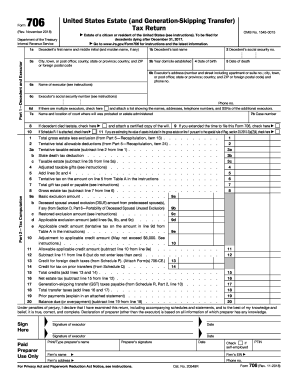

Who Can Use Form 706?

An individual must complete Form 706 if he is the executor of the estate of a U.S. resident or citizen who died in 2016. It is possible to file the statement if the gross estate (including exemption and taxable gifts) is above $5,450,000.

What Is the Purpose of Form 706?

All executors make use of Form 706 to calculate the estate tax that is imposed by Chapter 11 (the Internal Revenue Code). The tax refers to the whole estate. It is also used to count the GST (generation-skipping transfer) which is imposed by Chapter 13.

When is Form 706 Due?

Form 706 is filled out within a 9 months period after the death date of the departed. When there is no possibility to submit this statement by the deadline, an applicant can request an extension of time (for this, Form 4768 is used). You can get an extension up to 6 additional months.

What Forms Are to be Filed along with a 706?

There are the forms which are necessary to file along with United States Estate (and Generation-Skipping Transfer) Tax Return. They are 2055, 2056, 2056A, 2032, and 2032A. So, you may check out the instructions for these all statements as well.

What Information Must be Included in Form 706?

Part 1 is devoted to the details about the decedent and executor. It implies writing the names, SON, addresses, etc. Part 2 is tax computation. Elections by the executor is the title of Part 3. Part 4 is about the general information (it is the biggest part of Form 706). Recapitulation is the topic of Part 5. Part 6 is devoted to the portability of Deceased Spousal Unused Exclusion (DUE).

Who Is the Addressee of Form 706?

Submit your Form 706 to the following address:

Department of the Treasury

Internal Revenue Service Center

Cincinnati, OH 45999