IL 700 2015 free printable template

Show details

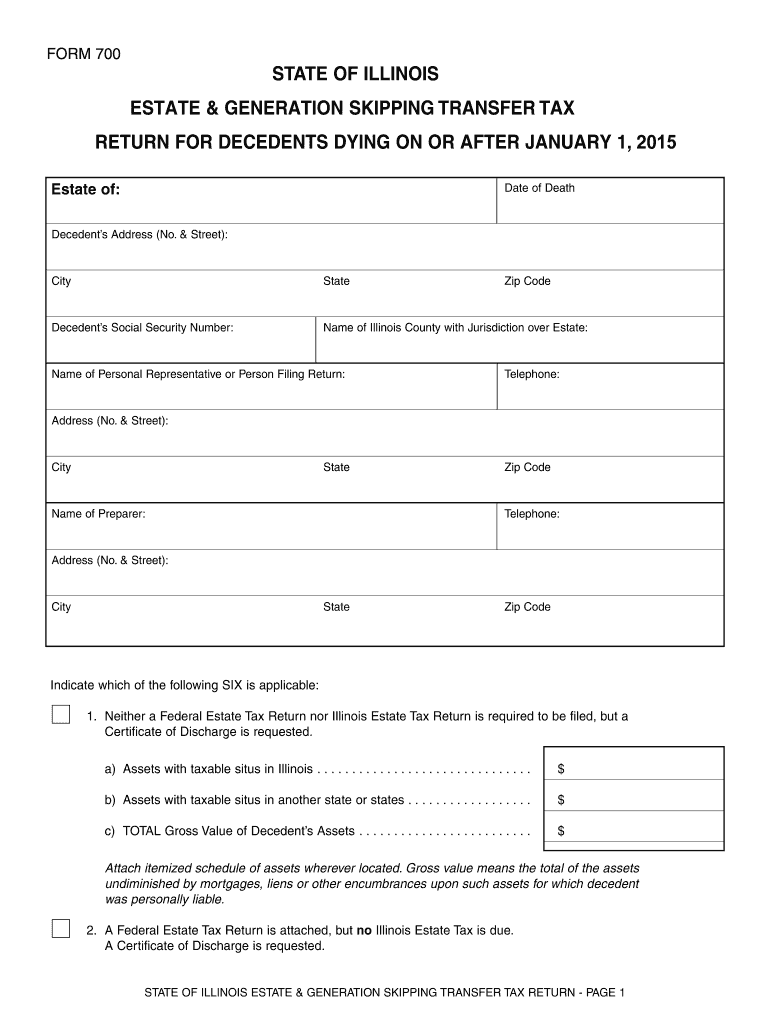

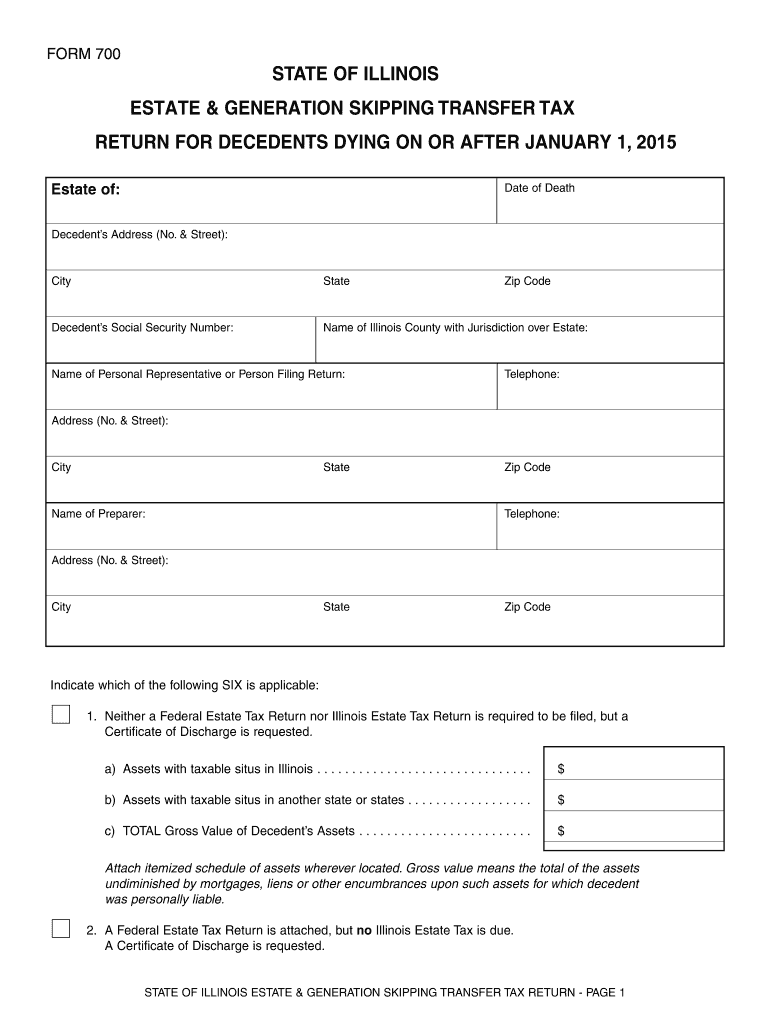

6. Full amount computed for Illinois Estate Tax from website calculator before apportionment Lines 3 5 from this Form 700 and applied to website calculator for interrelated calculation.. In such situations the estate representative is to prepare and file the Illinois Estate Tax Return Form 700 together with a Federal Form 706 Federal Estate Tax Return or any other form containing the same information even though the Federal return is not required to be filed with the Internal Revenue Service....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign illinois form 700

Edit your illinois form 700 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois form 700 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing illinois form 700 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit illinois form 700. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL 700 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out illinois form 700

How to fill out IL 700

01

Obtain a copy of Form IL 700 from the appropriate source.

02

Begin by entering your personal information in the designated fields, including your name, address, and contact details.

03

Fill in the date of your request and any specific identification numbers required.

04

Complete the sections that pertain to the purpose of the form, ensuring clarity and accuracy.

05

Sign and date the form at the bottom to certify that the information provided is true.

06

Make a photocopy of the completed form for your records before submission.

07

Submit the form as directed, either online, by mail, or in person, depending on the instructions provided.

Who needs IL 700?

01

Individuals or organizations seeking to access certain state services or benefits often require IL 700.

02

People applying for licenses, permits, or specific state entitlements may also need to complete this form.

Instructions and Help about illinois form 700

Fill

form

: Try Risk Free

People Also Ask about

Does Illinois have an inheritance or estate tax?

As of 2021, there is no federal or Illinois tax on inheritances. Some states do impose inheritance taxes, but not Illinois. Illinoisans who inherit money or property, or receive it as a gift, are not taxed.

Who must file Illinois estate tax return?

Do You Need to File an Illinois Estate Tax Return? If the gross estate of an Illinois resident has a value of more than $4 million, the personal representative or executor of the estate must file a state estate tax return. (Smaller estates won't need to file a return.)

How do I claim inheritance money in Illinois?

The total value of the deceased person's estate must be less than $100,000 and cannot contain any real estate in order to avoid a formal probate court proceedings. In those cases, the people who inherit can use an affidavit along with a copy of the death certificate to claim their inheritance.

Does Illinois require an inheritance tax waiver?

Inheritance Tax Releases: An Illinois Inheritance Tax Release may be necessary if a decedent died before January 1, 1983. If a release is required, please call Chicago (312) 814-2491 or Springfield (217) 524-5095 for further assistance.

Who pays Illinois estate tax?

This means that if you die and your total estate is worth less than $4 million, the estate won't owe anything to the state of Illinois. If your estate is worth more than $4 million, though, there is a progressive estate tax rate for all wealth your estate will have to pay before money can be dispersed to your heirs.

Do I need to file an Illinois estate tax return?

Do You Need to File an Illinois Estate Tax Return? If the gross estate of an Illinois resident has a value of more than $4 million, the personal representative or executor of the estate must file a state estate tax return. (Smaller estates won't need to file a return.)

What is Illinois estate tax exemption?

Illinois Estate Tax Exemption The estate tax threshold for Illinois is $4 million. This means that if you die and your total estate is worth less than $4 million, the estate won't owe anything to the state of Illinois.

What is the Illinois estate tax exemption for 2022?

Illinois' estate tax exemption will remain at $4,000,000 in 2022 with no adjustments for inflation. Like many states, their highest maximum estate tax is 16% and they do not offer portability for spouses.

When an estate tax return is required?

For the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in that year: the deceased estate's net income is more than the tax-free threshold for individuals. a beneficiary is presently entitled to any of the estate's income at the end of the income year.

Who must file IL 1041?

Trusts and Estates must complete Form IL-1041. Form IL-1041 (R12/21) is for tax year ending on or after December 31, 2021, and ending before December 31, 2022.

What assets are included for Illinois estate tax?

What is included in an Illinois estate? Bank accounts. Investment property such as stocks, bonds, CDs. Retirement accounts. Real estate. Interests in family businesses. Interests in other businesses. Life insurance proceeds from policies you owned. Personal property (cars, antiques, jewelry, art, etc.)

What assets are subject to Illinois estate tax?

The deceased individual's property and assets are considered part of the estate for tax purposes, some but not all assets include: Bank accounts. Life insurance policies. Investments such as stocks, bonds, CDs. Retirement accounts. Real estate. Interests in family-owned businesses. Interests in other businesses.

What assets are taxed at death?

Taxes on property owed at time of death This normally applies to property such as land or investments, and not to personal use property. Generally, property that is not being inherited by a spouse will be considered for tax purposes to have been sold immediately before the deceased's death at fair market value.

Where do I file my Illinois form 700?

Please send a copy of the State Treasurer's receipt to: Office of the Attorney General, Revenue Litigation Bureau, 100 West Randolph Street, 13th Floor, Chicago, Illinois 60601, or the Office of the Attorney General, Revenue Litigation Bureau, 500 South Second Street, Springfield, Illinois 62701, as appropriate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit illinois form 700 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including illinois form 700. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit illinois form 700 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share illinois form 700 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out illinois form 700 on an Android device?

Use the pdfFiller mobile app and complete your illinois form 700 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is IL 700?

IL 700 is a form used for reporting certain tax information to the state of Illinois.

Who is required to file IL 700?

Individuals and businesses that meet specific tax criteria set forth by the Illinois Department of Revenue are required to file IL 700.

How to fill out IL 700?

To fill out IL 700, you need to provide your personal information, relevant tax details, and any supporting documentation as required.

What is the purpose of IL 700?

The purpose of IL 700 is to ensure accurate reporting of tax liabilities and to facilitate the proper assessment and collection of taxes in Illinois.

What information must be reported on IL 700?

The information that must be reported on IL 700 includes personal identification details, income sources, and any tax credits or deductions applicable.

Fill out your illinois form 700 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Form 700 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.