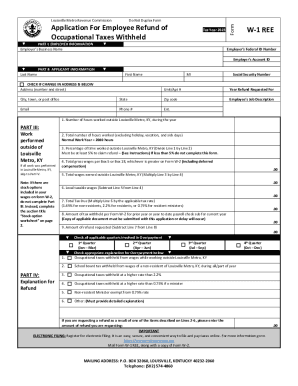

KY W1REE - Louisville City 2018 free printable template

Show details

Application for Employee Refund of

Occupational Taxes Withheld

PART I: EMPLOYER INFORMATION

Employers Business nameplate Do Not Duplex Form

W1REE×2018×V1.0FormLouisville Metro Revenue CommissionW1

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY W1REE - Louisville City

Edit your KY W1REE - Louisville City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY W1REE - Louisville City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY W1REE - Louisville City online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KY W1REE - Louisville City. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY W1REE - Louisville City Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY W1REE - Louisville City

How to fill out KY W1REE - Louisville City

01

Step 1: Download the KY W1REE form from the official Louisville City website.

02

Step 2: Fill out your personal information including your name, address, and contact details.

03

Step 3: Provide the necessary identification details as required by the form.

04

Step 4: Specify the services or permits you are applying for in Louisville City.

05

Step 5: Review all your entries for accuracy and completeness.

06

Step 6: Submit the completed form either online or via mail as instructed on the form.

Who needs KY W1REE - Louisville City?

01

Individuals or businesses seeking permits or licenses in Louisville City.

02

Residents applying for specific local programs or services.

03

Those needing to report certain compliance or regulatory information to city authorities.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a refund from ERC?

Most employers can expect to receive their ERTC refund within six months to a year after filing their return.

Can I claim employee retention credit in 2022?

Businesses can no longer pay wages to claim the Employee Retention Tax Credit, but they have until 2024, and in some instances 2025, to do a look back on their payroll during the pandemic and retroactively claim the credit by filing an amended tax return.

Is ERC refund legit?

The ERC is a legitimate payroll tax credit still accepted by the IRS today. Created by the CARES Act to incentivize employers to retain workers throughout the pandemic, the ERC can still be claimed retroactively by amending payroll taxes from 2020 and/or 2021.

Is the ERC refund real?

What is the ERC? The ERC is a refundable tax credit designed for businesses who continued paying employees while shutdown due to the COVID-19 pandemic or had significant declines in gross receipts from March 13, 2020 to December 31, 2021.

Who qualifies for the employee retention credit?

The credit is 50% of up to $10,000 in wages paid by an employer whose business is fully or partially suspended because of COVID-19 or whose gross receipts decline by more than 50%.

Is there a deadline to claim the employee retention credit?

Employee Retention Tax Credit Deadline The deadline for qualified firms to claim the ERTC is July 31, October 31, and December 31, 2021, with their Employee per quarter Form 941 tax filings.

Will Ertc be extended into 2022?

Employers may file Form 941-X up to three years after the original payroll taxes were due, which is typically on April 15. Thus, employers may claim the 2020 ERTC until April 15, 2024, and the 2021 ERTC until April 15, 2025.

How does ERC refund work?

The Employee Retention Credit under the CARES Act encourages businesses to keep employees on their payroll. The refundable tax credit is 50% of up to $10,000 in wages paid by an eligible employer whose business has been financially impacted by COVID-19.

Who is eligible for employee retention credit 2022?

If you own less than 50% of the business or multiple owners own less than 50% ownership, then you may be eligible to receive the employee retention tax credit. Additionally, if you have family members who have ownership of your business, their wages do not qualify for the employee retention credit.

Can I still get the employee retention credit?

Businesses can no longer pay wages to claim the Employee Retention Tax Credit, but they have until 2024, and in some instances 2025, to do a look back on their payroll during the pandemic and retroactively claim the credit by filing an amended tax return.

How do I get my ERC refund?

If you qualify for the ERC in 2020 or 2021, you can claim the credit retroactively by filing an updated Form 941X. You have three years from the day you submitted your first return or two years from the date you made payments to file an updated federal hiring tax return, ing to the IRS.

How do I get employee retention credit?

How does an Eligible Employer claim the Employee Retention Credit for qualified wages? Eligible Employers will report their total qualified wages for purposes of the Employee Retention Credit for each calendar quarter on their federal employment tax returns, usually Form 941, Employer's Quarterly Federal Tax Return.

Is the ERC credit still available?

For most businesses, the credit could be claimed on wages until Sept. 30, 2021, with certain businesses having until Dec. 31, 2021 to pay qualified wages.

Is the employee retention credit still available in 2022?

January 31, 2022 will be the last day to eFax Form 7200. Taxpayers that are not recovery startup businesses are not eligible for the employee retention credit for wages paid after September 30, 2021.

How long does it take to get a refund from ERC?

How Long Does It Take for the ERC Refund to Arrive? The IRS was previously expecting to provide refunds between six weeks to six months after the revised payroll reports were filed. You can expect a nine to twelve-month turnaround time for a refund to arrive.

Are there any ERC credits for 2022?

There is still time to apply for the ERTC tax credit in 2022. The credit is no longer available for current claims, but you can claim it retroactively by amending your employment tax returns. The IRS lets you amend returns and claim refunds for up to three years after the filing deadline.

How are ERC credits refunded?

The credit will be refunded to the employer when they file their annual tax return. For employers who have already filed their 2020 return, the IRS will automatically process the credit and issue a refund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit KY W1REE - Louisville City from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your KY W1REE - Louisville City into a dynamic fillable form that you can manage and eSign from anywhere.

How can I edit KY W1REE - Louisville City on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing KY W1REE - Louisville City.

How do I edit KY W1REE - Louisville City on an iOS device?

Use the pdfFiller mobile app to create, edit, and share KY W1REE - Louisville City from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is KY W1REE - Louisville City?

KY W1REE - Louisville City is a specific tax form used by businesses to report payroll taxes and other relevant financial information to the city of Louisville, Kentucky.

Who is required to file KY W1REE - Louisville City?

Businesses operating within the city of Louisville that are subject to local payroll taxes are required to file the KY W1REE - Louisville City form.

How to fill out KY W1REE - Louisville City?

To fill out the KY W1REE - Louisville City form, businesses need to provide details such as total payroll amounts, tax withheld, and employee information as per the instructions provided with the form.

What is the purpose of KY W1REE - Louisville City?

The purpose of KY W1REE - Louisville City is to ensure proper reporting and collection of local taxes from businesses operating in Louisville, thereby contributing to the city's revenue.

What information must be reported on KY W1REE - Louisville City?

The KY W1REE - Louisville City form requires reporting of total wages paid, payroll tax withheld, employee identification details, and any other relevant financial data required by the city.

Fill out your KY W1REE - Louisville City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY w1ree - Louisville City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.