Get the free NBTA Credit Unions Story

Show details

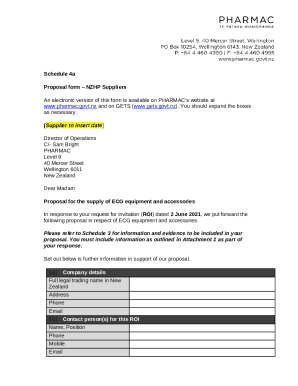

NITA Credit Unions Story NITA Credit Union was started in 1971 as an alternative to the banks for New Brunswick Teachers. From these humble roots, NITA Credit Union has grown into a full service financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nbta credit unions story

Edit your nbta credit unions story form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nbta credit unions story form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nbta credit unions story online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nbta credit unions story. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nbta credit unions story

How to fill out nbta credit unions story

01

To fill out NBTA Credit Union's story, follow these steps:

02

Start by gathering all the necessary information, such as the history of the credit union, its mission and values, and any notable achievements or milestones.

03

Begin the story with an engaging introduction that captures the reader's attention and provides an overview of what the credit union is all about.

04

Organize the story into sections or paragraphs, focusing on different aspects of the credit union's journey or impact.

05

Use specific examples and anecdotes to illustrate key points and highlight the unique features or benefits of NBTA Credit Union.

06

Include quotes or testimonials from members, employees, or community partners to add credibility and personal touch to the story.

07

Ensure the story is well-written, clear, and concise, using proper grammar and sentence structure.

08

Proofread the story for any errors or typos before finalizing it.

09

Add visuals such as relevant images, charts, or graphs to make the story more visually appealing.

10

Once the story is complete, share it through various channels such as the credit union's website, social media platforms, newsletters, or press releases.

11

Monitor and evaluate the response to the story, making adjustments or updates as necessary to enhance its impact.

Who needs nbta credit unions story?

01

Anyone interested in learning about NBTA Credit Union may find the story useful.

02

Potential members who want to understand the credit union's background, values, and services.

03

Current members who want to stay informed about the credit union's progress, achievements, and impact.

04

Employees or job seekers who want to get a better understanding of the credit union's culture, mission, and work environment.

05

Community partners or organizations that collaborate with NBTA Credit Union and want to showcase their partnership.

06

Journalists or media outlets seeking information about the credit union for articles or news coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nbta credit unions story to be eSigned by others?

Once your nbta credit unions story is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the nbta credit unions story electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your nbta credit unions story in seconds.

How do I fill out nbta credit unions story using my mobile device?

Use the pdfFiller mobile app to fill out and sign nbta credit unions story. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is nbta credit unions story?

NBTA Credit Union's story is a narrative about the history, mission, values, and achievements of the credit union.

Who is required to file nbta credit unions story?

The management and board of directors of NBTA Credit Union are typically responsible for filing the credit union's story.

How to fill out nbta credit unions story?

The story of NBTA Credit Union can be filled out by providing information about the credit union's formation, growth, services, and community involvement.

What is the purpose of nbta credit unions story?

The purpose of NBTA Credit Union's story is to provide stakeholders and members with a comprehensive overview of the credit union's history and values.

What information must be reported on nbta credit unions story?

Information on the founding members, key milestones, financial performance, community initiatives, and future goals of NBTA Credit Union must be reported on the credit union's story.

Fill out your nbta credit unions story online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nbta Credit Unions Story is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.