IRS 1120-FSC 2016 free printable template

Show details

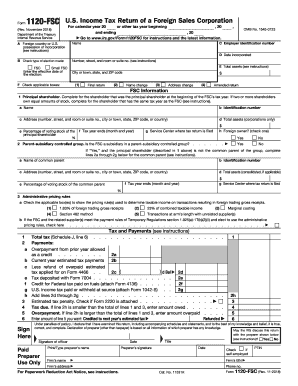

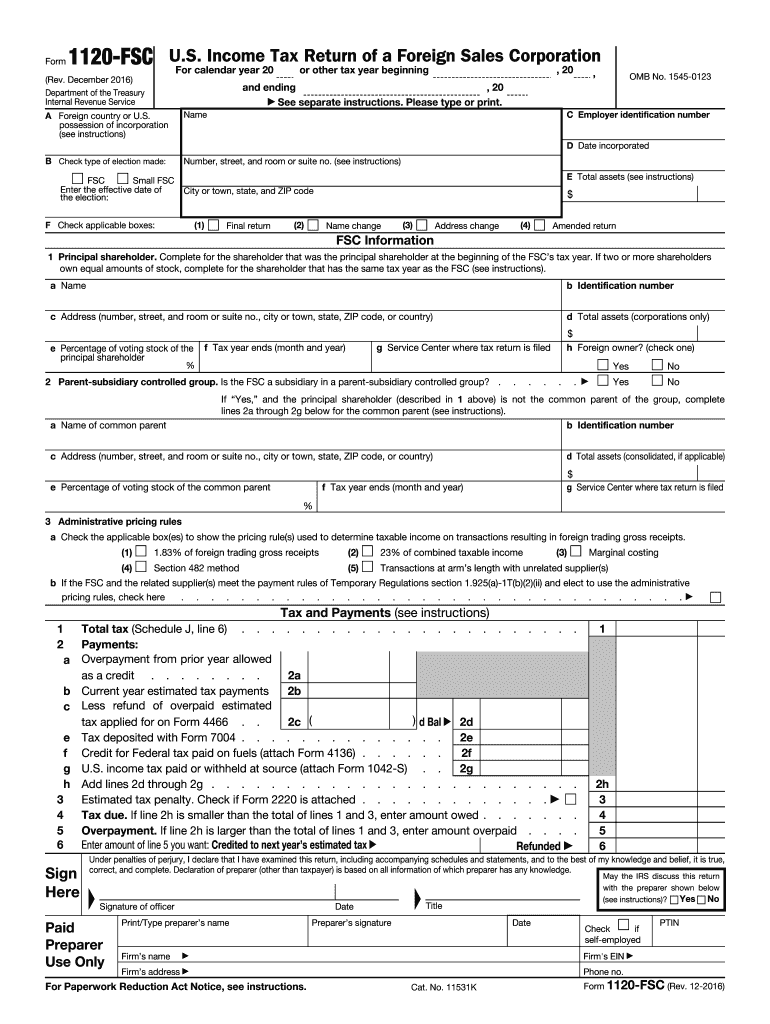

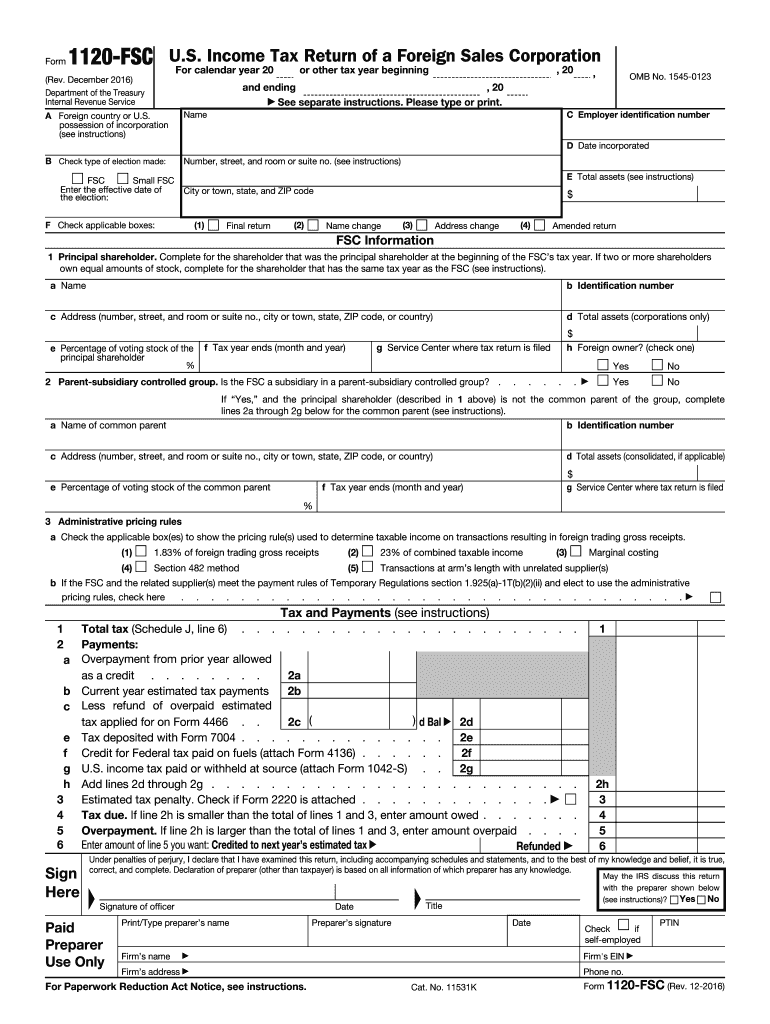

Form 1120-FSC U.S. Income Tax Return of a Foreign Sales Corporation For calendar year 20 (Rev. December 2016) Department of the Treasury Internal Revenue Service, 20 or other tax year beginning, OMB

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1120-FSC

Edit your IRS 1120-FSC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1120-FSC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1120-FSC online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 1120-FSC. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1120-FSC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1120-FSC

How to fill out IRS 1120-FSC

01

Gather necessary financial documents and information.

02

Complete the top portion with the corporation's name, address, and Employer Identification Number (EIN).

03

Fill out the income section, including gross income and cost of goods sold.

04

Report deductions such as operating expenses, salaries, and other allowable expenses.

05

Calculate the taxable income by subtracting total deductions from total income.

06

Complete the tax computation section to determine the tax owed.

07

Review the return for accuracy and completeness.

08

Sign the return and include the date.

09

File the form with the appropriate IRS office by the due date.

Who needs IRS 1120-FSC?

01

Corporations engaged in foreign sales that meet qualifying criteria.

02

Foreign corporations looking to claim benefits under U.S. tax laws.

03

Businesses that derive income from activities considered as foreign sales or services.

Fill

form

: Try Risk Free

People Also Ask about

What's an FSC form?

Corporations electing to be treated as a Foreign Sales Corporation (FSC) or small FSC file this form to report their. income, deductions, gains, losses, credits and. income tax liability.

What does FSC stand for in tax?

"A History of the Extraterritorial Income (ETI) and Foreign Sales Corporation (FSC) Export Tax-Benefit Controversy," Summary Page.

What is a VA FSC vendor file request form?

The mission of the Nationwide Vendor File Division of the Department of Veterans Affairs – Financial Services Center (VA-FSC) is to add, modify, or delete vendor records in the Financial Management Services (FMS) vendor file. The VA-FSC FMS vendor file controls aspects of when, where, and how vendors are paid.

Where to fax VA Form 10091?

Please fax the completed form to 512-460-5221 for processing.

What is va10091 form?

This information will be used by the Treasury Department to transmit payment data, by electronic means to vendor's financial institution. Failure to provide the requested information may delay or prevent the receipt of payments through the Automated Clearing House Payment System. VA FORM. MAR 2022. 10091.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 1120-FSC in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IRS 1120-FSC and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make edits in IRS 1120-FSC without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your IRS 1120-FSC, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit IRS 1120-FSC straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing IRS 1120-FSC.

What is IRS 1120-FSC?

IRS Form 1120-FSC is a tax return used by foreign sales corporations to report their income, gains, losses, deductions, etc. It is specifically for the purpose of claiming tax benefits available under the Internal Revenue Code for transactions relating to the sale of products.

Who is required to file IRS 1120-FSC?

Foreign sales corporations (FSCs) must file IRS Form 1120-FSC if they have derived income from foreign sales and want to claim the benefits under the FSC regulations.

How to fill out IRS 1120-FSC?

To fill out IRS Form 1120-FSC, businesses must provide detailed information including the corporation's name, address, identification number, and complete sections involving income, deductions, and credits. Each part of the form must be completed according to the specific instructions provided by the IRS.

What is the purpose of IRS 1120-FSC?

The purpose of IRS Form 1120-FSC is to allow foreign sales corporations to report their income and claim tax benefits under the IRC, which may include deferral of U.S. tax on foreign sales income.

What information must be reported on IRS 1120-FSC?

IRS Form 1120-FSC requires reporting of the corporation's total income, cost of goods sold, deductions, tax credits, and net income or loss, along with other relevant financial information. Additionally, it includes information on the types of foreign sales activities conducted.

Fill out your IRS 1120-FSC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1120-FSC is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.