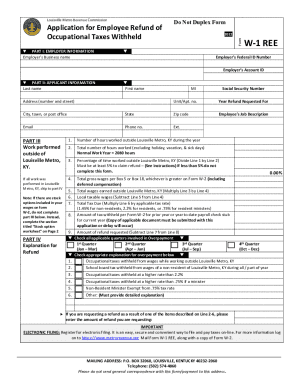

KY W1REE - Louisville City 2023-2025 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign w1ree form

Edit your w1ree employee louisville form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w1ree 2023-2025 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w1ree 2023-2025 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit w1ree 2023-2025 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY W1REE - Louisville City Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out w1ree 2023-2025 form

How to fill out KY W1REE - Louisville City

01

Obtain the KY W1REE form from the Kentucky revenue website or local office.

02

Fill in your personal information, including name, address, and Social Security number.

03

Provide details about your entity, including the type of business and the ownership structure.

04

Indicate the reason for the exemption on the form.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form.

07

Submit the completed form to the appropriate Kentucky revenue office.

Who needs KY W1REE - Louisville City?

01

Businesses seeking to claim a sales tax exemption on certain purchases in Louisville City.

02

Entities engaged in activities specified under Kentucky sales tax exemption laws.

Fill

form

: Try Risk Free

People Also Ask about

Can I file my Kentucky state taxes online?

Kentucky is now offering KY File, a new way to file your current year return free of charge. It allows you to: Select the Kentucky income tax forms and schedules that you need. Fill in your tax information online.

Does Louisville Ky have local income tax?

Resident employees-Employees who work and live in Louisville Metro, Kentucky, are subject to a tax rate of 2.2% (. 0220).

Does Kentucky have a state withholding form?

If you meet any of the four exemptions you are exempted from Kentucky withholding. However, you must complete this form and file it with your employer before withholding can be stopped. You will need to maintain a copy of the K-4 for your permanent records.

Does Jefferson County Alabama have an occupational tax?

The Jefferson County Occupational Tax is a 0.45% tax on wages for all workers in Jefferson County, signed into law by Governor Bob Riley on August 14, 2009.

What is an OL 3 form?

This editable tax form is used by individuals, partnerships, and corporations which have had any business activity in Louisville Metro, Kentucky (Jefferson County) during a calendar or fiscal year.

What is an occupational tax in Kentucky?

The occupational tax is imposed upon the privilege of engaging in business, profession, occupation, or trade within Louisville Metro, Kentucky, regardless of the legal residence of the person so engaged.

Do you file city taxes in Kentucky?

Most (if not all) KY cities and counties administer their local income tax. It is not handled by the state tax dept.

What occupation means tax?

Occupation tax is a tax the government imposes on certain trades and professions. It is usually a set amount the government levies, typically as a license fee, on doctors, lawyers, and other professionals. However, sometimes it may be a proportion of gross income.

What payroll taxes do employers pay in Kentucky?

Kentucky Payroll Laws, Taxes, and Regulations Both the employer and the employee pay these taxes, each paying 7.65% of the total tax.

What is the Jefferson County occupational tax?

Jeffersontown's Occupational Tax is a 1% wage withholding tax on an employee's gross wage. The tax must be withheld and remitted by the employer to the Jeffersontown Revenue Department on a quarterly basis each April 30th, July 31st, October 31st and January 31st.

What taxes do you pay in Louisville Ky?

The minimum combined 2022 sales tax rate for Louisville, Kentucky is 6%. This is the total of state, county and city sales tax rates. The Kentucky sales tax rate is currently 6%.

Does Louisville accept federal extension?

A standard extension request form (OL-3E) is available through the Louisville Metro Revenue Commission's website. However, a copy of your federal income extension request for the same year, is acceptable.

What is Louisville occupational tax?

The tax rate is determined by where the employee lives. For employees who work in Louisville Metro, but live outside of Louisville Metro, the occupational fee/tax rate is 1.45% (. 0145). For employees who both work and live in Louisville Metro, the occupational fee/tax rate is 2.2% (. 0220).

What taxes do employees pay in Kentucky?

Compute tax on wages using the 5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

What is business and occupation?

What is the business and occupation (B&O) tax? The state B&O tax is a gross receipts tax. It is measured on the value of products, gross proceeds of sale, or gross income of the business.

How much tax does an LLC pay in Kentucky?

Every member or manager of the Kentucky LLC earning profit out of the LLC has to pay the Federal Self-Employment Tax (also called the Social Security or Medicare Tax). The Federal Self-Employment Tax applies to all the earnings of an LLC member or manager. The Federal Self-Employment Tax rate in Kentucky is 15.3%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my w1ree 2023-2025 form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your w1ree 2023-2025 form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit w1ree 2023-2025 form in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing w1ree 2023-2025 form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my w1ree 2023-2025 form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your w1ree 2023-2025 form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is KY W1REE - Louisville City?

KY W1REE - Louisville City is a specific tax form used for reporting employee wages, tax withheld, and other relevant information for workers in Louisville, Kentucky.

Who is required to file KY W1REE - Louisville City?

Employers who have employees working in Louisville and are liable for local income tax are required to file KY W1REE - Louisville City.

How to fill out KY W1REE - Louisville City?

To fill out KY W1REE - Louisville City, employers must provide details such as the total wages paid, the amount of local tax withheld, and employee information as required by the form.

What is the purpose of KY W1REE - Louisville City?

The purpose of KY W1REE - Louisville City is to report employee compensation and withholdings for local city income tax, ensuring compliance with Louisville tax regulations.

What information must be reported on KY W1REE - Louisville City?

The information that must be reported on KY W1REE - Louisville City includes employee names, social security numbers, total wages paid, and the amount of tax withheld.

Fill out your w1ree 2023-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

w1ree 2023-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.