ID Form 41 2017 free printable template

Show details

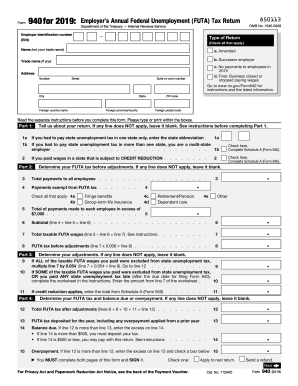

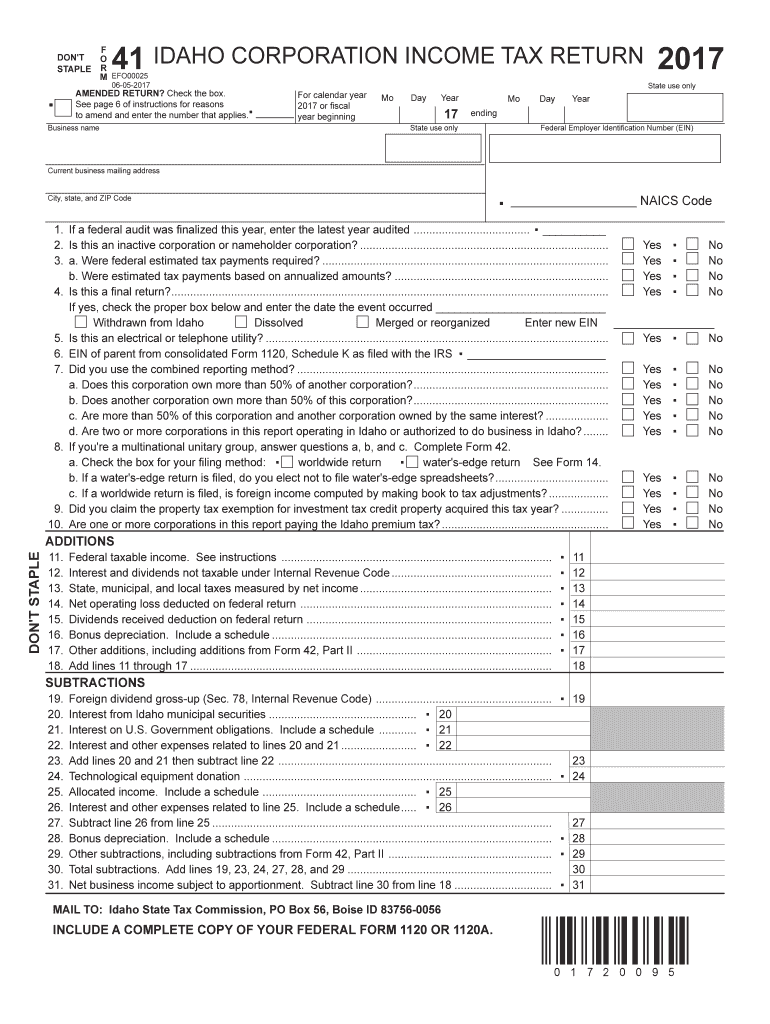

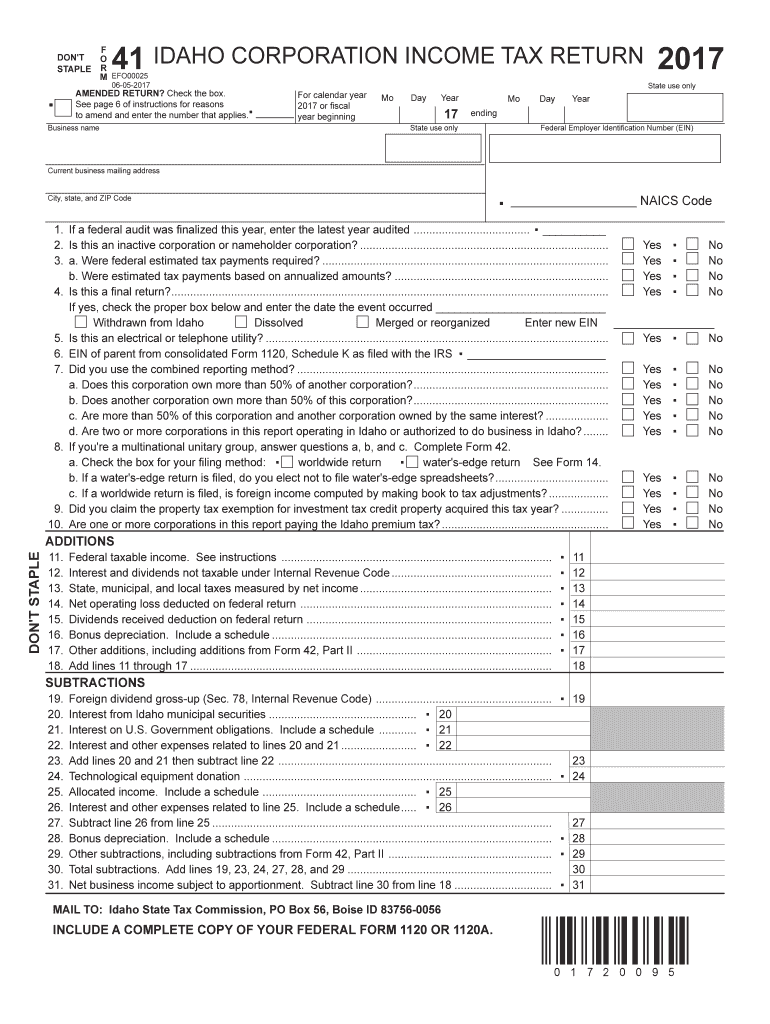

DON'T STAPLE.41 IDAHO CORPORATION INCOME TAX RETURN 2017F O R M EFO0002506052017AMENDED RETURN? Check the box. See page 6 of instructions for reasons to amend and enter the number that applies. Business

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ID Form 41

Edit your ID Form 41 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID Form 41 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ID Form 41 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ID Form 41. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID Form 41 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID Form 41

How to fill out ID Form 41

01

Obtain ID Form 41 from the official website or authorized office.

02

Read the instructions carefully to understand the fields required.

03

Fill out your personal information in the designated sections, including name, address, and date of birth.

04

Provide identification details as requested, such as a driver's license number or Social Security number.

05

Complete any additional sections related to your specific situation or request.

06

Review all the information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form as directed, either online or via mail.

Who needs ID Form 41?

01

Individuals applying for government benefits or services.

02

Persons needing to verify their identity for legal purposes.

03

Citizens or residents requiring identification for travel or employment.

04

Anyone needing to replace lost or stolen identification documents.

Fill

form

: Try Risk Free

People Also Ask about

Are capital losses deductible on Form 1041?

If the Trust generates a Capital Loss, the beneficiaries in most cases will not see a capital loss on their Schedule K-1 (Form 1041) Beneficiary's Share of Income, Deductions, Credits, etc.. If the Trust generates a Capital Loss, it can not be passed through to the Trust's beneficiaries.

What is the earliest you can file taxes for 2022?

January 23: IRS begins 2023 tax season and starts accepting and processing individual 2022 tax returns. January 27: Earned Income Tax Credit Awareness Day to raise awareness of valuable tax credits available to many people – including the option to use prior-year income to qualify.

What expenses can be deducted on Form 1041?

What expenses are deductible? State and local taxes paid. Executor and trustee fees. Fees paid to attorneys, accountants, and tax preparers. Charitable contributions. Prepaid mortgage interest and qualified mortgage insurance premiums. Qualified business income. Trust income distributed to beneficiaries (attach Schedule K-1)

Who must file Alabama Form 41?

Estates/Trusts with 20 or more beneficiaries at the end of the Estate/Trust's taxable year are mandated to e-file Alabama fiduciary income tax returns, for that calendar year and all subsequent tax years.

What is the PA-41 Schedule A?

PURPOSE OF SCHEDULE Use PA-41 Schedule A to report interest income and gambling and lottery winnings of estates and trusts.

What are expenses that a taxpayer is allowed to deduct?

Itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Types of itemized deductions include mortgage interest, state or local income taxes, property taxes, medical or dental expenses in excess of AGI limits, or charitable donations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ID Form 41 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your ID Form 41 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for the ID Form 41 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your ID Form 41 and you'll be done in minutes.

How do I fill out the ID Form 41 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ID Form 41 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is ID Form 41?

ID Form 41 is a tax form used for reporting income and other taxes owed to a jurisdiction, particularly by businesses or self-employed individuals.

Who is required to file ID Form 41?

Entities such as corporations, partnerships, and sole proprietors engaged in business activities that meet specific income thresholds within a jurisdiction are required to file ID Form 41.

How to fill out ID Form 41?

To fill out ID Form 41, gather necessary financial information, accurately complete sections regarding income, deductions, and taxes owed, and ensure all fields are filled out according to the guidelines provided by the taxing authority.

What is the purpose of ID Form 41?

The purpose of ID Form 41 is to report financial information to tax authorities, determine tax obligations, and ensure compliance with state or federal tax laws.

What information must be reported on ID Form 41?

ID Form 41 typically requires reporting of gross income, allowable deductions, tax credits, and any other relevant financial data that impacts tax liability.

Fill out your ID Form 41 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID Form 41 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.