KS SOS NP 50 2015 free printable template

Show details

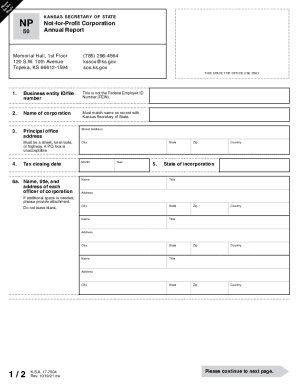

Complete and correct new Annual Report (form NP) and submit with a $40 filing fee. ... kiss SOS.ks.gov. Topeka, KS 66612-1594 www.sos.ks.gov. NP. 50.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS SOS NP 50

Edit your KS SOS NP 50 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS SOS NP 50 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS SOS NP 50 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KS SOS NP 50. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS SOS NP 50 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS SOS NP 50

How to fill out KS SOS NP 50

01

Obtain the KS SOS NP 50 form from the Kansas Secretary of State's website or local office.

02

Carefully read the instructions provided with the form.

03

Fill in your business name, ensuring it matches the name you want to register.

04

Provide your business address, including city, state, and zip code.

05

Include your contact information, including your phone number and email address.

06

Specify the type of business entity you are registering (e.g., LLC, Corporation).

07

List the names and addresses of the business's officers or members.

08

Sign and date the form to certify that the information is true and accurate.

09

Submit the completed form along with any necessary fees to the Kansas Secretary of State.

Who needs KS SOS NP 50?

01

Individuals or business owners looking to register a new business in the state of Kansas.

02

Entrepreneurs intending to establish a Limited Liability Company (LLC) or Corporation.

03

Anyone needing to formally document their business structure with the state.

Fill

form

: Try Risk Free

People Also Ask about

Who do you file your annual report with each year in the state of Kansas by April 15th?

Kansas Secretary of State Memorial Hall, First Floor 120 S. W. 10th Ave. Due Date: Annually by the 15th day of the 4th month after the close of your fiscal year.

What is kar in Kansas?

Kansas Administrative Regulations (K.A.R.) and the Kansas Register, but are not published in the K.A.R. books. The 2022 Kansas Administrative Regulations (K.A.R.) Volumes contain the most current version of permanent regulations filed through December 31, 2021.

How do I contact the Secretary of State in Kansas?

Office Phone Numbers Main Office: 785-296-4575. Administration: 785-296-4580. Business Services: 785-296-4564. Elections: 800-262-8683. Publications & Communications: 785-296-4052.

Is Kansas a state in the US?

Admitted as a free state, Kansas became the 34th state in 1861, less than three months before the Civil War began.

Who files an annual report?

Businesses typically file annual reports electronically, in many cases using a registered agent who can complete the required documents on the company's behalf.

Do all companies need an annual report?

In general, most states require corporations and other businesses with shareholders to file annual reports. If they fail to do so, they may lose their corporate designation and the tax advantages that go with that designation.

Who needs an annual report?

Annual report filing requirements One requirement imposed by the state corporation and LLC statutes is for corporations and LLCs to file an annual report in the formation state and every state where they are qualified or registered to do business.

Who has to file a KS annual report?

All for-profit entities with a tax period other than a calendar year must file an annual report no later than the 15th day of the fourth month following the end of the entity's tax period. Not-for-profit entities with a calendar year tax period may file an annual report any time after the end of the tax period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my KS SOS NP 50 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your KS SOS NP 50 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find KS SOS NP 50?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific KS SOS NP 50 and other forms. Find the template you need and change it using powerful tools.

How do I make edits in KS SOS NP 50 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing KS SOS NP 50 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is KS SOS NP 50?

KS SOS NP 50 is a form that is used in Kansas for nonprofit organizations to report their activities and maintain compliance with state regulations.

Who is required to file KS SOS NP 50?

Nonprofit organizations that are registered in Kansas and are required to report their financial activities to the Secretary of State must file KS SOS NP 50.

How to fill out KS SOS NP 50?

To fill out KS SOS NP 50, organizations need to provide details about their operations, financials, and any changes that occurred during the year. It typically requires information such as the organization’s name, address, and financial statements.

What is the purpose of KS SOS NP 50?

The purpose of KS SOS NP 50 is to ensure transparency and accountability of nonprofit organizations by collecting information about their activities and financial status.

What information must be reported on KS SOS NP 50?

KS SOS NP 50 requires organizations to report information such as their mission statement, a summary of activities, income and expenditures, and any changes in leadership or structure.

Fill out your KS SOS NP 50 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS SOS NP 50 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.