04

Provide detailed information about the refund being requested, including the reason for the refund and the amount.

05

Attach any supporting documentation, such as invoices or receipts, that substantiate your claim.

06

Sign and date the form to certify the information provided is accurate.

07

Submit the completed form and documentation to the appropriate Texas Comptroller office as instructed.

Who needs TX Comptroller AP-152?

01

Businesses or individuals who have overpaid sales or use tax in Texas and are seeking a refund.

02

Tax professionals assisting clients with tax refund claims related to sales and use tax.

Fill

form

: Try Risk Free

People Also Ask about

What is a Texas tax payer ID number?

Texas Taxpayer Number: This 11-digit number is issued to an individual/entity by the Comptroller of Public Accounts. If the individual/entity was previously issued a Texas taxpayer number, enter it here. Leave this field blank if you have not previously registered for a Texas taxpayer number.

What is a Texas payee ID?

State payees include vendors who contract with a state agency to provide goods or services and individual recipients. In almost all cases, payees are required to provide one of these nine-digit identification numbers to obtain a TIN: Federal employer identification number (EIN)

What is a Texas payee ID form?

State payees include vendors who contract with a state agency to provide goods or services and individual recipients. In almost all cases, payees are required to provide one of these nine-digit identification numbers to obtain a TIN: Federal employer identification number (EIN)

How do I find my Texas 11 digit taxpayer number?

0:18 2:08 How to Find Your 11-Digit Sales Tax Taxpayer Number [Official] - YouTube YouTube Start of suggested clip End of suggested clip Number or ein. Legal name city or zip code to find the taxpayer. Number try your legal name first.MoreNumber or ein. Legal name city or zip code to find the taxpayer. Number try your legal name first.

Is TX ID and EIN the same?

Note: An EIN Number is not the same thing as a Texas State Tax ID Number. A federal EIN is issued by the IRS. And a Texas Tax ID Number is issued by the Texas Comptroller.

What is a Texas business ID number?

The Texas Tax ID is a unique number assigned to businesses by the state. If you do not have your EIN, you can still apply for a Texas sales and use tax permit. Until you receive your federal Employer Identification Number, the comptroller's office will only be able to issue a license with a temporary number.

What is 11 digit Texas tax payer number?

Texas Taxpayer Number: This 11-digit number is issued to an individual/entity by the Comptroller of Public Accounts. If the individual/entity was previously issued a Texas taxpayer number, enter it here. Leave this field blank if you have not previously registered for a Texas taxpayer number.

How much does it cost to get a Texas tax ID number?

Applying for an EIN for your Texas LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

What is the Texas payee ID number?

State payees include vendors who contract with a state agency to provide goods or services and individual recipients. In almost all cases, payees are required to provide one of these nine-digit identification numbers to obtain a TIN: Federal employer identification number (EIN)

What is the tax ID number example?

It is a 9-digit number, beginning with the number "9", formatted like an SSN (NNN-NN-NNNN).

Does Texas have an employer state ID number?

Most businesses operating in Texas will require both a federal tax ID and a Texas state tax ID number. Fortunately, despite the fact that these two numbers are distinct, the process for applying to them is highly similar and easy to follow.

Is a Texas tax ID the same as an EIN?

A Texas Tax ID number is assigned by the state's comptroller or franchise tax board. The federal Employer Identification Number (EIN) is a nine-digit number issued to a business or company by the IRS. As part of the application process for getting your Texas Tax ID, you must be able to provide the federal EIN.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my TX Comptroller AP-152 directly from Gmail?

TX Comptroller AP-152 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send TX Comptroller AP-152 to be eSigned by others?

TX Comptroller AP-152 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete TX Comptroller AP-152 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your TX Comptroller AP-152, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is TX Comptroller AP-152?

TX Comptroller AP-152 is a form used by the Texas Comptroller of Public Accounts for reporting certain financial information related to fixed assets and property.

Who is required to file TX Comptroller AP-152?

Entities that are exempt from property taxes in Texas and need to report their fixed assets are required to file TX Comptroller AP-152.

How to fill out TX Comptroller AP-152?

To fill out TX Comptroller AP-152, you need to provide basic information about your organization, a detailed listing of the fixed assets, their values, and any relevant supporting documentation as required.

What is the purpose of TX Comptroller AP-152?

The purpose of TX Comptroller AP-152 is to ensure transparency and proper reporting of fixed assets owned by exempt entities in Texas for accountability in financial management.

What information must be reported on TX Comptroller AP-152?

Information that must be reported on TX Comptroller AP-152 includes the organization's name, address, the type of exempt status, a detailed list of assets, acquisition dates, and corresponding values.

Fill out your TX Comptroller AP-152 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller AP-152 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.