Get the free Report of Self-Employment Earnings 2-01 rewdoc - patchhawaii

Show details

MAXIMUS State of Hawaii Department of Human Services Benefit, Employment and Support Services Division Preschool Open Doors 677 Queen Street, Suite 400A Honolulu, HI 96813 Tel: 5875254 Toll Free:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report of self-employment earnings

Edit your report of self-employment earnings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report of self-employment earnings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing report of self-employment earnings online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit report of self-employment earnings. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out report of self-employment earnings

How to fill out a report of self-employment earnings?

01

Gather all necessary information: Before starting the report, gather all your income and expense records related to your self-employment activities. This may include invoices, receipts, bank statements, and any other relevant documents.

02

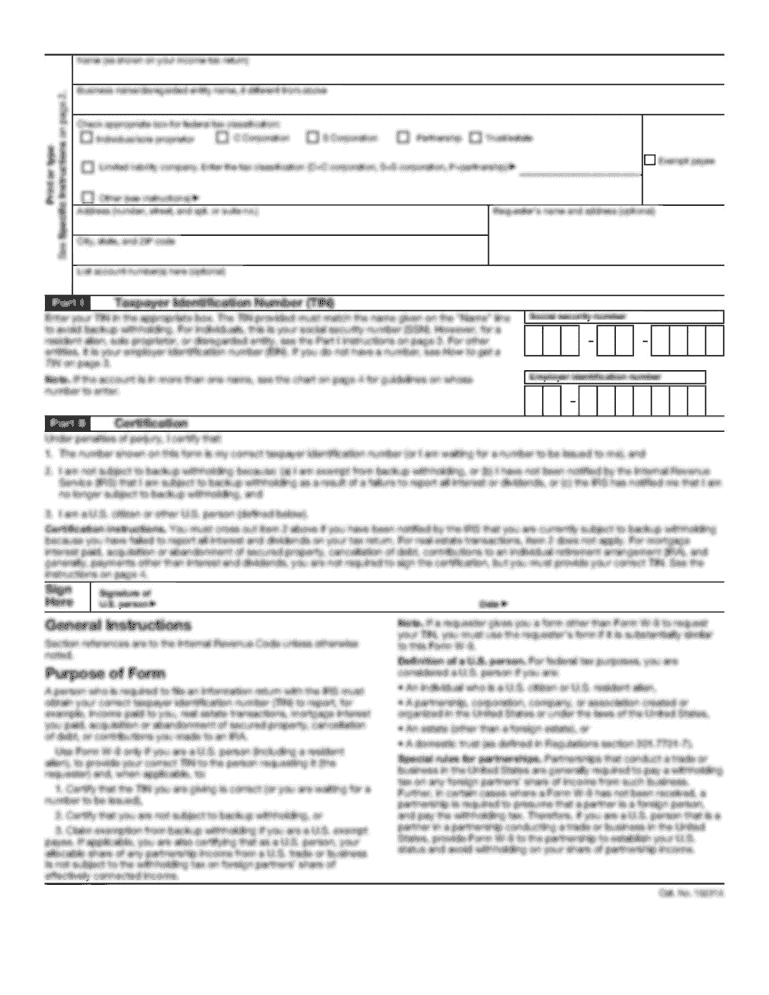

Identify the required form: Depending on your country and tax jurisdiction, there may be specific forms for reporting self-employment earnings. Determine the appropriate form that needs to be filled out. It is important to ensure that you are using the correct form to accurately report your earnings.

03

Provide personal information: Begin by filling out your personal information, such as your name, address, social security number, or any other identification details requested on the form. Make sure to review the instructions provided to ensure accuracy.

04

Describe your business activities: Provide a detailed description of your self-employment activities. This may include the type of business, services or products offered, and the duration that you have been self-employed.

05

Report your income: On the form, report the total amount of income you earned from your self-employment activities during the reporting period. This includes any cash, checks, or other forms of payment received.

06

Deduct eligible expenses: Deduct any allowable business expenses from your self-employment income. Be sure to review tax regulations or consult a tax professional to ensure that you are claiming eligible expenses accurately.

07

Calculate net profit or loss: Subtract your total expenses from your total income to calculate your net profit or loss from self-employment. This figure represents the amount that is subject to taxation.

08

Include additional information: Some forms may require the inclusion of additional information or schedules. Examples may include specific industry-related details or the need to break down your expenses by category.

Who needs a report of self-employment earnings?

01

Self-employed individuals: If you work for yourself and earn income through your own business activities, whether as a freelancer, contractor, or small business owner, you are typically required to report your self-employment earnings.

02

Tax authorities: Government tax authorities need reports of self-employment earnings to ensure individuals are accurately reporting their income and paying the appropriate amount of taxes.

03

Banks and financial institutions: When applying for loans or mortgages, banks and financial institutions may require reports of self-employment earnings to assess an individual's income stability and repayment capacity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send report of self-employment earnings for eSignature?

Once your report of self-employment earnings is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get report of self-employment earnings?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific report of self-employment earnings and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in report of self-employment earnings without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit report of self-employment earnings and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Fill out your report of self-employment earnings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report Of Self-Employment Earnings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.