IL 700 2022 free printable template

Show details

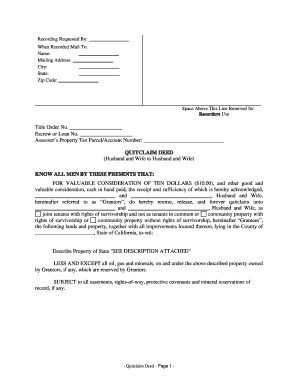

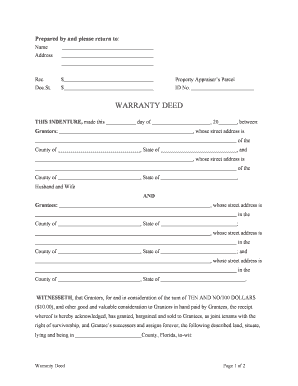

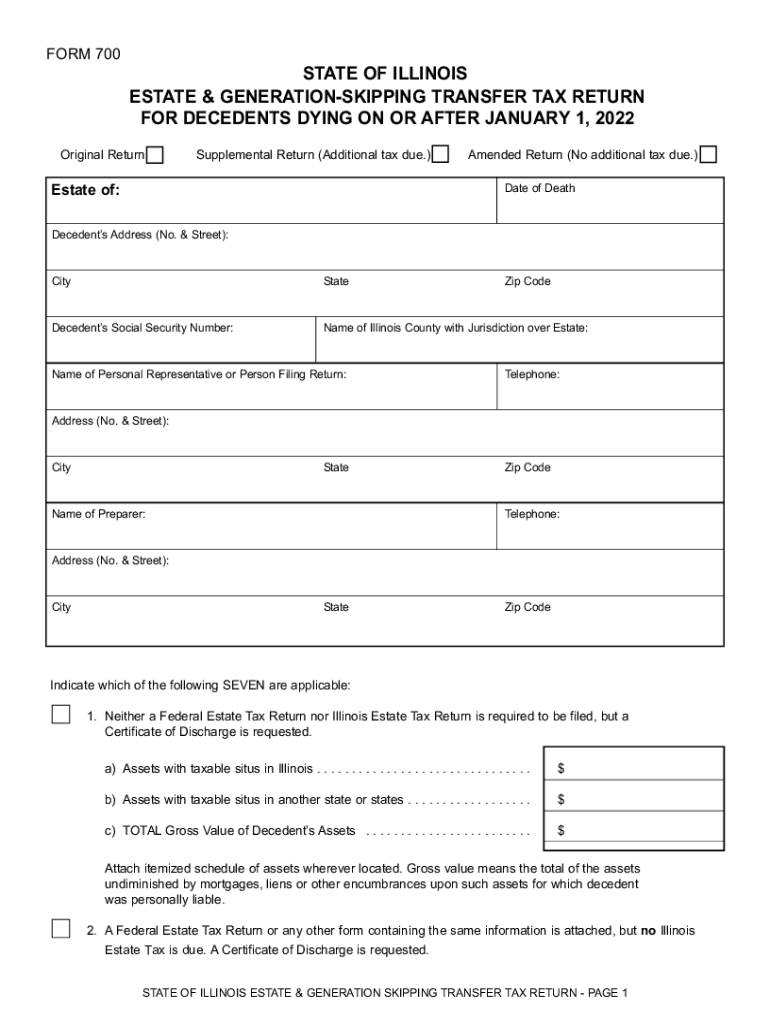

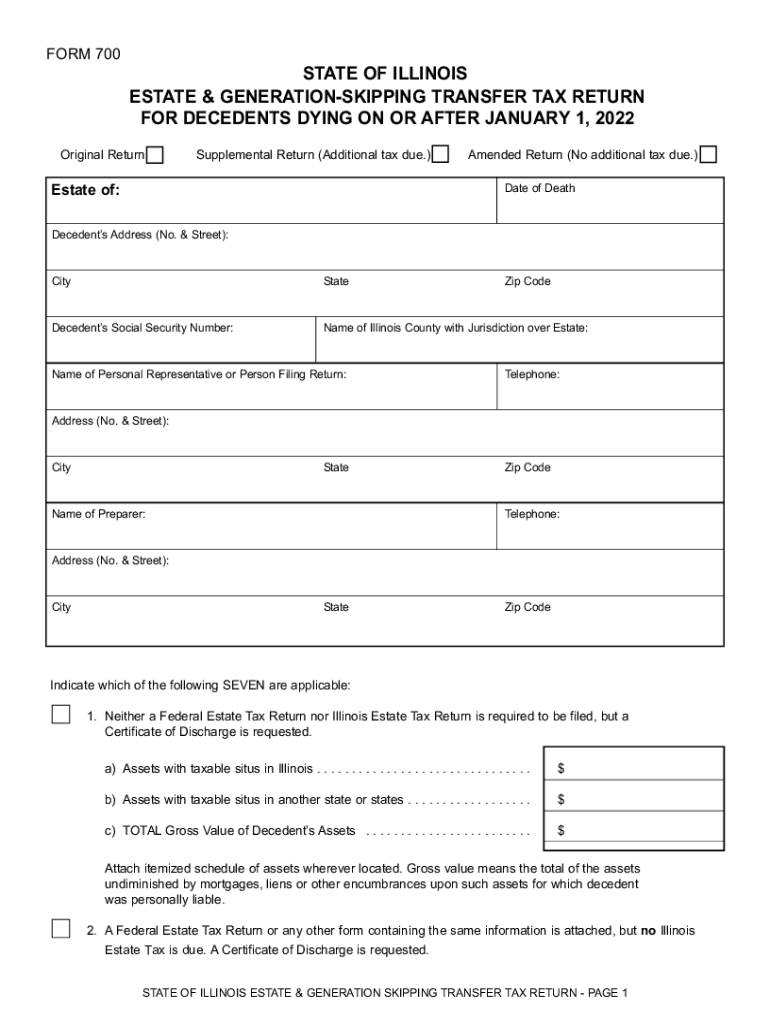

The exclusion amount operates as a taxable threshold and not as a credit against tax due. If an estate s gross value exceeds 4 million after inclusion of adjusted taxable gifts an Illinois Form 700 must be filed whether or not a federal return is required by the Internal Revenue Service. The estate representative should prepare and submit the Illinois Form 700 with a Federal Form 706 including all schedules appraisals wills trusts attachments etc. If an estate is not federally taxable and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL 700

Edit your IL 700 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL 700 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL 700 online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IL 700. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL 700 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL 700

How to fill out IL 700

01

Obtain a copy of IL 700 form from the relevant state department website or office.

02

Fill out the personal information section at the top of the form, including your name, address, and contact details.

03

Specify the purpose of the form in the designated section.

04

Complete any additional information required, as specified by the form instructions.

05

Review the entire form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form to the designated authority or mailbox listed in the instructions.

Who needs IL 700?

01

Individuals or businesses applying for a permit or license in the state.

02

Anyone required to provide specific information to comply with state regulations.

03

Persons needing to report a change of address or personal information related to state records.

Fill

form

: Try Risk Free

People Also Ask about

Does Illinois have an inheritance or estate tax?

As of 2021, there is no federal or Illinois tax on inheritances. Some states do impose inheritance taxes, but not Illinois. Illinoisans who inherit money or property, or receive it as a gift, are not taxed.

Who must file Illinois estate tax return?

Do You Need to File an Illinois Estate Tax Return? If the gross estate of an Illinois resident has a value of more than $4 million, the personal representative or executor of the estate must file a state estate tax return. (Smaller estates won't need to file a return.)

How do I claim inheritance money in Illinois?

The total value of the deceased person's estate must be less than $100,000 and cannot contain any real estate in order to avoid a formal probate court proceedings. In those cases, the people who inherit can use an affidavit along with a copy of the death certificate to claim their inheritance.

Does Illinois require an inheritance tax waiver?

Inheritance Tax Releases: An Illinois Inheritance Tax Release may be necessary if a decedent died before January 1, 1983. If a release is required, please call Chicago (312) 814-2491 or Springfield (217) 524-5095 for further assistance.

Who pays Illinois estate tax?

This means that if you die and your total estate is worth less than $4 million, the estate won't owe anything to the state of Illinois. If your estate is worth more than $4 million, though, there is a progressive estate tax rate for all wealth your estate will have to pay before money can be dispersed to your heirs.

Do I need to file an Illinois estate tax return?

Do You Need to File an Illinois Estate Tax Return? If the gross estate of an Illinois resident has a value of more than $4 million, the personal representative or executor of the estate must file a state estate tax return. (Smaller estates won't need to file a return.)

What is Illinois estate tax exemption?

Illinois Estate Tax Exemption The estate tax threshold for Illinois is $4 million. This means that if you die and your total estate is worth less than $4 million, the estate won't owe anything to the state of Illinois.

What is the Illinois estate tax exemption for 2022?

Illinois' estate tax exemption will remain at $4,000,000 in 2022 with no adjustments for inflation. Like many states, their highest maximum estate tax is 16% and they do not offer portability for spouses.

When an estate tax return is required?

For the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in that year: the deceased estate's net income is more than the tax-free threshold for individuals. a beneficiary is presently entitled to any of the estate's income at the end of the income year.

Who must file IL 1041?

Trusts and Estates must complete Form IL-1041. Form IL-1041 (R12/21) is for tax year ending on or after December 31, 2021, and ending before December 31, 2022.

What assets are included for Illinois estate tax?

What is included in an Illinois estate? Bank accounts. Investment property such as stocks, bonds, CDs. Retirement accounts. Real estate. Interests in family businesses. Interests in other businesses. Life insurance proceeds from policies you owned. Personal property (cars, antiques, jewelry, art, etc.)

What assets are subject to Illinois estate tax?

The deceased individual's property and assets are considered part of the estate for tax purposes, some but not all assets include: Bank accounts. Life insurance policies. Investments such as stocks, bonds, CDs. Retirement accounts. Real estate. Interests in family-owned businesses. Interests in other businesses.

What assets are taxed at death?

Taxes on property owed at time of death This normally applies to property such as land or investments, and not to personal use property. Generally, property that is not being inherited by a spouse will be considered for tax purposes to have been sold immediately before the deceased's death at fair market value.

Where do I file my Illinois form 700?

Please send a copy of the State Treasurer's receipt to: Office of the Attorney General, Revenue Litigation Bureau, 100 West Randolph Street, 13th Floor, Chicago, Illinois 60601, or the Office of the Attorney General, Revenue Litigation Bureau, 500 South Second Street, Springfield, Illinois 62701, as appropriate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IL 700 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IL 700 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the IL 700 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your IL 700.

How do I fill out IL 700 on an Android device?

Complete IL 700 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IL 700?

IL 700 is a form used by businesses and individuals in Illinois to report historical and financial data regarding the use of certain tax credits and public assistance programs.

Who is required to file IL 700?

Individuals and businesses that claim any available tax credits or participate in Illinois tax incentive programs are required to file IL 700.

How to fill out IL 700?

To fill out IL 700, the filer should provide the required personal and entity information, detail the tax credits claimed or assistance programs accessed, and report any relevant financial data as instructed on the form.

What is the purpose of IL 700?

The purpose of IL 700 is to gather necessary information for the administration of tax credits and incentive programs, ensuring compliance and proper use of public funds.

What information must be reported on IL 700?

IL 700 requires reporting personal and business information, tax identification numbers, details of claimed credits, specific amounts of credits or assistance received, and other financial information related to the tax year.

Fill out your IL 700 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL 700 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.