IRS 1120-FSC 2018-2025 free printable template

Show details

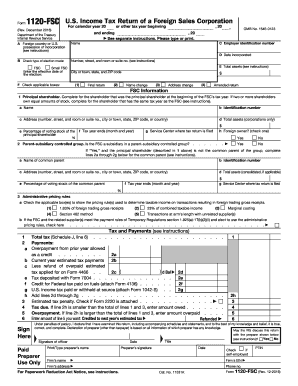

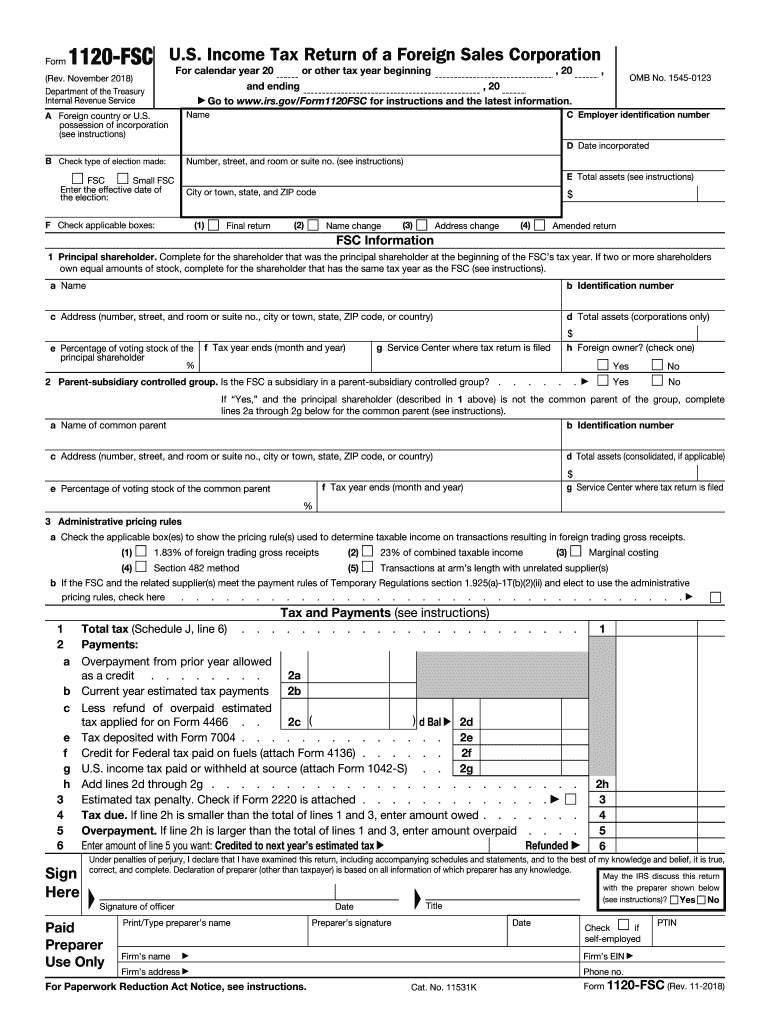

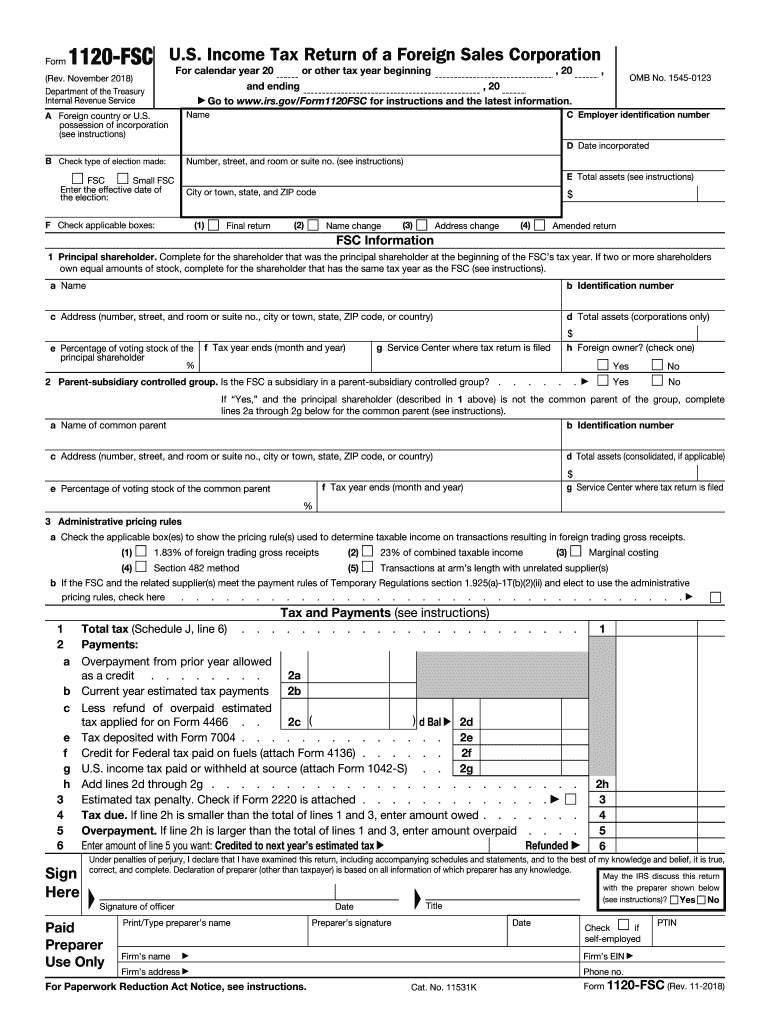

Form1120FSCU. S. Income Tax Return of a Foreign Sales Corporation For calendar year 20(Rev. November 2018) Department of the Treasury Internal Revenue Service, 20or other tax year beginning, OMB No.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 1120 fsc form

Edit your irs 1120 fsc 2018-2025 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs 1120 fsc 2018-2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs 1120 fsc 2018-2025 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irs 1120 fsc 2018-2025. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1120-FSC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs 1120 fsc 2018-2025

How to fill out IRS 1120-FSC

01

Obtain IRS Form 1120-FSC from the IRS website.

02

Fill out the basic identification information, including the corporation's name, address, and Employer Identification Number (EIN).

03

Indicate the type of foreign sales corporation (FSC) and provide details about its activities.

04

Report on the income generated by the FSC, including any gross receipts and deductions.

05

Complete the Balance Sheet section to report the FSC's assets, liabilities, and shareholders' equity.

06

Calculate the tax liability using the applicable tax rates, if necessary.

07

Review the form for accuracy and completeness.

08

Sign and date the form, and submit it to the IRS by the due date.

Who needs IRS 1120-FSC?

01

Businesses that qualify as Foreign Sales Corporations (FSC) and have income from foreign sales need to file IRS Form 1120-FSC.

Fill

form

: Try Risk Free

People Also Ask about

What's an FSC form?

Corporations electing to be treated as a Foreign Sales Corporation (FSC) or small FSC file this form to report their. income, deductions, gains, losses, credits and. income tax liability.

What does FSC stand for in tax?

"A History of the Extraterritorial Income (ETI) and Foreign Sales Corporation (FSC) Export Tax-Benefit Controversy," Summary Page.

What is a VA FSC vendor file request form?

The mission of the Nationwide Vendor File Division of the Department of Veterans Affairs – Financial Services Center (VA-FSC) is to add, modify, or delete vendor records in the Financial Management Services (FMS) vendor file. The VA-FSC FMS vendor file controls aspects of when, where, and how vendors are paid.

Where to fax VA Form 10091?

Please fax the completed form to 512-460-5221 for processing.

What is va10091 form?

This information will be used by the Treasury Department to transmit payment data, by electronic means to vendor's financial institution. Failure to provide the requested information may delay or prevent the receipt of payments through the Automated Clearing House Payment System. VA FORM. MAR 2022. 10091.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit irs 1120 fsc 2018-2025 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your irs 1120 fsc 2018-2025 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my irs 1120 fsc 2018-2025 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your irs 1120 fsc 2018-2025 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out irs 1120 fsc 2018-2025 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign irs 1120 fsc 2018-2025 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IRS 1120-FSC?

IRS 1120-FSC is a tax form used by foreign sales corporations to report their income and calculate the U.S. tax liability.

Who is required to file IRS 1120-FSC?

Foreign sales corporations that have income effectively connected with a U.S. trade or business are required to file IRS 1120-FSC.

How to fill out IRS 1120-FSC?

To fill out IRS 1120-FSC, you must provide information on your income, deductions, and other relevant financial details as specified in the form instructions.

What is the purpose of IRS 1120-FSC?

The purpose of IRS 1120-FSC is to allow foreign corporations to report their income and claim benefits associated with operating as a foreign sales corporation under U.S. tax law.

What information must be reported on IRS 1120-FSC?

Information that must be reported includes gross receipts, cost of goods sold, deductions for business expenses, and credits, among other details pertinent to the corporation's financial situation.

Fill out your irs 1120 fsc 2018-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs 1120 Fsc 2018-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.