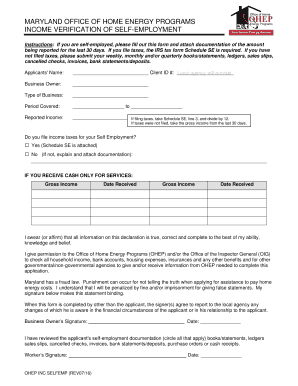

Income Verification Letter For Self Employed

What is income verification letter for self employed?

An income verification letter for the self-employed is a document that confirms the income of an individual who is working for themselves and does not have a traditional employer. This letter is often requested by lenders, landlords, or other organizations to verify the financial status of the self-employed individual.

What are the types of income verification letter for self employed?

There are several types of income verification letters that self-employed individuals may need to provide. Some common types include:

Profit and Loss Statement: This document shows the revenue, expenses, and net income of the self-employed individual's business.

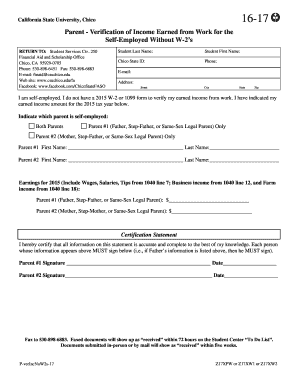

Tax Returns: Providing copies of the most recent tax returns can also serve as income verification for self-employed individuals.

Bank Statements: Bank statements can be used to show regular income deposits and business transactions.

Client Invoices: Providing copies of invoices from clients can demonstrate the income generated from self-employment.

How to complete income verification letter for self employed

To complete an income verification letter for self-employed, follow these steps:

01

Gather necessary financial documents, such as profit and loss statements, tax returns, bank statements, and client invoices.

02

Organize the documents in a clear and organized manner to present a complete picture of your income as a self-employed individual.

03

Write a formal letter addressed to the requesting party, stating your name, contact information, and the purpose of the letter.

04

Include a brief introduction explaining your self-employment status and why the income verification is being requested.

05

Attach the relevant financial documents as evidence of your income.

06

Close the letter with a polite and professional tone, offering to provide any additional information if needed.

07

Sign the letter and make copies of both the letter and supporting documents for your own records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out income verification letter for self employed

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a self-employed statement?

A self-employment declaration letter is a document that discloses information about a person's work status as being self-employed. This letter can be used for various purposes such as obtaining a visa, child custody, applying for a job, applying for a loan, etc.

How do I write an income verification letter?

In every income verification letter, you need to include the following personal details: Name. Phone number and email address. Employer's name. Employer's phone number and email address. Job title. Income (salary or hourly wage) Number of hours worked on a weekly basis.

What is the best proof of self-employment?

Ways to show proof of income if you are self-employed include tax returns, Form 1099, bank statements (both personal and of the business account), audited profit and loss statements, and official invoices.

Can I write my own self-employment letter?

A letter for self-employed income is frequently requested by lenders to corroborate a potential borrower's self-employment income and total years in business. The borrower can write the letter, but lenders require an official document, prepared and signed by a CPA or tax preparer.

What is a self-employed letter?

A Self Employment Declaration Letter is a document that intents to disclose information about his or her work being self-employed.

What is self-employed income statement?

The IRS self-employed year-to-date profit and loss statement requirements are reported in Form 1040--Schedule C Profit or Loss from Business. On this statement, you need to report your gross income from self-employment and your gross expenses.

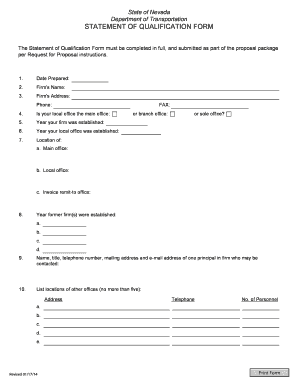

Related templates