IL 700 2021 free printable template

Show details

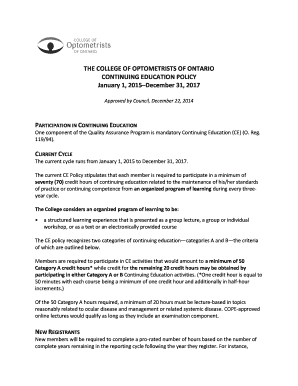

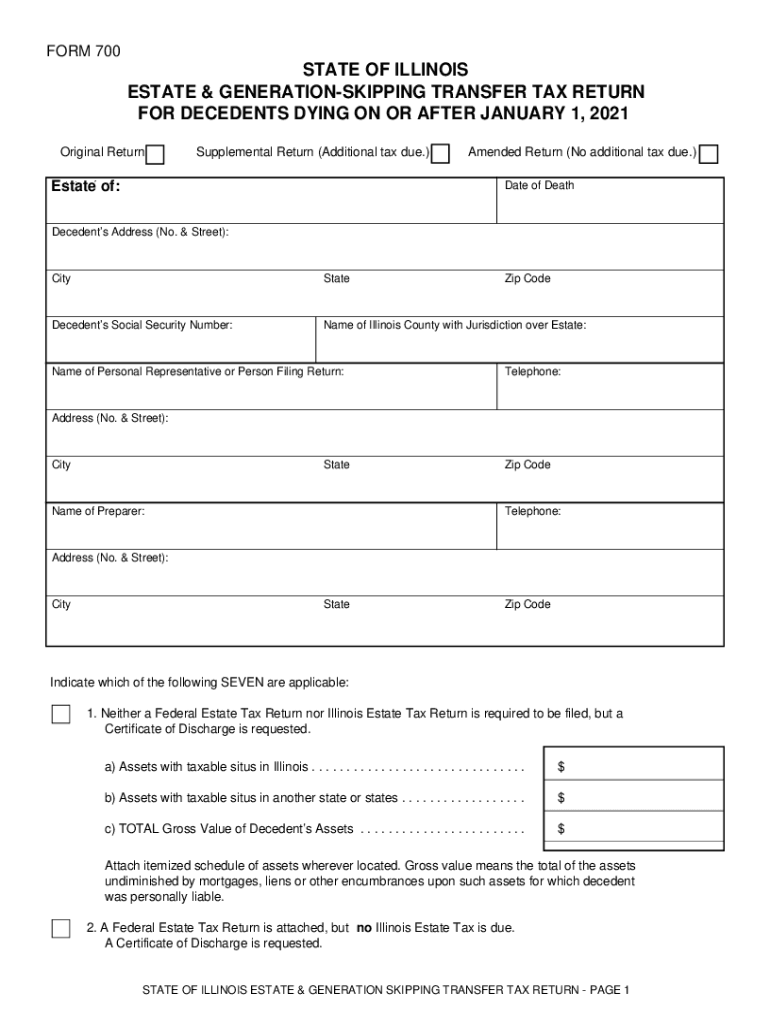

6. Full amount computed for Illinois Estate Tax from website calculator before apportionment Lines 3 5 from this Form 700 and applied to website calculator for interrelated calculation.. In such situations the estate representative is to prepare and file the Illinois Estate Tax Return Form 700 together with a Federal Form 706 Federal Estate Tax Return or any other form containing the same information even though the Federal return is not required to be filed with the Internal Revenue Service....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax forms 2021 printable

Edit your tax forms 2021 printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax forms 2021 printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax forms 2021 printable online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax forms 2021 printable. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL 700 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax forms 2021 printable

How to fill out IL 700

01

Obtain the IL 700 form from the appropriate source.

02

Fill in your personal information such as name, address, and contact details in the designated areas.

03

Provide relevant information regarding the specific purpose of the IL 700 form.

04

Review the instructions on the form to ensure all required fields are completed accurately.

05

Sign and date the form at the indicated places.

06

Submit the completed form to the appropriate agency or department as instructed.

Who needs IL 700?

01

Individuals or organizations seeking to apply for a specific program or service associated with IL 700.

02

Those who need to report or document certain information required by state regulations.

Instructions and Help about tax forms 2021 printable

Fill

form

: Try Risk Free

People Also Ask about

Does Illinois have an inheritance or estate tax?

As of 2021, there is no federal or Illinois tax on inheritances. Some states do impose inheritance taxes, but not Illinois. Illinoisans who inherit money or property, or receive it as a gift, are not taxed.

Who must file Illinois estate tax return?

Do You Need to File an Illinois Estate Tax Return? If the gross estate of an Illinois resident has a value of more than $4 million, the personal representative or executor of the estate must file a state estate tax return. (Smaller estates won't need to file a return.)

How do I claim inheritance money in Illinois?

The total value of the deceased person's estate must be less than $100,000 and cannot contain any real estate in order to avoid a formal probate court proceedings. In those cases, the people who inherit can use an affidavit along with a copy of the death certificate to claim their inheritance.

Does Illinois require an inheritance tax waiver?

Inheritance Tax Releases: An Illinois Inheritance Tax Release may be necessary if a decedent died before January 1, 1983. If a release is required, please call Chicago (312) 814-2491 or Springfield (217) 524-5095 for further assistance.

Who pays Illinois estate tax?

This means that if you die and your total estate is worth less than $4 million, the estate won't owe anything to the state of Illinois. If your estate is worth more than $4 million, though, there is a progressive estate tax rate for all wealth your estate will have to pay before money can be dispersed to your heirs.

Do I need to file an Illinois estate tax return?

Do You Need to File an Illinois Estate Tax Return? If the gross estate of an Illinois resident has a value of more than $4 million, the personal representative or executor of the estate must file a state estate tax return. (Smaller estates won't need to file a return.)

What is Illinois estate tax exemption?

Illinois Estate Tax Exemption The estate tax threshold for Illinois is $4 million. This means that if you die and your total estate is worth less than $4 million, the estate won't owe anything to the state of Illinois.

What is the Illinois estate tax exemption for 2022?

Illinois' estate tax exemption will remain at $4,000,000 in 2022 with no adjustments for inflation. Like many states, their highest maximum estate tax is 16% and they do not offer portability for spouses.

When an estate tax return is required?

For the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in that year: the deceased estate's net income is more than the tax-free threshold for individuals. a beneficiary is presently entitled to any of the estate's income at the end of the income year.

Who must file IL 1041?

Trusts and Estates must complete Form IL-1041. Form IL-1041 (R12/21) is for tax year ending on or after December 31, 2021, and ending before December 31, 2022.

What assets are included for Illinois estate tax?

What is included in an Illinois estate? Bank accounts. Investment property such as stocks, bonds, CDs. Retirement accounts. Real estate. Interests in family businesses. Interests in other businesses. Life insurance proceeds from policies you owned. Personal property (cars, antiques, jewelry, art, etc.)

What assets are subject to Illinois estate tax?

The deceased individual's property and assets are considered part of the estate for tax purposes, some but not all assets include: Bank accounts. Life insurance policies. Investments such as stocks, bonds, CDs. Retirement accounts. Real estate. Interests in family-owned businesses. Interests in other businesses.

What assets are taxed at death?

Taxes on property owed at time of death This normally applies to property such as land or investments, and not to personal use property. Generally, property that is not being inherited by a spouse will be considered for tax purposes to have been sold immediately before the deceased's death at fair market value.

Where do I file my Illinois form 700?

Please send a copy of the State Treasurer's receipt to: Office of the Attorney General, Revenue Litigation Bureau, 100 West Randolph Street, 13th Floor, Chicago, Illinois 60601, or the Office of the Attorney General, Revenue Litigation Bureau, 500 South Second Street, Springfield, Illinois 62701, as appropriate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax forms 2021 printable in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your tax forms 2021 printable, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the tax forms 2021 printable in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your tax forms 2021 printable in minutes.

Can I edit tax forms 2021 printable on an Android device?

With the pdfFiller Android app, you can edit, sign, and share tax forms 2021 printable on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is IL 700?

IL 700 is a form used in Illinois for reporting certain types of financial information, often related to income tax.

Who is required to file IL 700?

Individuals and businesses that meet specific income thresholds or other criteria set by the Illinois Department of Revenue are required to file IL 700.

How to fill out IL 700?

To fill out IL 700, obtain the form from the Illinois Department of Revenue website, provide accurate income and financial information, and follow the instructions for completion.

What is the purpose of IL 700?

The purpose of IL 700 is to collect data for tax assessment and ensure compliance with Illinois tax laws.

What information must be reported on IL 700?

IL 700 requires reporting of personal identification information, income details, and any tax credits or deductions applicable to the filer.

Fill out your tax forms 2021 printable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Forms 2021 Printable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.