KS SOS NP 50 2018 free printable template

Show details

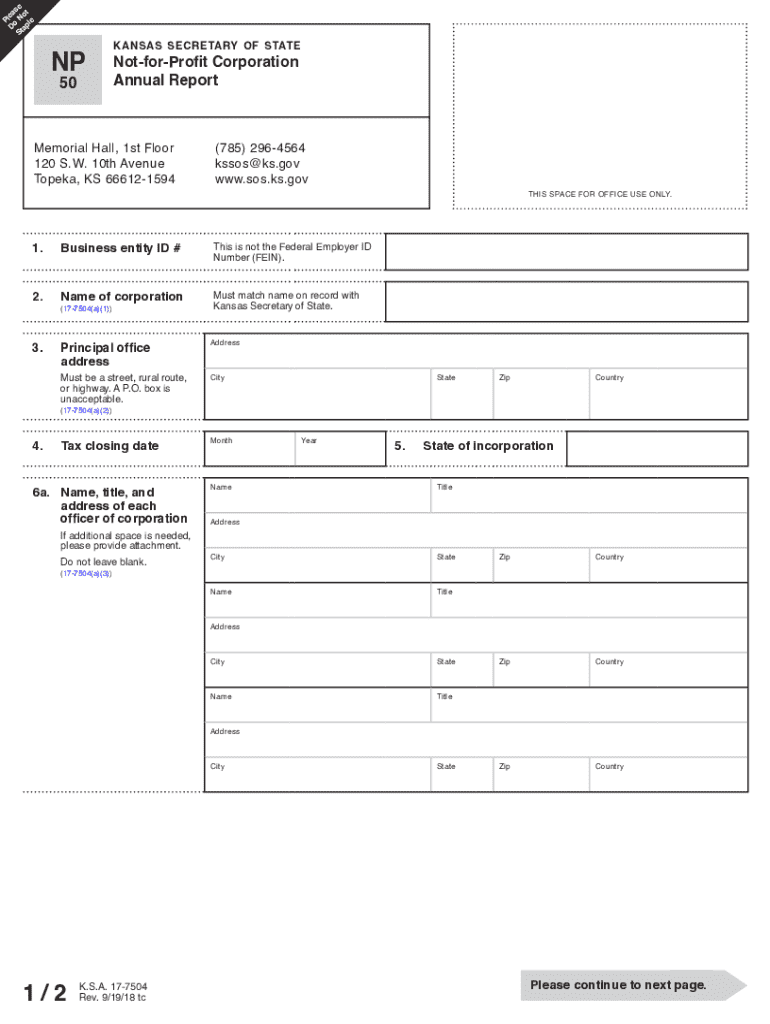

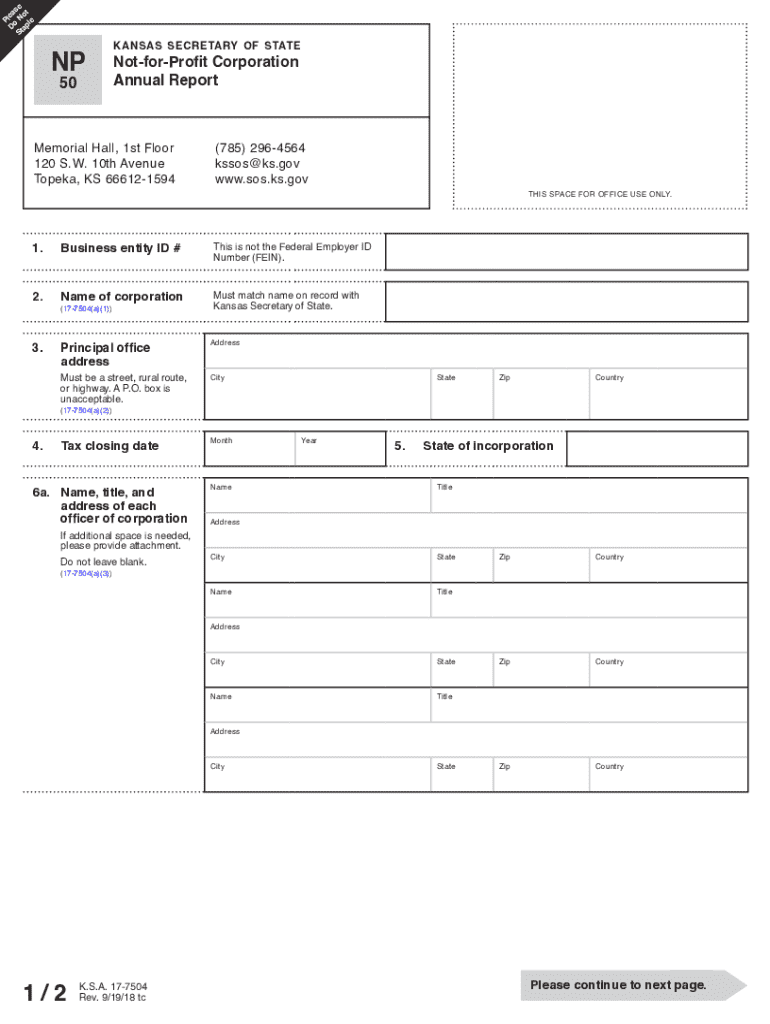

P D lea St o N se ap ot le NP kansas secretary of state Not-for-Profit Corporation Annual Report GENERAL FILING INSTRUCTIONS The following form must be complete and accompanied by the correct filing fee or the document will not be accepted for filing. 17-7504 c Signature of Authorized Signer X Name of Signer printed or typed 2/2 Title/Position Required Phone Number Please review to ensure completion. AG for Forms AR or NP Complete this form only if the business entity owns or leases land...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS SOS NP 50

Edit your KS SOS NP 50 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS SOS NP 50 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS SOS NP 50 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KS SOS NP 50. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS SOS NP 50 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS SOS NP 50

How to fill out KS SOS NP 50

01

Obtain the KS SOS NP 50 form from the Kansas Secretary of State's website or your local office.

02

Fill out the 'Entity Name' section with the name of your business.

03

Provide the 'Business Address' including street, city, state, and zip code.

04

Complete the 'Registered Agent' section, listing the name and address of your registered agent.

05

Check the appropriate box for the type of entity you are registering (e.g., corporation, LLC).

06

Fill in the 'Duration' of your business if it is not perpetual.

07

Sign and date the application, ensuring that it is signed by the appropriate party.

08

Prepare the necessary filing fee and submit the form to the Kansas Secretary of State, either online or via mail.

Who needs KS SOS NP 50?

01

Anyone looking to register a business entity in Kansas needs to fill out the KS SOS NP 50 form.

02

Entrepreneurs starting new businesses, whether corporations or LLCs, should complete this form.

03

Existing businesses wishing to register a new name or structure will also need to fill out this form.

Fill

form

: Try Risk Free

People Also Ask about

How do I register as a foreign entity in Kansas?

To register a foreign corporation in Kansas, you must file an Application for Registration of Foreign Covered Entity with the Kansas Secretary of State. . You can submit this document by mail, by fax, or in person. The Foreign Corporation Application for a foreign Kansas corporation costs $115 to file.

How much does it cost to reinstate an LLC in Kansas?

How much will it cost to revive a Kansas LLC? The filing fee for a Certificate of Reinstatement is $35.

How much does it cost to file an annual report at Kansas Secretary of State?

FILING FEE: The filing fee for the annual report is $55. If you are filing this annual report as part of a reinstatement due to forfeiture, you may owe a different fee (fees are listed with the reinstatement form).

Who needs to file KS annual report?

All for-profit entities with a calendar year tax period may file an annual report any time after the end of the tax period. An annual report may be filed beginning January 1 but must be filed by April 15.

How much is the annual report fee in Kansas?

FILING FEE: The filing fee for the annual report is $55. If you are filing this annual report as part of a reinstatement due to forfeiture, you may owe a different fee (fees are listed with the reinstatement form).

What is the annual fee for an LLC in Kansas?

All Kansas LLCs need to pay $50 per year for the Kansas Annual Report fee. These state fees are paid to the Secretary of State. And this is the only state-required annual fee. You have to pay this to keep your LLC in good standing, and the fee applies to all Kansas Limited Liability Companies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit KS SOS NP 50 in Chrome?

KS SOS NP 50 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the KS SOS NP 50 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your KS SOS NP 50 in seconds.

Can I create an eSignature for the KS SOS NP 50 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your KS SOS NP 50 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is KS SOS NP 50?

KS SOS NP 50 is a specific form used by nonprofit organizations in Kansas to register or submit information to the Secretary of State's office.

Who is required to file KS SOS NP 50?

Nonprofit organizations operating in Kansas that are seeking to maintain their status or comply with state regulations are required to file KS SOS NP 50.

How to fill out KS SOS NP 50?

To fill out KS SOS NP 50, an organization should provide the required information accurately, sign the form, and submit it according to the instructions provided by the Kansas Secretary of State.

What is the purpose of KS SOS NP 50?

The purpose of KS SOS NP 50 is to collect necessary information about nonprofit organizations and ensure compliance with state regulations.

What information must be reported on KS SOS NP 50?

The information that must be reported on KS SOS NP 50 typically includes the organization's name, address, purpose, and details about board members and officers.

Fill out your KS SOS NP 50 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS SOS NP 50 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.