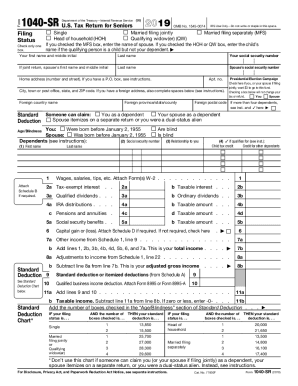

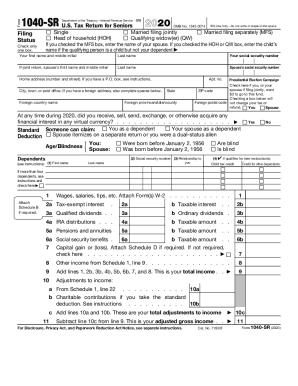

IRS 1040 Schedule R 2018 free printable template

Instructions and Help about IRS 1040 Schedule R

How to edit IRS 1040 Schedule R

How to fill out IRS 1040 Schedule R

About IRS 1040 Schedule R 2018 previous version

What is IRS 1040 Schedule R?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

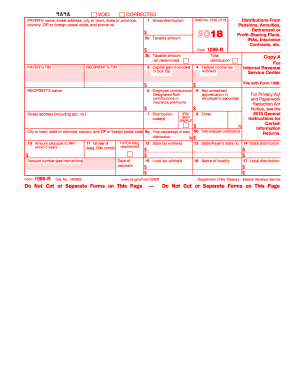

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 Schedule R

What should I do if I need to correct a mistake on my form 1040 printable?

If you discover an error after submitting your form 1040 printable, you can file an amended return using Form 1040-X. Ensure you follow the specific guidelines for corrections, as the process might differ based on the nature of the mistakes.

How can I verify the status of my filed form 1040 printable?

To verify the status of your submitted form 1040 printable, you can use the IRS's 'Where's My Refund?' tool if you're expecting a refund. Alternatively, you may contact the IRS directly to inquire about your filing status.

Are e-signatures acceptable for form 1040 printable submissions?

Yes, e-signatures are generally accepted for filing your form 1040 printable, especially when you e-file. Ensure you follow the procedures set by the IRS for e-signature use to maintain compliance.

What common errors should I avoid when filing my form 1040 printable?

Some common errors include incorrect Social Security numbers, omissions of income, and math mistakes. Carefully review your form before submission to minimize these errors and consider using tax software for added checks.

What should I do if I receive a notice from the IRS regarding my form 1040 printable?

If you receive a notice from the IRS concerning your form 1040 printable, read it carefully to understand the issue raised. Prepare any necessary documentation and respond promptly, addressing any required information or corrections as specified in the notice.

See what our users say