KY W1REE - Louisville City 2020 free printable template

Show details

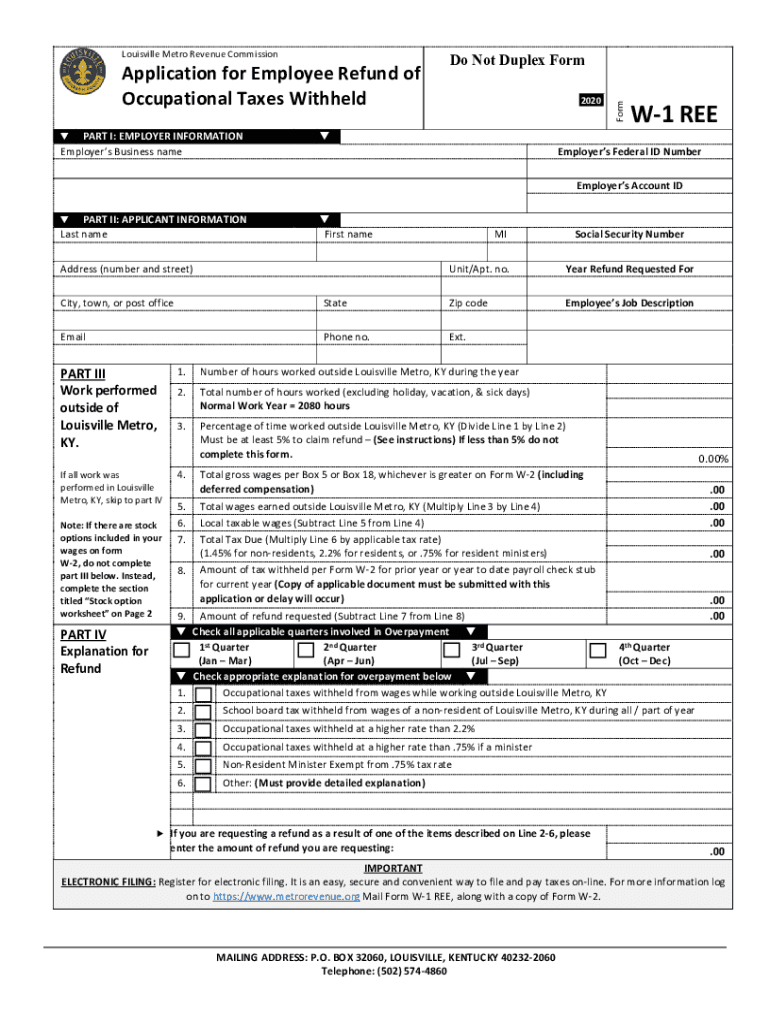

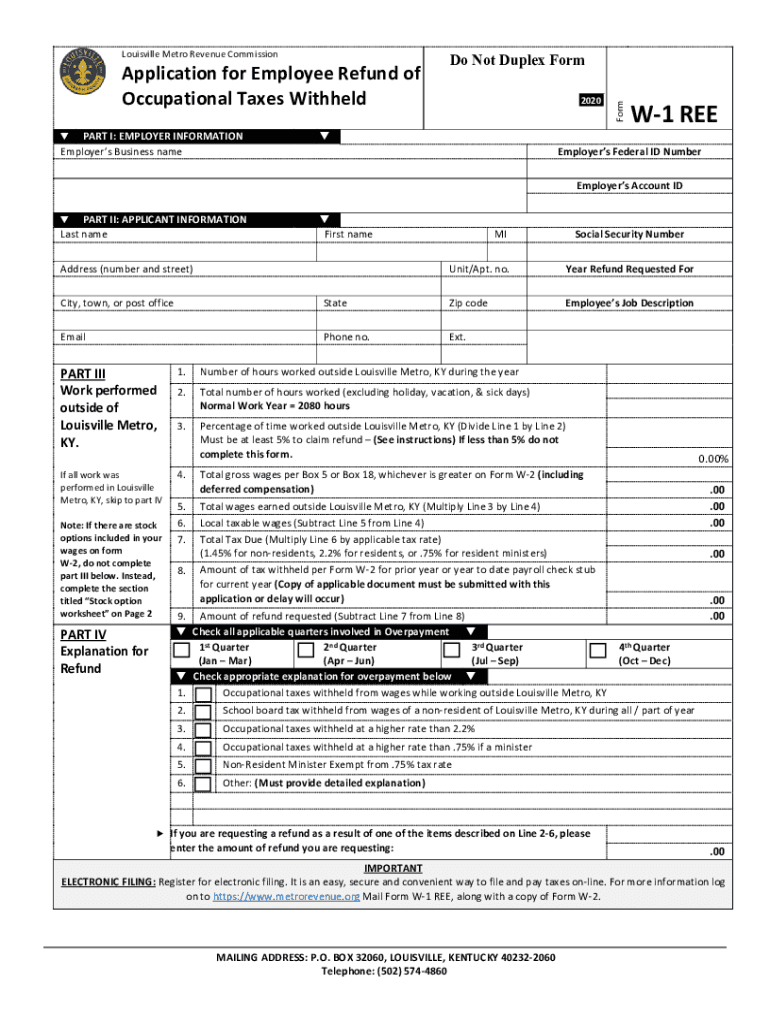

Application for Employee Refund of

Occupational Taxes Withheld

PART I: EMPLOYER INFORMATION

Employers Business named Not Duplex Form

2020FormLouisville Metro Revenue CommissionW1 Employers Federal

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY W1REE - Louisville City

Edit your KY W1REE - Louisville City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY W1REE - Louisville City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY W1REE - Louisville City online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit KY W1REE - Louisville City. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY W1REE - Louisville City Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY W1REE - Louisville City

How to fill out KY W1REE - Louisville City

01

Obtain the KY W1REE form from the official Kentucky state website or local office.

02

Fill out the heading section with your name, address, and contact information.

03

Indicate the year for which you are filing the W1REE form.

04

Provide details of your income sources in the appropriate fields.

05

Calculate the total income and any applicable deductions.

06

Review your entries for accuracy.

07

Sign and date the form in the designated area.

08

Submit the form by mail or electronically as instructed.

Who needs KY W1REE - Louisville City?

01

Individuals and businesses in Louisville City earning income.

02

Residents of Louisville who need to report income for state tax purposes.

03

Employers who must submit employee wage information.

Fill

form

: Try Risk Free

People Also Ask about

Can I file my Kentucky state taxes online?

Kentucky is now offering KY File, a new way to file your current year return free of charge. It allows you to: Select the Kentucky income tax forms and schedules that you need. Fill in your tax information online.

Does Louisville Ky have local income tax?

Resident employees-Employees who work and live in Louisville Metro, Kentucky, are subject to a tax rate of 2.2% (. 0220).

Does Kentucky have a state withholding form?

If you meet any of the four exemptions you are exempted from Kentucky withholding. However, you must complete this form and file it with your employer before withholding can be stopped. You will need to maintain a copy of the K-4 for your permanent records.

Does Jefferson County Alabama have an occupational tax?

The Jefferson County Occupational Tax is a 0.45% tax on wages for all workers in Jefferson County, signed into law by Governor Bob Riley on August 14, 2009.

What is an OL 3 form?

This editable tax form is used by individuals, partnerships, and corporations which have had any business activity in Louisville Metro, Kentucky (Jefferson County) during a calendar or fiscal year.

What is an occupational tax in Kentucky?

The occupational tax is imposed upon the privilege of engaging in business, profession, occupation, or trade within Louisville Metro, Kentucky, regardless of the legal residence of the person so engaged.

Do you file city taxes in Kentucky?

Most (if not all) KY cities and counties administer their local income tax. It is not handled by the state tax dept.

What occupation means tax?

Occupation tax is a tax the government imposes on certain trades and professions. It is usually a set amount the government levies, typically as a license fee, on doctors, lawyers, and other professionals. However, sometimes it may be a proportion of gross income.

What payroll taxes do employers pay in Kentucky?

Kentucky Payroll Laws, Taxes, and Regulations Both the employer and the employee pay these taxes, each paying 7.65% of the total tax.

What is the Jefferson County occupational tax?

Jeffersontown's Occupational Tax is a 1% wage withholding tax on an employee's gross wage. The tax must be withheld and remitted by the employer to the Jeffersontown Revenue Department on a quarterly basis each April 30th, July 31st, October 31st and January 31st.

What taxes do you pay in Louisville Ky?

The minimum combined 2022 sales tax rate for Louisville, Kentucky is 6%. This is the total of state, county and city sales tax rates. The Kentucky sales tax rate is currently 6%.

Does Louisville accept federal extension?

A standard extension request form (OL-3E) is available through the Louisville Metro Revenue Commission's website. However, a copy of your federal income extension request for the same year, is acceptable.

What is Louisville occupational tax?

The tax rate is determined by where the employee lives. For employees who work in Louisville Metro, but live outside of Louisville Metro, the occupational fee/tax rate is 1.45% (. 0145). For employees who both work and live in Louisville Metro, the occupational fee/tax rate is 2.2% (. 0220).

What taxes do employees pay in Kentucky?

Compute tax on wages using the 5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

What is business and occupation?

What is the business and occupation (B&O) tax? The state B&O tax is a gross receipts tax. It is measured on the value of products, gross proceeds of sale, or gross income of the business.

How much tax does an LLC pay in Kentucky?

Every member or manager of the Kentucky LLC earning profit out of the LLC has to pay the Federal Self-Employment Tax (also called the Social Security or Medicare Tax). The Federal Self-Employment Tax applies to all the earnings of an LLC member or manager. The Federal Self-Employment Tax rate in Kentucky is 15.3%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KY W1REE - Louisville City without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like KY W1REE - Louisville City, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I edit KY W1REE - Louisville City on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit KY W1REE - Louisville City.

Can I edit KY W1REE - Louisville City on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign KY W1REE - Louisville City right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is KY W1REE - Louisville City?

KY W1REE - Louisville City is a tax form used for reporting earnings and withholdings for employees working in Louisville, Kentucky.

Who is required to file KY W1REE - Louisville City?

Employers who have employees working within the city limits of Louisville, Kentucky, are required to file KY W1REE - Louisville City.

How to fill out KY W1REE - Louisville City?

To fill out KY W1REE - Louisville City, employers must provide their business information, employee earnings, tax withheld, and any other relevant financial data as required by the form.

What is the purpose of KY W1REE - Louisville City?

The purpose of KY W1REE - Louisville City is to ensure the accurate reporting and collection of local taxes from wages earned by employees in Louisville.

What information must be reported on KY W1REE - Louisville City?

The information that must be reported on KY W1REE - Louisville City includes the employer's details, employee names, Social Security numbers, total wages paid, and the amount of local tax withheld.

Fill out your KY W1REE - Louisville City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY w1ree - Louisville City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.