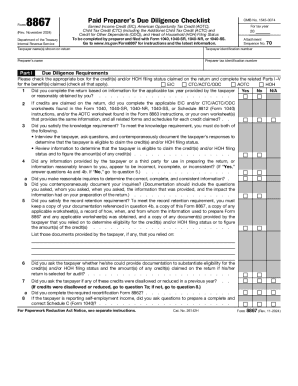

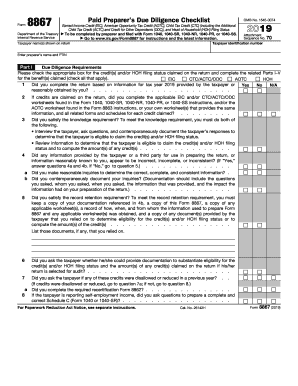

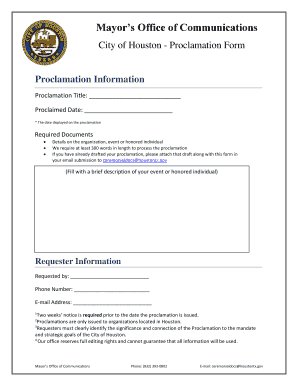

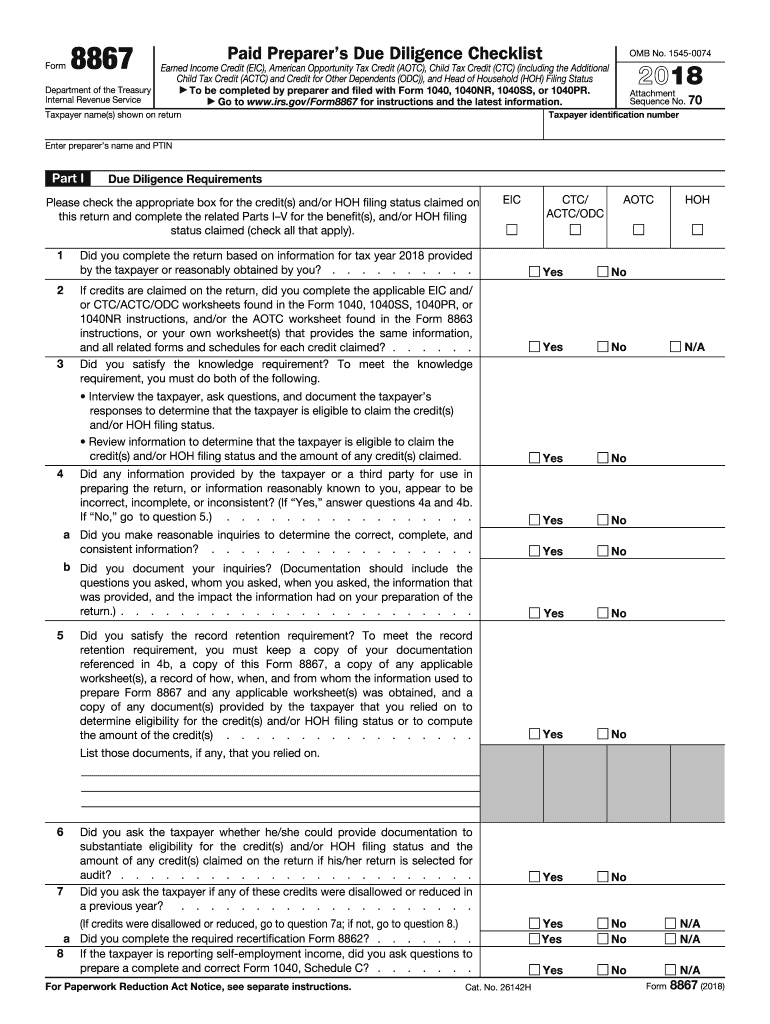

IRS 8867 2018 free printable template

Instructions and Help about IRS 8867

How to edit IRS 8867

How to fill out IRS 8867

About IRS 8 previous version

What is IRS 8867?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8867

What should I do if I realize I made a mistake after submitting form 8867?

If you discover an error after filing form 8867, you should submit a corrected version. Corrections can typically be made by e-filing an amended return or following your state's guidance on amendments. It is essential to keep records of the changes for your files, as this will help in case of any future inquiries.

How can I check the status of my form 8867 submission?

To verify the status of your submitted form 8867, you can use the IRS's online tools or contact their help line. Make sure to have your filing details handy, as these will assist in quickly locating the status of your submission. Additionally, familiarize yourself with common e-file rejection codes to troubleshoot potential issues.

Are e-signatures on form 8867 acceptable?

Yes, e-signatures are acceptable for form 8867 if you follow the IRS guidelines for electronic filing. Ensure that your electronic signature process complies with the requirements outlined in IRS regulations to maintain the validity of your submission. This encompasses proper authentication and optional secure methods of signature capture.

What should I prepare if I receive an audit notice related to form 8867?

If you receive an audit notice concerning form 8867, gather all relevant documentation supporting your claims made on the form. This includes any receipts, supporting statements, and records that validate your provided information. Being organized will facilitate a smoother audit process and ensure that you can promptly address any questions from the auditors.

What common errors should I avoid when submitting form 8867?

Common pitfalls when filing form 8867 include omitting required signatures, failing to provide accurate taxpayer identification numbers, and submitting without necessary supporting documentation. To avoid these mistakes, double-check your entries, ensure all fields are completed, and maintain consistent records for verification to enhance your filing accuracy.

See what our users say