KS SOS NP 50 2011 free printable template

Show details

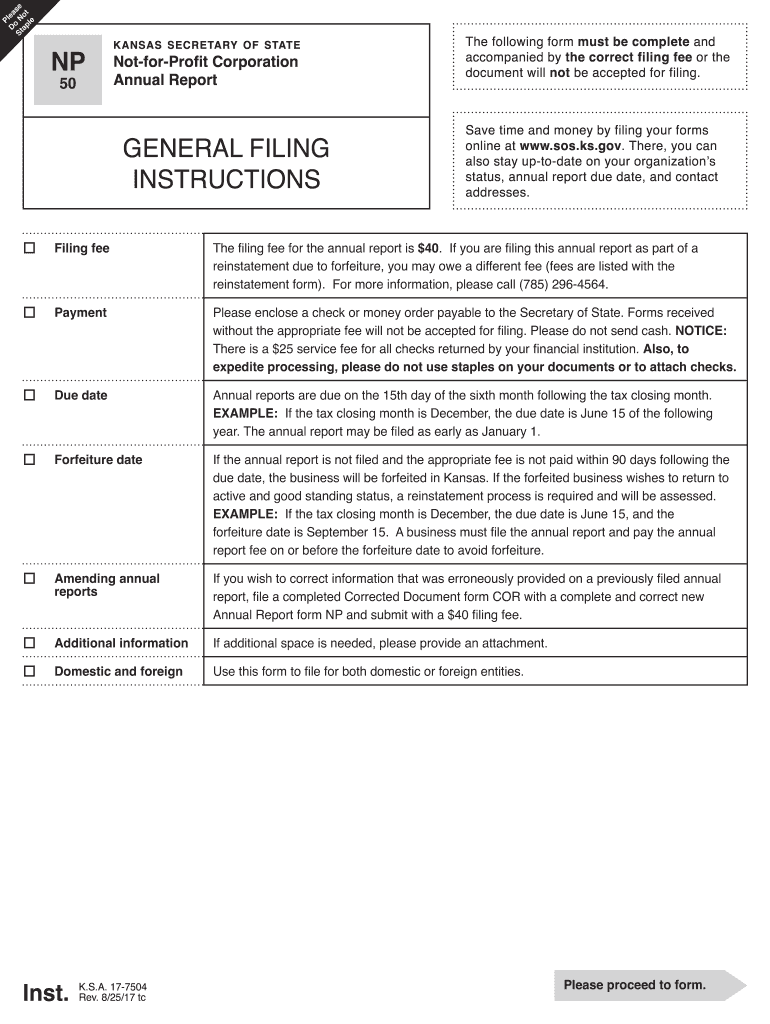

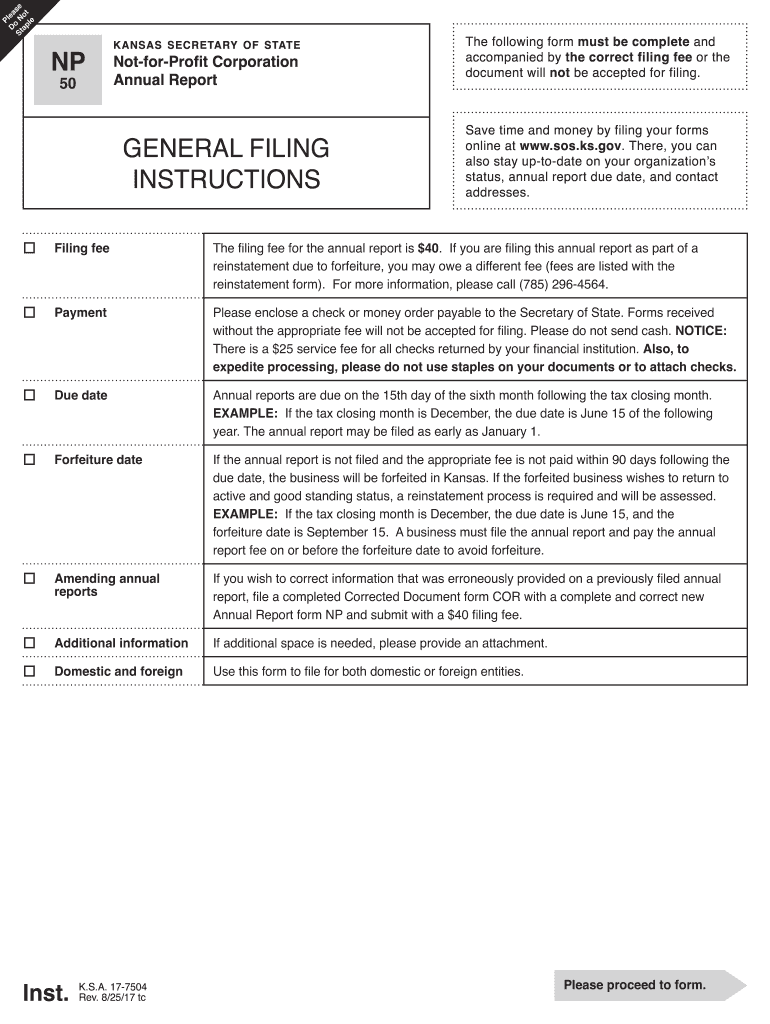

Complete the form and attach a complete and correct new Annual Report form NP and submit with a 40 filing fee. NP kansas secretary of state Not-for-Profit Corporation Annual Report Instructions Kansas Office of the Secretary of State Memorial Hall 1st Floor 120 S.W. 10th Avenue Topeka KS 66612-1594 785 296-4564 kssos sos. ks. gov www. sos. ks. gov The following form must be complete and accompanied by the correct filing fee or the document will not be accepted for filing. Save time and money...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS SOS NP 50

Edit your KS SOS NP 50 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS SOS NP 50 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS SOS NP 50 online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KS SOS NP 50. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS SOS NP 50 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS SOS NP 50

How to fill out KS SOS NP 50

01

Obtain the KS SOS NP 50 form, which is available online or at local government offices.

02

Read the instructions carefully to understand the requirements.

03

Fill in the entity name at the top of the form.

04

Provide the principal office address, including street, city, state, and zip code.

05

Include the name and mailing address of the registered agent.

06

Indicate the purpose of the business or entity.

07

Specify the duration of the business if it is not perpetual.

08

List the names and addresses of the initial directors or members.

09

Sign and date the form as required.

10

Submit the completed form along with the required filing fee to the appropriate office.

Who needs KS SOS NP 50?

01

Anyone looking to form a nonprofit organization in Kansas.

02

Existing nonprofit organizations wishing to update their registration.

03

Individuals involved in the management of a nonprofit entity.

Fill

form

: Try Risk Free

People Also Ask about

Who do you file your annual report with each year in the state of Kansas by April 15th?

Kansas Secretary of State Memorial Hall, First Floor 120 S. W. 10th Ave. Due Date: Annually by the 15th day of the 4th month after the close of your fiscal year.

What is kar in Kansas?

Kansas Administrative Regulations (K.A.R.) and the Kansas Register, but are not published in the K.A.R. books. The 2022 Kansas Administrative Regulations (K.A.R.) Volumes contain the most current version of permanent regulations filed through December 31, 2021.

How do I contact the Secretary of State in Kansas?

Office Phone Numbers Main Office: 785-296-4575. Administration: 785-296-4580. Business Services: 785-296-4564. Elections: 800-262-8683. Publications & Communications: 785-296-4052.

Is Kansas a state in the US?

Admitted as a free state, Kansas became the 34th state in 1861, less than three months before the Civil War began.

Who files an annual report?

Businesses typically file annual reports electronically, in many cases using a registered agent who can complete the required documents on the company's behalf.

Do all companies need an annual report?

In general, most states require corporations and other businesses with shareholders to file annual reports. If they fail to do so, they may lose their corporate designation and the tax advantages that go with that designation.

Who needs an annual report?

Annual report filing requirements One requirement imposed by the state corporation and LLC statutes is for corporations and LLCs to file an annual report in the formation state and every state where they are qualified or registered to do business.

Who has to file a KS annual report?

All for-profit entities with a tax period other than a calendar year must file an annual report no later than the 15th day of the fourth month following the end of the entity's tax period. Not-for-profit entities with a calendar year tax period may file an annual report any time after the end of the tax period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KS SOS NP 50 to be eSigned by others?

To distribute your KS SOS NP 50, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in KS SOS NP 50?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your KS SOS NP 50 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out the KS SOS NP 50 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign KS SOS NP 50. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is KS SOS NP 50?

KS SOS NP 50 is a form used in the state of Kansas for non-profit organizations to report specific information required by the Secretary of State.

Who is required to file KS SOS NP 50?

Non-profit organizations registered in Kansas are required to file KS SOS NP 50 as part of their compliance with state regulations.

How to fill out KS SOS NP 50?

To fill out KS SOS NP 50, organizations must provide their name, address, federal tax identification number, and specific details regarding their operations and finances as outlined in the form instructions.

What is the purpose of KS SOS NP 50?

The purpose of KS SOS NP 50 is to maintain transparency and accountability among non-profit organizations operating in Kansas by collecting essential data on their activities.

What information must be reported on KS SOS NP 50?

KS SOS NP 50 requires reporting of the organization's name, address, mission statement, details of the board members, and financial information such as revenue and expenditures.

Fill out your KS SOS NP 50 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS SOS NP 50 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.