IL 700 2011 free printable template

Show details

6. Full amount computed for Illinois Estate Tax from website calculator before apportionment Lines 3 5 from this Form 700 and applied to website calculator for interrelated calculation.. Line 6 Schedule A or B Form 700. The percentage of Illinois assets to total assets is then computed with the percentage applied to the tax base for apportionment purposes to determine the amount of Illinois estate tax due. Illinoisattorneygeneral.gov. The computations are based upon using the amounts of the...

pdfFiller is not affiliated with any government organization

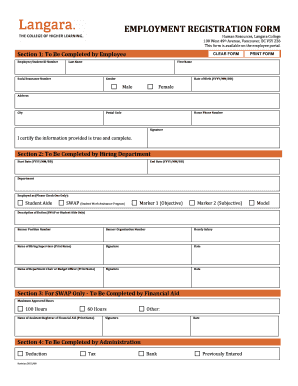

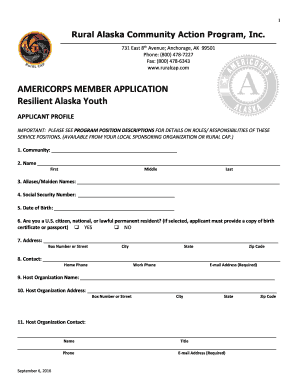

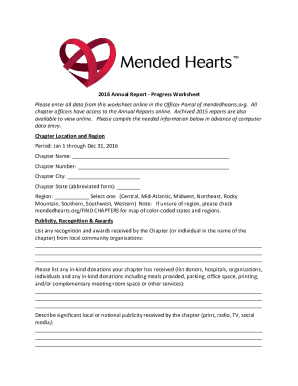

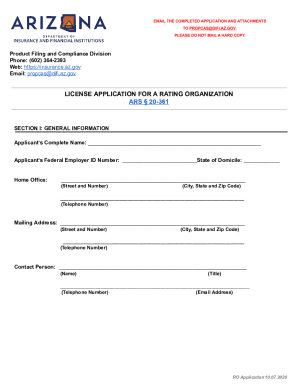

Get, Create, Make and Sign illinois form 700 2011

Edit your illinois form 700 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois form 700 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit illinois form 700 2011 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit illinois form 700 2011. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL 700 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out illinois form 700 2011

How to fill out IL 700

01

Obtain the IL 700 form from the appropriate agency or website.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information in the designated fields.

04

Provide any required documentation or attachments as specified.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form to the relevant office or department.

Who needs IL 700?

01

Individuals seeking to apply for benefits or services associated with the IL 700 form.

02

Organizations or entities that are required to report information regarding eligibility for state programs.

Instructions and Help about illinois form 700 2011

Fill

form

: Try Risk Free

People Also Ask about

Who is subject to Illinois estate tax?

What Is Included in an Illinois Estate? Remember, the estate tax only applies to estates worth over $4 million. This also applies to non-residents who own physical or real property in Illinois valued over $4 million. An estate would be taxed at 28.5%, while estates valued over $11.18 million are taxed at 40%.

How do I avoid inheritance tax in Illinois?

Illinois Estate Tax Exemption The estate tax threshold for Illinois is $4 million. This means that if you die and your total estate is worth less than $4 million, the estate won't owe anything to the state of Illinois.

Does the estate of a deceased person need to file a tax return?

Income tax on income generated by assets of the estate of the deceased. If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

Is there an inheritance tax in Illinois 2023?

Remember, the estate tax only applies to estates worth over $4 million. This also applies to non-residents who own physical or real property in Illinois valued over $4 million. An estate would be taxed at 28.5%, while estates valued over $11.18 million are taxed at 40%.

Who must file an Illinois estate tax return?

Do You Need to File an Illinois Estate Tax Return? If the gross estate of an Illinois resident has a value of more than $4 million, the personal representative or executor of the estate must file a state estate tax return. (Smaller estates won't need to file a return.)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my illinois form 700 2011 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your illinois form 700 2011 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get illinois form 700 2011?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the illinois form 700 2011 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete illinois form 700 2011 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your illinois form 700 2011. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is IL 700?

IL 700 is a form used for reporting tax-related information to the state of Illinois.

Who is required to file IL 700?

Individuals or businesses that meet specific income and tax criteria in Illinois are required to file IL 700.

How to fill out IL 700?

To fill out IL 700, taxpayers should provide personal information, income details, deductions, and other required documentation as outlined in the form's instructions.

What is the purpose of IL 700?

The purpose of IL 700 is to collect data to ensure compliance with state tax laws and assess the correct amount of tax owed.

What information must be reported on IL 700?

IL 700 requires reporting of personal identification information, income sources, deductions claimed, and any tax credits.

Fill out your illinois form 700 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Form 700 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.