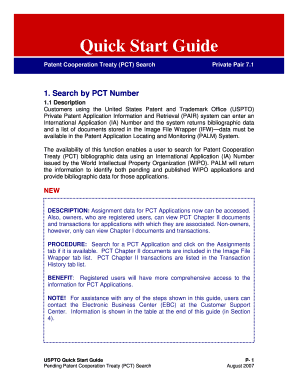

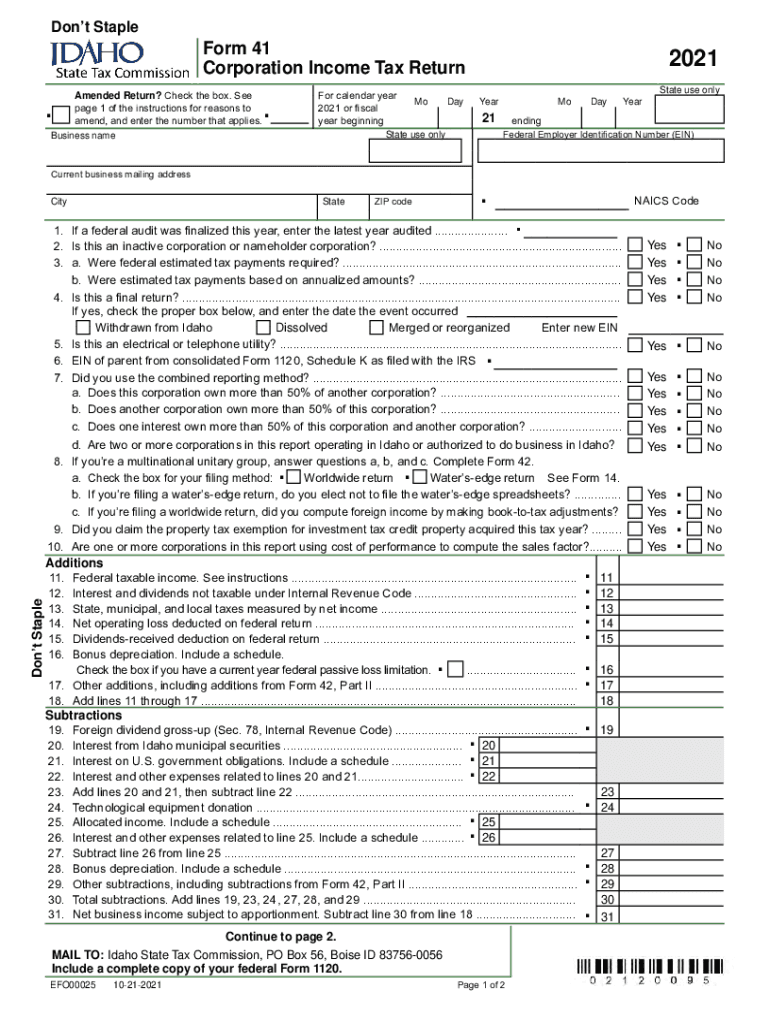

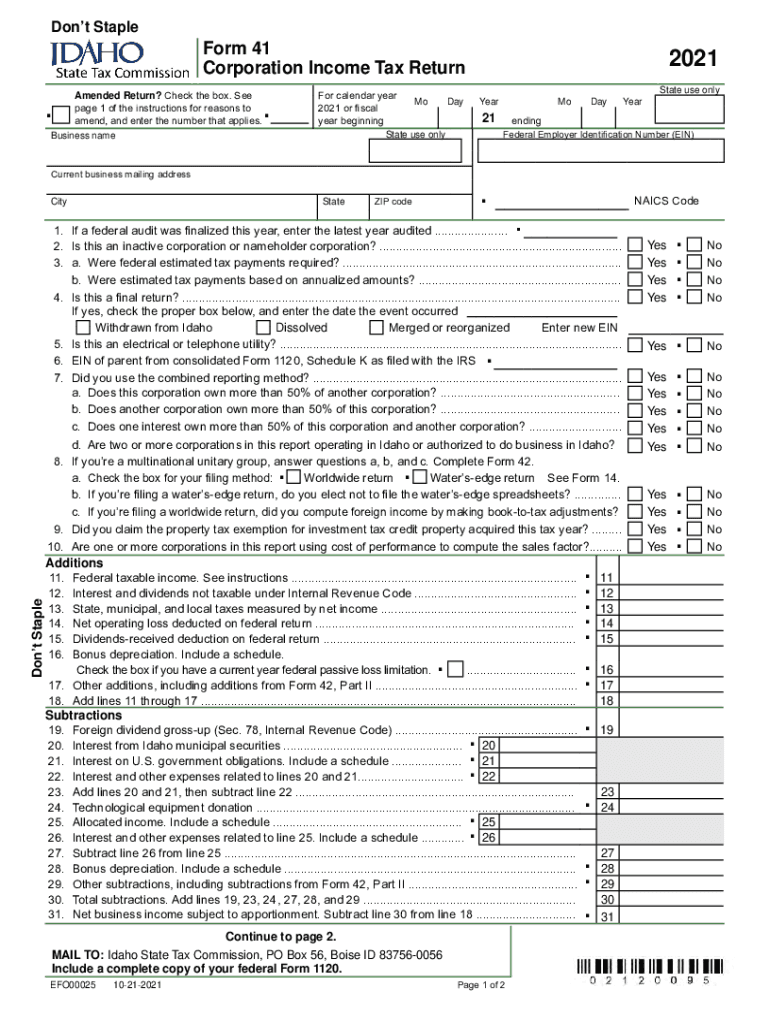

ID Form 41 2021 free printable template

Show details

Don't Tapeworm 41 Corporation Income Tax Return Amended Return? Check the box. See page 1 of the instructions for reasons to amend, and enter the number that applies. For calendar year 2021 or fiscal

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ID Form 41

Edit your ID Form 41 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID Form 41 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ID Form 41 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ID Form 41. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID Form 41 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID Form 41

How to fill out ID Form 41

01

Obtain ID Form 41 from the relevant authority or website.

02

Start by filling in your personal details, including your full name, date of birth, and address.

03

Provide identification information such as your Social Security Number or other necessary IDs.

04

Indicate the purpose of the ID request and attach any required documents.

05

Review the form for accuracy and completeness.

06

Sign and date the form.

07

Submit the completed form according to the guidelines provided (online, by mail, or in person).

Who needs ID Form 41?

01

Individuals who require official identification for personal or legal purposes, such as applying for jobs, opening bank accounts, or obtaining government services.

Fill

form

: Try Risk Free

People Also Ask about

Are capital losses deductible on Form 1041?

If the Trust generates a Capital Loss, the beneficiaries in most cases will not see a capital loss on their Schedule K-1 (Form 1041) Beneficiary's Share of Income, Deductions, Credits, etc.. If the Trust generates a Capital Loss, it can not be passed through to the Trust's beneficiaries.

What is the earliest you can file taxes for 2022?

January 23: IRS begins 2023 tax season and starts accepting and processing individual 2022 tax returns. January 27: Earned Income Tax Credit Awareness Day to raise awareness of valuable tax credits available to many people – including the option to use prior-year income to qualify.

What expenses can be deducted on Form 1041?

What expenses are deductible? State and local taxes paid. Executor and trustee fees. Fees paid to attorneys, accountants, and tax preparers. Charitable contributions. Prepaid mortgage interest and qualified mortgage insurance premiums. Qualified business income. Trust income distributed to beneficiaries (attach Schedule K-1)

Who must file Alabama Form 41?

Estates/Trusts with 20 or more beneficiaries at the end of the Estate/Trust's taxable year are mandated to e-file Alabama fiduciary income tax returns, for that calendar year and all subsequent tax years.

What is the PA-41 Schedule A?

PURPOSE OF SCHEDULE Use PA-41 Schedule A to report interest income and gambling and lottery winnings of estates and trusts.

What are expenses that a taxpayer is allowed to deduct?

Itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Types of itemized deductions include mortgage interest, state or local income taxes, property taxes, medical or dental expenses in excess of AGI limits, or charitable donations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ID Form 41 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing ID Form 41.

Can I edit ID Form 41 on an iOS device?

Create, modify, and share ID Form 41 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete ID Form 41 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your ID Form 41. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is ID Form 41?

ID Form 41 is a specific form used in certain jurisdictions for tax reporting purposes, typically related to income tax or business operations.

Who is required to file ID Form 41?

Entities and individuals who meet certain criteria, such as income thresholds or business classifications, are required to file ID Form 41.

How to fill out ID Form 41?

To fill out ID Form 41, gather necessary financial documents, follow the instructions provided with the form, and accurately report the required information.

What is the purpose of ID Form 41?

The purpose of ID Form 41 is to report specific financial information to tax authorities and ensure compliance with tax regulations.

What information must be reported on ID Form 41?

ID Form 41 typically requires reporting of income, deductions, credits, and other financial details relevant to the taxpayer's financial activities.

Fill out your ID Form 41 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID Form 41 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.